Manage Working Capital Effectively by Blocking Non-Compliant Vendors

Optimize Accounts Payable for Significant Monthly ITC Savings

Manage Working Capital Effectively by Blocking Non-Compliant Vendors

Here’s why Choose LogiTax for Account Payable Excellence!

Vendor management

Vendor management

Are You Ready to Tackle These Vendor Management Challenges that impact on your Business?

Get started with the Best Vendor Management Software!

Get real-time updates on vendor return filing status. Easily check if vendors are compliant, in default, or non-compliant for seamless business processes.

Save time with one-click verification of over 1000 vendors, eliminating manual checks on the GST portal.

Efficiently track vendor performance with the latest purchase transactions for transparent relationships. Verify if vendors are eligible for generating IRN.

Make informed decisions by evaluating vendor risk through credit mismatches and disputes. Also, Vendors are labelled based on their risk level.

Streamline tax credit processes by monitoring and maintaining a compliant vendor base in real-time.

Set filing preferences based on vendor frequency—monthly or quarterly—for precise and timely communication.

Vendor Payment Hold

Vendor Payment Hold

Are These Vendor Payment Challenges Holding You Back & leading to delayed payments?

Get started with the smart payment hold software solution!

Customize hold percentage, avoiding full invoice amount hold.

Save time by checking vendor GSTR-3B status in bulk for payment decisions

Efficiently hold payments when vendor GSTIN status is canceled.

Release payments based on supply type, zero tax value, or reconciliation category.

Avoid unnecessary holds, fostering better relationships with vendors.

Vendor Follow-up

Vendor Follow-up

Are These Vendor Follow-Up Challenges affecting your Operations & impacting your business?

Discover Seamless Vendor Follow-Up Solutions with LogiTax!

One-time setup with customizable tolerance limits for efficient vendor tracking.

Verify changes in GSTR-2A, mark as "resolved" for prompt discrepancy resolution.

Maintain a transparent record of all follow-ups, promoting accountability and communication.

Personalize communication with vendors, improving follow-up effectiveness.

Prioritize vendors and documents efficiently with a dashboard view.

Best vendor management software to streamline all your vendor process

Elevate Efficiency with LogiTax: Your Ultimate Vendor Management System!

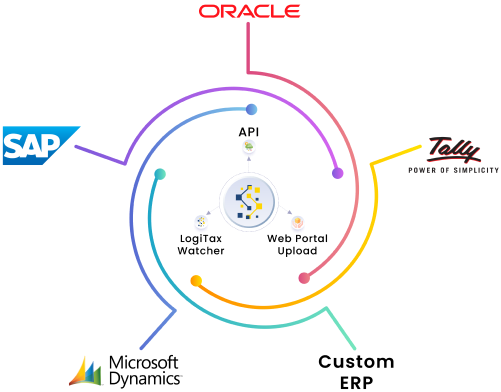

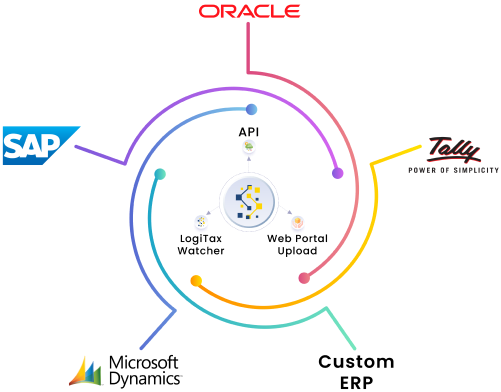

Effortless integration with ERP systems for streamlined processes.

Stay ahead with automated compliance monitoring and risk assessment.

Tailored vendor management options for diverse business needs.

Automated processes save valuable time and resources.

Smart payment control for effective working capital management.

Smart payment control for effective working capital management.

Intuitive design for easy adoption and efficient operations.

Identify and resolve issues before they impact financial stability.