Seamlessly Generate ZATCA-Compliant Invoices with LogiTax

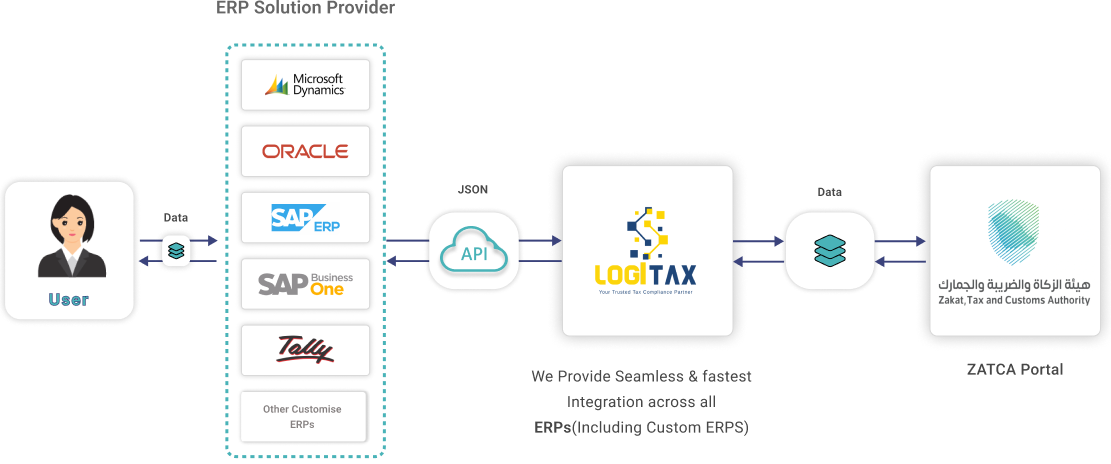

Our E invoicing solution is tailored for seamless integration with ERPs, ensuring your compliance journey is efficient and trouble-free.

Schedule a Demo NowAchieve Phase II Compliance with LogiTax's Trusted E invoicing Solution

- Quick API integration in JSON for efficient development.

- Seamless connection with POS and ERPs.

- Pre-built SAP integrations for enhanced efficiency.

- ZATCA compliance expertise for VAT and ZAKAT.

- Instant e-invoice for B2B and B2C transactions.

- Robust ZATCA compliance for both Phase I and II.

- Multilingual support in e-invoice generation.

- Expert team for reliable automation support.

- Flexible pricing and deployment options.

- 99.95% assured uptime for uninterrupted services.

- Quick API integration in JSON for efficient development.

- Seamless connection with POS and ERPs.

- Pre-built SAP integrations for enhanced efficiency.

- ZATCA compliance expertise for VAT and ZAKAT.

- Instant e-invoice for B2B and B2C transactions.

- Robust ZATCA compliance for both Phase I and II.

- Multilingual support in e-invoice generation.

- Expert team for reliable automation support.

- Flexible pricing and deployment options.

- 99.95% assured uptime for uninterrupted services.

How LogiTax Seamlessly Integrates with ERP Systems

Unlock ZATCA Compliance with Ease: Start Your 30-Day Free Trial Today!

Schedule a Demo

LogiTax Systems as a Billing Application

Registration

- Register devices for ZATCA interaction.

- Generate Public/Private Key.

- Prevent export of stamping keys.

- Generate CSR and get ZATCA approval.

- Create API communication credentials (CSID).

Generation

- Generate a unique hash per invoice for ZATCA.

- Use the previous invoice hash for ZATCA submission.

- Create a signing certificate with unique fields.

- Generate ZATCA-compliant XML & QR code for B2C.

- Create a Cryptographic stamp for B2C.

Printing

- ZATCA-compliant invoice in company layout.

- PDF A/3 invoice with embedded XML.

Storage

- Archive the invoice in storage

LogiTax Systems as a Backend API Aggregator

Registration

- Register devices for ZATCA interaction.

- Generate Public/Private Key.

- Prevent export of stamping keys.

- Generate CSR and get ZATCA approval.

- Create API communication credentials (CSID).

Generation

- Generate a unique hash per invoice for ZATCA.

- Use the previous invoice hash for ZATCA submission.

- Create a signing certificate with unique fields.

- Generate ZATCA-compliant XML & QR code for B2C.

- Create a Cryptographic stamp for B2C.

Printing

- ZATCA-compliant invoice in company layout.

- PDF A/3 invoice with embedded XML.

Integration Modes in ZATCA with LogiTax

- Generate invoices directly from LogiTax.

- Connect your ERP using API integration.

- Implement database-based integration.

Connect with LogiTax: Your ZATCA-Approved E-Invoicing Vendor

Seamless ZATCA Phase II Integration

Achieve effortless compliance with ZATCA Phase II through LogiTax's seamless integration with ERPs, ensuring quick and secure generation of ZATCA e-invoices that are 100% compliant with the electronic invoicing system.

Advanced Validation and Compliance

LogiTax goes beyond basic compliance, offering advanced validation mechanisms in adherence to ZATCA's e-invoicing data dictionary. Ensure accurate and error-free electronic tax invoices, reducing the risk of penalties.

Tamper-Proof Security

LogiTax prioritizes data security with a tamper-proof system and detailed audit logs. Businesses can trust the solution to provide a secure environment for their electronic invoicing processes, ensuring compliance with ZATCA standards.

Billing Platform

LogiTax not only ensures compliance but also serves as a comprehensive billing platform. Manage your invoicing needs seamlessly with LogiTax, offering a user-friendly interface and robust features for efficient billing processes.

Continuous Updates and Alerts

Stay informed with LogiTax's regular updates and alerts on KSA e-Invoicing. Subscribers receive the latest insights, enabling them to proactively adapt to compliance changes and make informed decisions.

Real-Time Data Submissions

Overcome the challenge of timely data submissions with LogiTax's electronic invoicing solution. Enjoy the benefits of real-time data submissions, facilitating a faster and more efficient compliance process under ZATCA e invoice Phase II.

Dedicated Support Team

Navigate ZATCA e invoice Phase II compliance with confidence, backed by LogiTax's dedicated support team offering round-the-clock assistance in both Arabic and English. Experience continuous support throughout your e-invoicing journey.

Free Trial for Hassle-Free Onboarding

Experience a hassle-free transition to zatca e invoice Phase II compliance with LogiTax's 30-day free trial. Businesses can explore the benefits risk-free, ensuring a smooth onboarding process without commitments.

Tailored ERP Integration

LogiTax stands out by offering a tailored approach to ERP integration, providing ready connectors for diverse systems, including electronic invoice for SAP and Oracle.

XML Generation & API Communication

LogiTax handles the XML generation of e-invoices for communication with Zatka. There is no requirement to generate it from the ERP side.