Starting August 1st, 2023,

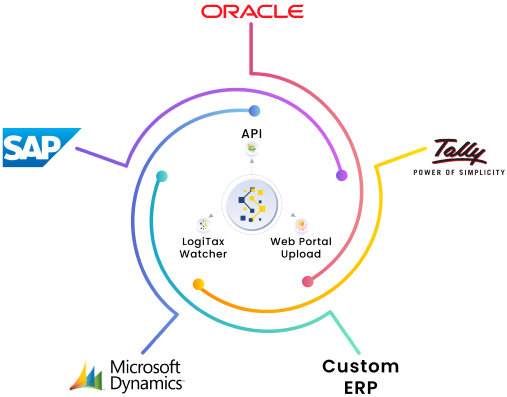

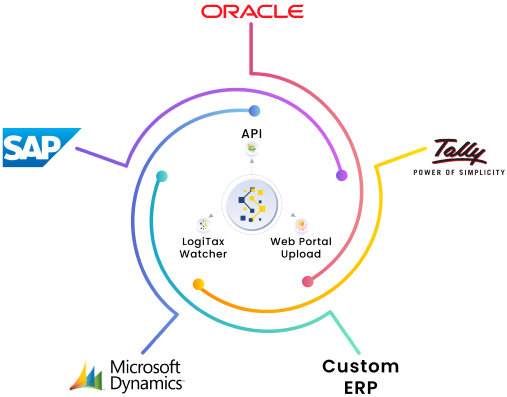

Now generate E-Invoices from your ERP with just 1-click! It

can integrate with your accounting and ERP platforms via

ready-made plugins

Starting August 1st, 2023,

E-Invoicing is mandatory for businesses with a turnover of INR 5 crore or more

Now generate E-Invoices from your ERP with just 1-click! It can integrate with your accounting and ERP platforms via ready-made plugins

Faster and Enriched API

LogiTax Invoice software offers seamless API integration with your ERP systems, ensuring smooth data exchange and synchronization of invoice data.

Real-Time Reporting

With real-time reporting of invoices, businesses will have accurate and up-to-date records of their transactions, which will also help during tax audits.

Data Mapping and Validation

LogiTax Invoice software intelligently matches fields and performs validation checks for accurate and compliant data transfer.

Seamless Workflow

With Logitax, businesses can maintain their existing workflow within Tally, SAP, or ERP systems while leveraging the benefits of LogiTax E-Invoicing system.

Automated Data Synchronization

This ensures that all relevant invoice data seamlessly flows between the systems without any manual intervention.

LogiTax A One-Stop Solution for all your E-Invoicing Needs

It tracks and manages the generation and renewals for every API request that originates from ERP.

It has designed a simplified JSON schema where state codes, address lengths, NULL blocks etc are handled internally.

It maintains the request JSONs, response JSONs, audit trails with multi year E-invoice reports accessible on the LogiTax portal.

It includes decrypted QR code, error descriptions, E-Way Bill detailed & summary printouts, and email notifications to users.

LogiTax A One-Stop Solution for all your E-Invoicing Needs

It tracks and manages the generation and renewals for every API request that originates from ERP.

It has designed a simplified JSON schema where state codes, address lengths, NULL blocks etc are handled internally.

It maintains the request JSONs, response JSONs, audit trails with multi year E-invoice reports accessible on the LogiTax portal.

It includes decrypted QR code, error descriptions, E-Way Bill detailed & summary printouts, and email notifications to users.

Discover the benefits of LogiTax E-Invoicing solution

Discover the benefits of LogiTax E-Invoicing solution

Discover the benefits of LogiTax E-Invoicing solution

Discover the benefits of LogiTax E-Invoicing solution

Best online Invoicing software is here!

Seamless Integration & Generation

LogiTax integrates with accounting software/ERPs for seamless data transfer, eliminating manual data entry. Generates E-Invoice & E-Way Bill in 3 seconds.

Real-Time Validation

It Validates invoice data for accuracy, completeness, and tax compliance, ensuring seamless generation of E-invoices.

Audit Trail

Provides 8 Years of Data history of all invoice-related activities, facilitating audits and compliance. Enables traceability and accountability in case of disputes or discrepancies.

Past Period E-Invoice Generation

Ensures continuity and consistency in invoice generation, even for past periods. Facilitates the transition from manual invoicing to E-invoicing seamlessly.

Single-Click Reconciliation

Significantly minimizes the time and effort needed for manual reconciliation tasks. Identifies non-compliances through a single-click.

E-mail notifications

LogiTax provides real-time updates for E-invoices and E-Way-Bills generation, ensuring effective communication. Users can customize the email with their logo on the E-Invoice.

LogiTax Watcher

No API code, JSON schema, validations are needed. Enable E-Invoicing within a Day using LogiTax Watcher.

Real-Time Reconciliation

Sales Register & E-Invoice Reconciliation, reduces the time and effort required for manual reconciliation processes. It helps to get all the data for mismatched invoices.

IRN Offline Utility

During the downtime the user won't be able to access the LogiTax Portal. But if the user still needs to generate IRN they can do that using the IRN Offline Utility feature.

Failed IRN Generation Alerts

These error messages provide insights into the reason for the failure, allowing businesses to rectify the issues and ensure successful generation.

Get advanced functionalities for bulk return filing and reconciliation. It allows them to file GST returns for multiple clients or units simultaneously, saving time and effort.

LogiTax solution seamlessly integrates with various ERP systems, streamlining data transfer and reducing manual data entry errors

With built-in error checks and validation reducing the chances of filing incorrect GST returns. Beneficial for SMEs, to avoid penalties and audits.

Get advanced reporting capabilities and customizable dashboards that provide a clear overview of GST compliance status and financial data.