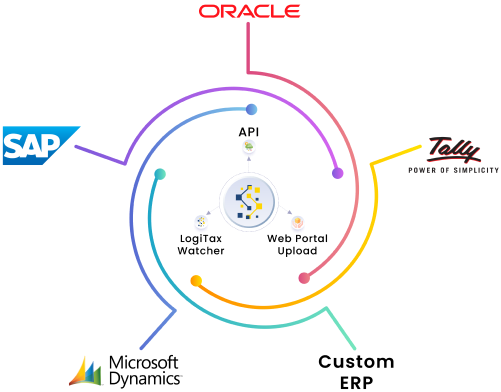

Make compliance effortless with our ERP integration solutions.

Make compliance effortless with our ERP integration solutions.

Get advanced functionalities for bulk return filing and reconciliation. It allows them to file GST returns for multiple clients or units simultaneously, saving time and effort.

LogiTax solution seamlessly integrates with various ERP systems, streamlining data transfer and reducing manual data entry errors

With built-in error checks and validation reducing the chances of filing incorrect GST returns. Beneficial for SMEs, to avoid penalties and audits.

Get advanced reporting capabilities and customizable dashboards that provide a clear overview of GST compliance status and financial data.

GSTR 1

Filing your GSTR-1 return has never been simpler! File your monthly or quarterly returns with details of all outward supplies, including purchases and sales.

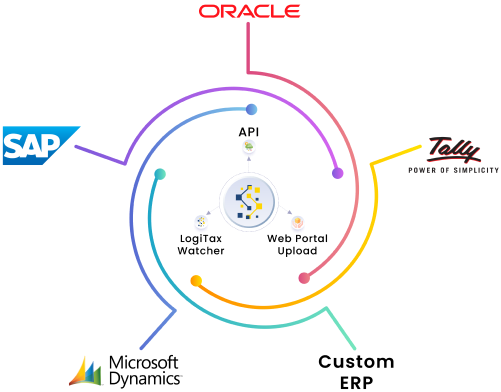

GSTR 3B

No more last-minute rushes to file your GSTR-3B returns. Get a summary return of outward supplies, input tax credit, and tax payments on a monthly or quarterly basis (for QRMP scheme taxpayers).

GSTR 9

It's time to file your annual returns! Consolidate all your monthly or quarterly GST returns (GSTR-1, GSTR-2A, GSTR-3B) filed within the year.

GSTR 9C

Say goodbye to the stress of year-end compliance. Receive a comprehensive, self-certified GST reconciliation statement before December 31st of the next financial year.

GSTR 6

Simplify your GSTR-6 filing with Logitax! Benefit from automated credit distribution in just a click and seamless invoicing of distributed credit. Say goodbye to manual calculations and streamline your process effortlessly.

GSTR 1

Filing your GSTR-1 return has never been simpler! File your monthly or quarterly returns with details of all outward supplies, including purchases and sales.

GSTR 3B

No more last-minute rushes to file your GSTR-3B returns. Get a summary return of outward supplies, input tax credit, and tax payments on a monthly or quarterly basis (for QRMP scheme taxpayers).

GSTR 9

It's time to file your annual returns! Consolidate all your monthly or quarterly GST returns (GSTR-1, GSTR-2A, GSTR-3B) filed within the year.

GSTR 9C

Say goodbye to the stress of year-end compliance. Receive a comprehensive, self-certified GST reconciliation statement before December 31st of the next financial year.

GSTR 6

Simplify your GSTR-6 filing with Logitax! Benefit from automated credit distribution in just a click and seamless invoicing of distributed credit. Say goodbye to manual calculations and streamline your process effortlessly.

Report your GSTR 2B data to reconcile ITC with your own books, check ITC availability, and maximize your eligibility for ITC each month. Identify mismatches and rectify them, saving you hours of manual work

LogiTax seamlessly integrates with Tally, SAP, and ERP systems, ensuring a smooth and error-free data exchange.

LogiTax minimizing manual intervention, ensuring accurate GST returns. It also saves time by eliminating the need to run reconciliation for each GSTIN and multiple periods separately.

LogiTax minimizing manual intervention, ensuring accurate GST returns. It also saves time by eliminating the need to run reconciliation for each GSTIN and multiple periods separately.

Achieve real-time accuracy in GST return filings and reduce the risk of errors, thanks to LogiTax's compatibility with any existing software.

Save time and reduce costs by eliminating the need for manual reconciliation efforts, all while ensuring compliance.

LogiTax offers an intuitive and user-friendly interface, making it accessible for users of all levels of expertise.

PAN-focused actions

Easily manage actions at the PAN level for businesses with multiple GSTINs.

Effortless data importation

Seamlessly import data either at the GSTIN level or across the entire PAN, simplifying data handling for single or multiple months.

Streamlined invoice reconciliation

Ensure you never miss out on any tax credit by effectively reconciling invoices from suppliers across all GSTINs under your PAN.

PAN level Reconciliation

Effortlessly reconcile multiple GSTINs under one PAN with just a click. Also detect cross-state invoices under the reconciliation categories.

Comprehensive Comparison

Conduct thorough comparisons of invoices, credits, and summaries for your PAN, enabling intelligent reporting and analysis for all your GSTINs.

PAN-focused actions

Easily manage actions at the PAN level for businesses with multiple GSTINs.

PAN-focused actions

Easily manage actions at the PAN level for businesses with multiple GSTINs.

PAN-focused actions

Easily manage actions at the PAN level for businesses with multiple GSTINs.

PAN-focused actions

Easily manage actions at the PAN level for businesses with multiple GSTINs.

PAN-focused actions

Easily manage actions at the PAN level for businesses with multiple GSTINs.

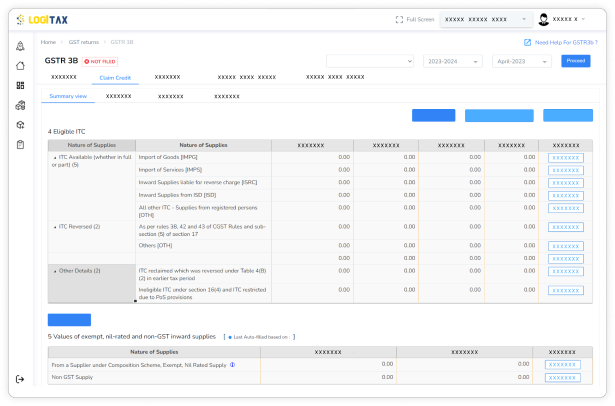

Precise credit tracking

No more missing out on credits you're entitled to, and no more claiming and reversing credits incorrectly.

Effortless monitoring

LogiTax offers a single-screen solution for identifying what you can't claim, what's claimable from previous periods, and monitoring all unclaimed PR and 2B data.

Seamless auto-fill

Enjoy effortless auto-fill for Tables 4 and 5, saving you valuable time and reducing errors.

Automated compliance

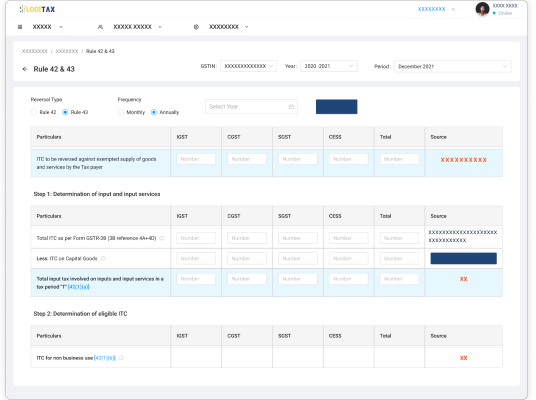

LogiTax takes care of Rule 42 and 43 compliance automatically, so you can focus on what matters.

Ineligible supply detection

Our system automatically detects ineligible supplies, ensuring your filings are accurate and compliant.

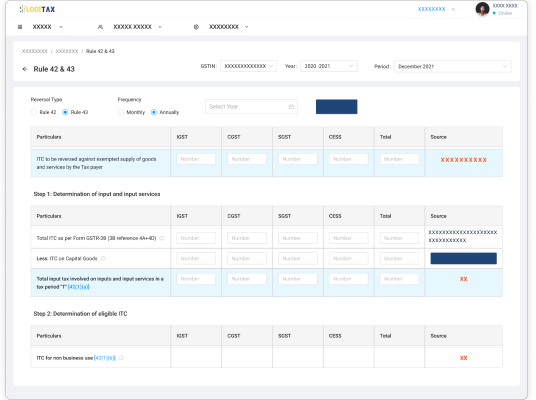

Efficient item-level ITC utilization

One-click rule 42 and 43 calculation

Manual ITC reversal entry

If you have the reversal amounts ready, effortlessly input them in Table 4(B)(2) and proceed with your GSTR-3B filing.

Efficient item-level ITC utilization

One-click rule 42 and 43 calculation

Manual ITC reversal entry

If you have the reversal amounts ready, effortlessly input them in Table 4(B)(2) and proceed with your GSTR-3B filing.

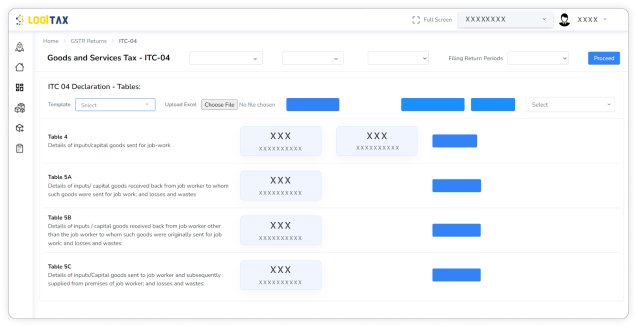

Automated data compilation

No more manual data compilation headaches. Our solution gathers and organizes your goods transfer data from various sources & multiple locations.

Seamless integration

Our platform seamlessly integrates with your existing systems, making data extraction and transfer details hassle-free.

Error detection and alerts

Worried about errors in your ITC-04? Our system automatically detects discrepancies and notifies you, so you can rectify them before filing.

Real-time updates

Stay in the loop with real-time updates on your ITC-04 status and submission. No more last-minute rushes.

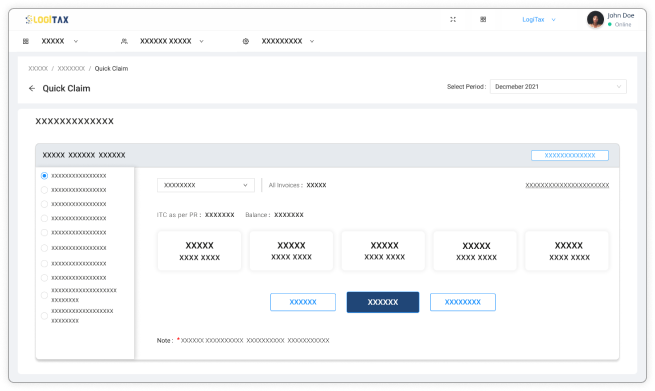

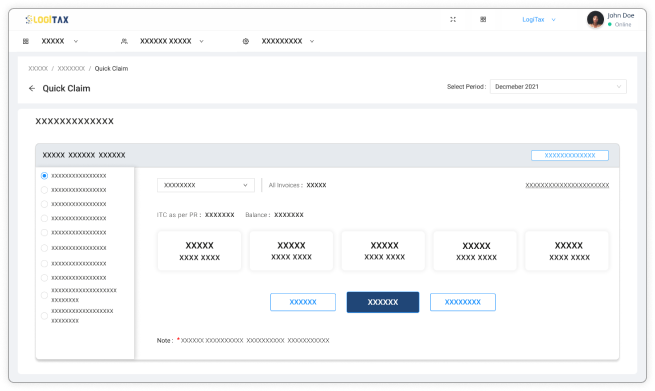

Single-view simplicity & effortless claiming

Experience the power of a single view that simplifies complex GST claim processes. Quick Claim offers one-click actions for claiming or claiming and reversing, reducing multiple steps.

Improved functionality

Get comprehensive invoice-wise views for unreconciled 2B and PR of previous months, as well as actions for reconciled, claimed, reversed, and reclaimed data from the previous period.

Zero excel dependency

Say goodbye to Excel tracking for GST claims. Quick Claim eliminates the need for Excel entirely.

Single-view simplicity & effortless claiming

Experience the power of a single view that simplifies complex GST claim processes. Quick Claim offers one-click actions for claiming or claiming and reversing, reducing multiple steps.

Improved functionality

Get comprehensive invoice-wise views for unreconciled 2B and PR of previous months, as well as actions for reconciled, claimed, reversed, and reclaimed data from the previous period.

Zero excel dependency

Say goodbye to Excel tracking for GST claims. Quick Claim eliminates the need for Excel entirely.

Define eligibility status at the item level

Efficiently categorize multiple items within an invoice as eligible or ineligible in bulk.

Easily claim single or multiple invoices

With specified percentages (e.g., 50%, 20%) without the hassle of separate calculations

Streamline PAN-level ITC claims

Handle the entire process for all GSTINs under the same PAN using a single Excel file.

| Excel | LogiTax |

|---|---|

Static and Isolated: Limited collaboration! |

Dynamic & collaborative: Teamwork thrives! |

Manual data entry: Error-prone & time-consuming! |

Automated precision: Error-free & swift! |

Stuck in the past: No real-time insights! |

Real-Time agility: Data at your fingertips! |

No compliance lifeline: Risky business! |

Compliance confidence: Secure & seamless! |

No history available in excel |

Access to historical datain one click! |

User-Friendly

Our software is designed with simplicity in mind, making it accessible to users of all levels of expertise.

Comprehensive support

Have questions or need assistance? Our dedicated support team is here to help you every step of the way.

Accuracy

Say goodbye to calculation errors. Our software handles all the complex computations, minimizing the risk of mistakes.

Data security

We prioritize the security of your data. Our software is equipped with robust security features to keep your information safe.

Timely filing

Never miss a deadline again. Our automated reminders ensure that you file your returns on time, avoiding penalties.

Affordability

Enjoy cost-effective solutions that don't break the bank. Our pricing plans are designed to suit businesses of all sizes.

GSTR-2A is a dynamic statement that automatically reflects the details of inward supplies received by a registered taxpayer. It is generated based on the information submitted by the supplier in their GSTR-1, GSTR-5, GSTR-6, GSTR-7, and GSTR-8.

GSTR-2B, in contrast, is a static statement auto-generated on a specific date only based on information furnished by suppliers in their GSTR-1, GSTR-5 or GSTR-6 only. The GSTR 2B of a particular period gets generated on 14th of next month.