Generating E-Way Bills Made Simple with LogiTax – Your Step-by-Step Guide

Your Ultimate Guide to E-Way Bills for Effortless Business Operations

Generating E-Way Bills Made Simple with LogiTax – Your Step-by-Step Guide

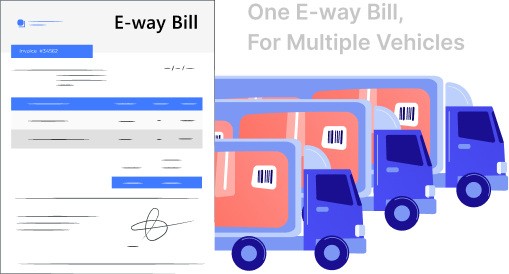

The Multi-Vehicle Option allows for a single E-way Bill to be used across multiple vehicles! Transporting goods using multiple vehicles is now easier than ever.

The Multi-Vehicle Option allows for a single E-way Bill to be used across multiple vehicles! Transporting goods using multiple vehicles is now easier than ever.

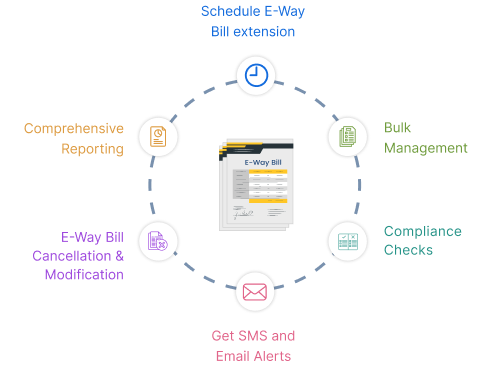

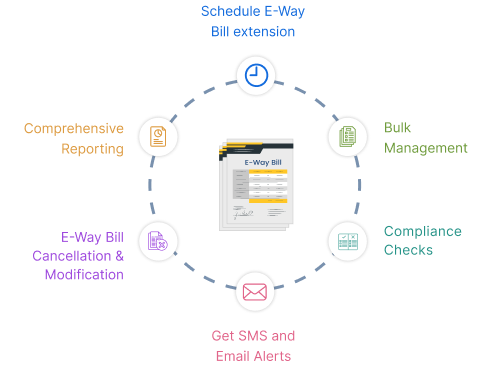

Simplifying E-Way Bill Compliance

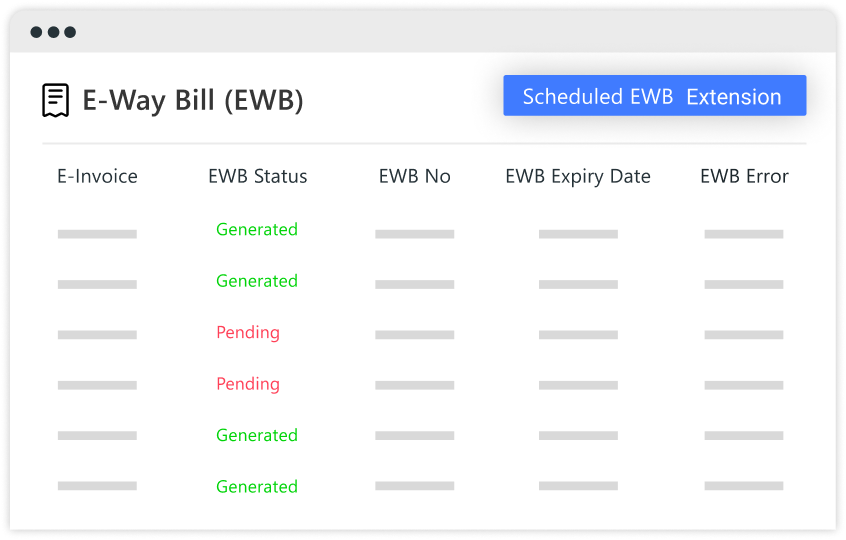

Identify invoices without E-Way Bills effortlessly, ensuring compliance and avoiding potential penalties.

Stay ahead of expiring E-Way Bills by monitoring nearing expiration dates, ensuring timely renewal or extension.

Plan and schedule E-Waybills extension in advance, once the E-Way Bill validity nears. This ensures compliance with transportation regulations and prevents last-minute issues.

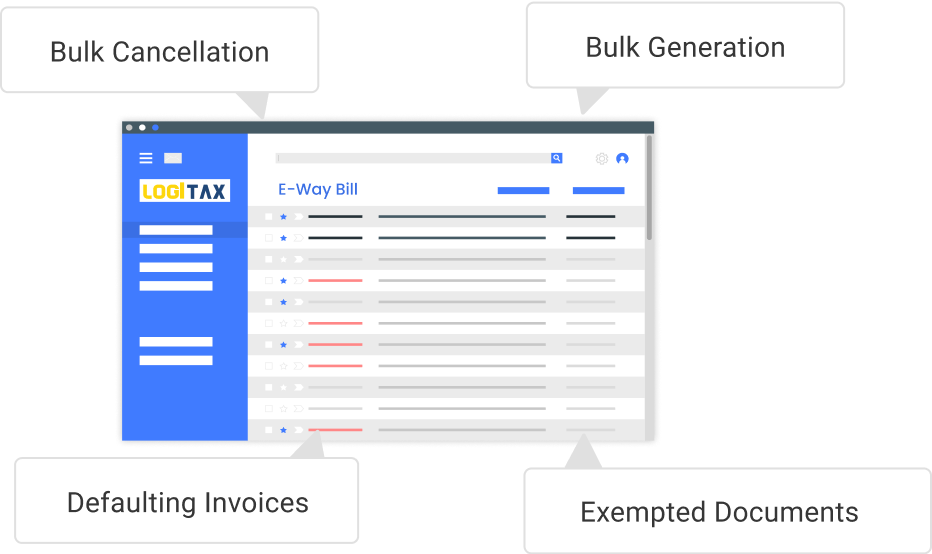

Simplify invoice generation and cancellation with one-click bulk actions, saving valuable time and streamlining operations.

Save time by automatically identifying exempted documents, eliminating the need for manual identification during E-Way Bill generation.

Quickly spot defaulting invoices requiring immediate attention and resolution with a single click.

Simplify invoice generation and cancellation with one-click bulk actions, saving valuable time and streamlining operations.

Save time by automatically identifying exempted documents, eliminating the need for manual identification during E-Way Bill generation.

Quickly spot defaulting invoices requiring immediate attention and resolution with a single click.

Access over 30 detailed reports covering aspects like liability, compliance, reconciliation, aiding in monitoring, auditing, and compliance management.

Accelerate E-Waybill generation by automating distance calculation, enhancing overall efficiency.

Simplifying E-Way Bill Compliance

For Chartered Accountants (CAs)

For Chartered Accountants (CAs)

LogiTax simplifies E-Way Bill compliance for CAs, reducing manual effort and ensuring accuracy.

CAs can monitor multiple clients' E-Way Bills in real-time, minimizing compliance risks and penalties.

Seamless integration with various accounting systems facilitates smooth adoption into existing workflows.

For ERP Partners

For ERP Partners

LogiTax's E-Way Bill solution seamlessly integrates with ERP systems, enhancing supply chain efficiency.

ERP partners can customize E-Way Bill workflows, delivering personalized solutions to their clients.

LogiTax's scalable solution accommodates businesses of all sizes, supporting the growth of ERP partners' clientele.

For SMEs (Small and Medium Enterprises)

For SMEs (Small and Medium Enterprises)

LogiTax provides SMEs with a cost-effective E Way Bill solution, making compliance budget-friendly.

SMEs benefit from a user-friendly interface, streamlining E-Way Bill processes without extensive training.

As SMEs expand, LogiTax's scalable solutions ensure E-Way Bill management adapts to growing demands.

For Corporates

For Corporates

LogiTax eliminates the need for two-factor authentication, streamlining the E-Way Bill process for enhanced convenience.

Automation reduces delays in the supply chain, contributing to overall efficiency in logistics management.

Corporates benefit from real-time tracking, ensuring visibility into their consignments and enhancing control over the transportation process.

Here's why it's the best

LogiTax seamlessly integrates with SAP, SAP B1, Oracle, Microsoft, Tally, and custom ERPs, ensuring a seamless workflow without disruptions.

Experience unparalleled automation with LogiTax, reducing manual efforts and ensuring accurate E-Way Bill generation across various ERP platforms.

Enjoy real-time synchronization of data between LogiTax and your ERP system, keeping information updated and accurate without delays.

The National Informatics Centre (NIC) has introduced 2-Factor Authentication (2FA) for added security.

Alongside your username and password, a one-time password (OTP) will be required for authentication.

Enable 2FA today through LogiTax for a hassle-free experience, without the need to visit the E-Way Bill portal separately.

Enjoy enhanced security measures and peace of mind while utilizing LogiTax's top-notch E-Way Bill and E-Invoice solutions!