As per section 2(55) of the CGST Act, 2017, "goods and services tax practitioner" means any person who has been approved under section 48 to act as such practitioner. As per section 48, the GST practitioner should get approval from the GSTN and also, and he needs to fulfill his duties and obligations as may be prescribed.

In simple words, a GST Practitioner is a tax professional who can prepare returns and perform other activities based on the information furnished to him by a taxable person. (However, the legal responsibility of such filings remains with the Taxpayer.) For this purpose, GST Practitioners (GSTP) are required to be enrolled with the Centre or State Authority. CA/ CS/ CMA holding Certificate of Practice (COP), Advocates, Retired Government Officials, and Graduates are eligible to apply for registration. In addition, GSTPs can be appointed Authorized Representatives who can act on behalf of the taxpayers and represent them before tax authorities.

As per Rule 83 of the CGST Rules, 2017, the following are the eligibility conditions for registration as a GST practitioner:

Also, the following are some additional criteria of which anyone should be satisfied to get registered:

Note:

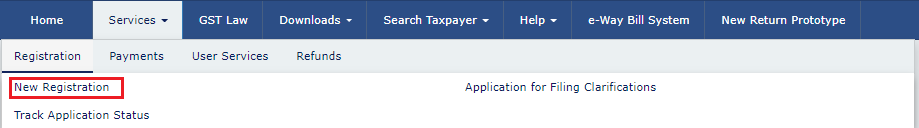

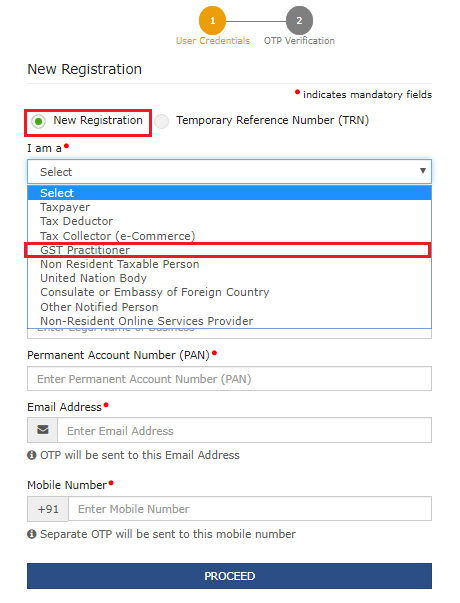

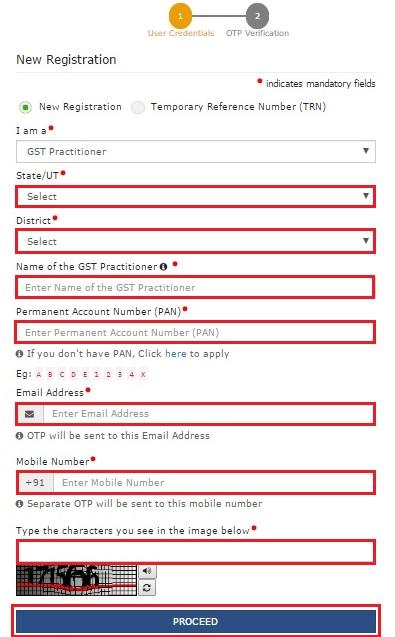

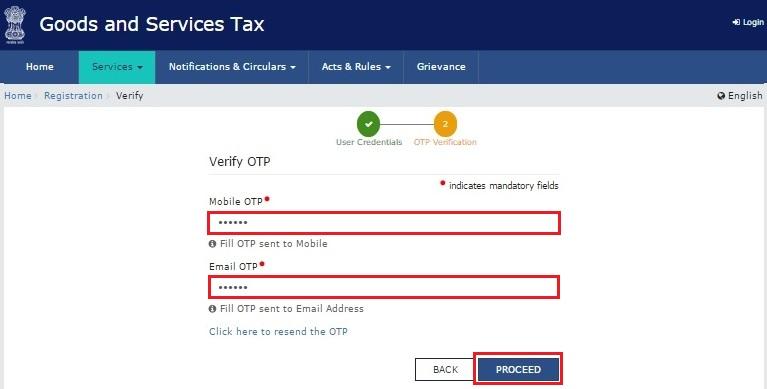

Note: Different One Time Password (OTP) will be sent to your email address and mobile number you just mentioned for authentication.

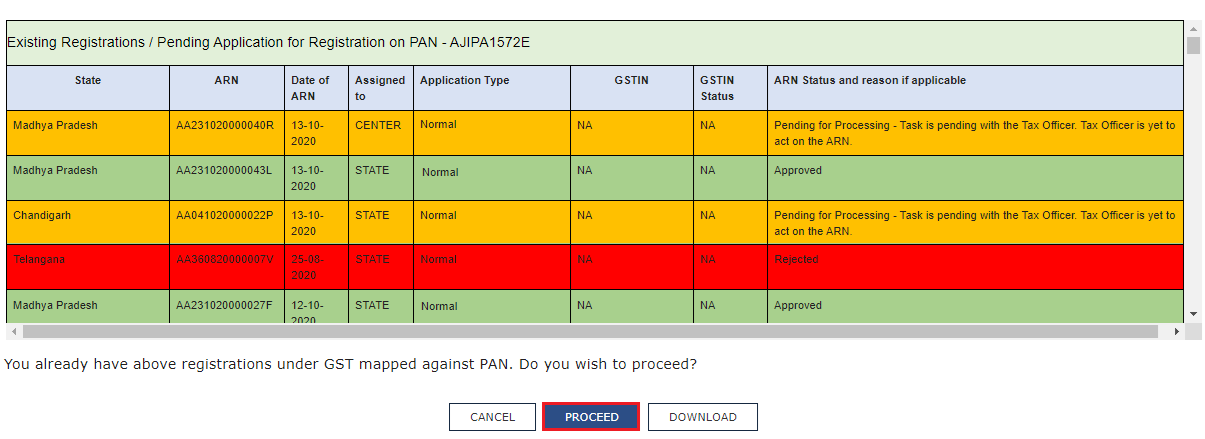

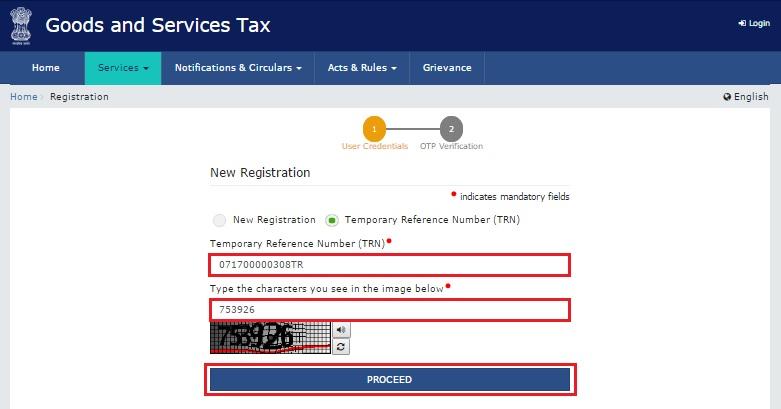

Note: On clicking proceed, GST Portal displays all the GSTINs / Provisional IDs / UINs / GSTP IDs mapped to the same PAN across India. Click the PROCEED button.

Note:

After successful validation, you will be directed to the OTP Verification page.

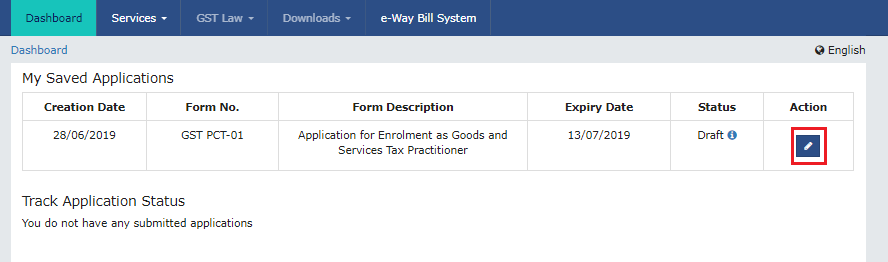

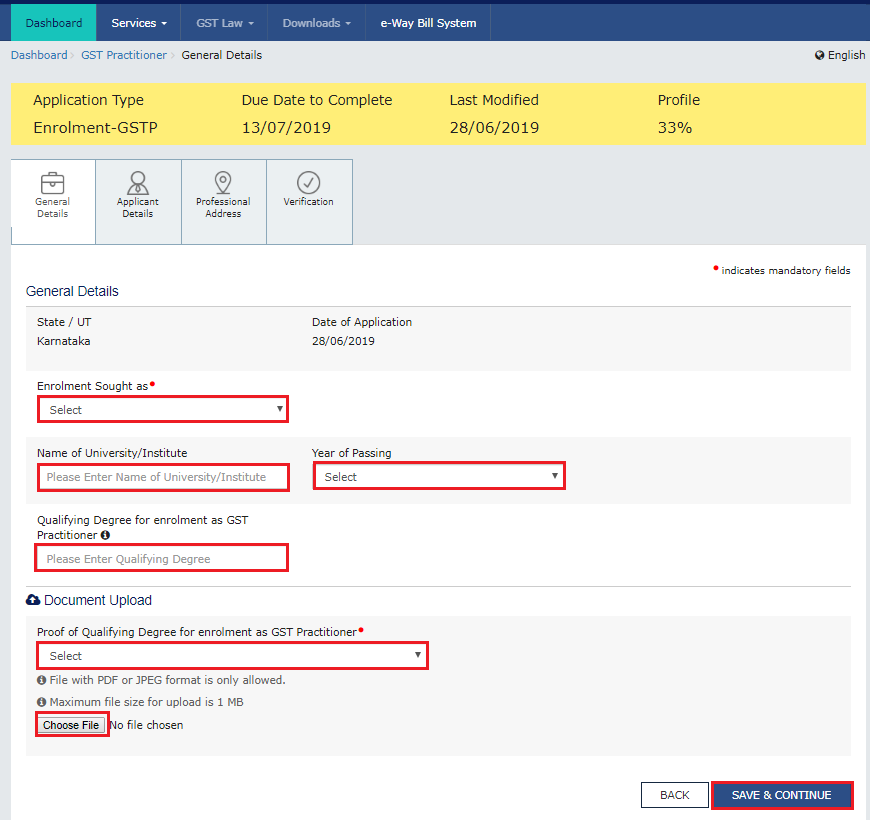

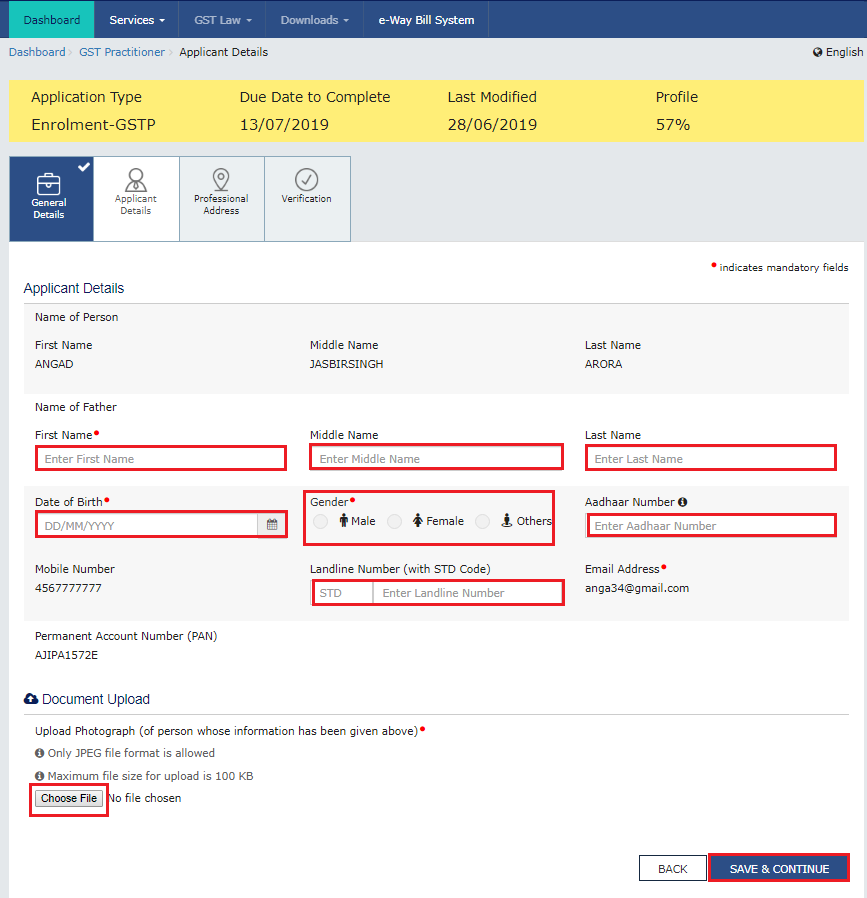

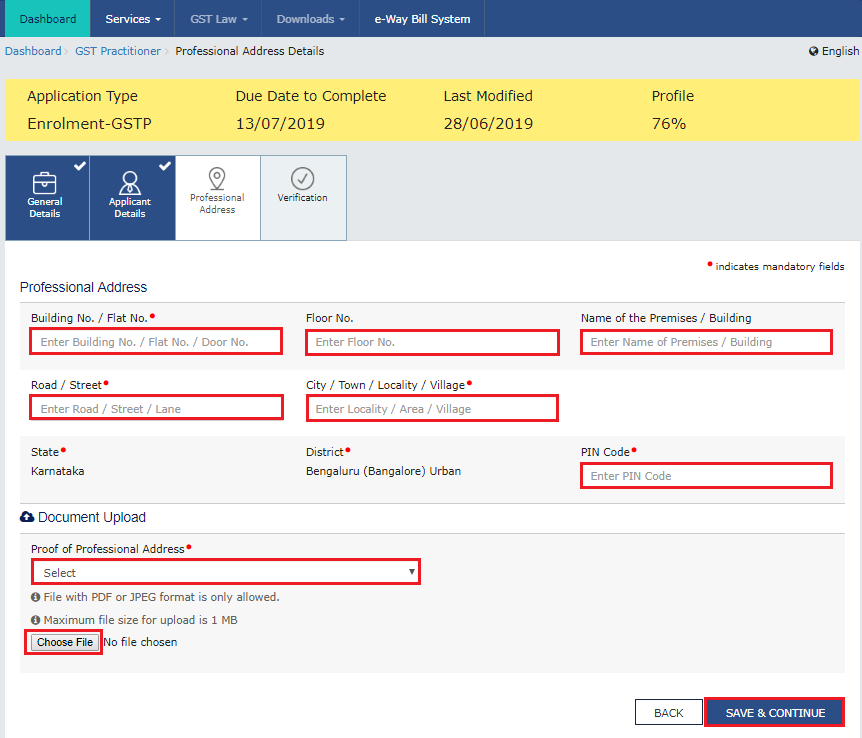

PART B of the form has four sections that must be filled sequentially. The first section is General Details.

In the Case of DSC:

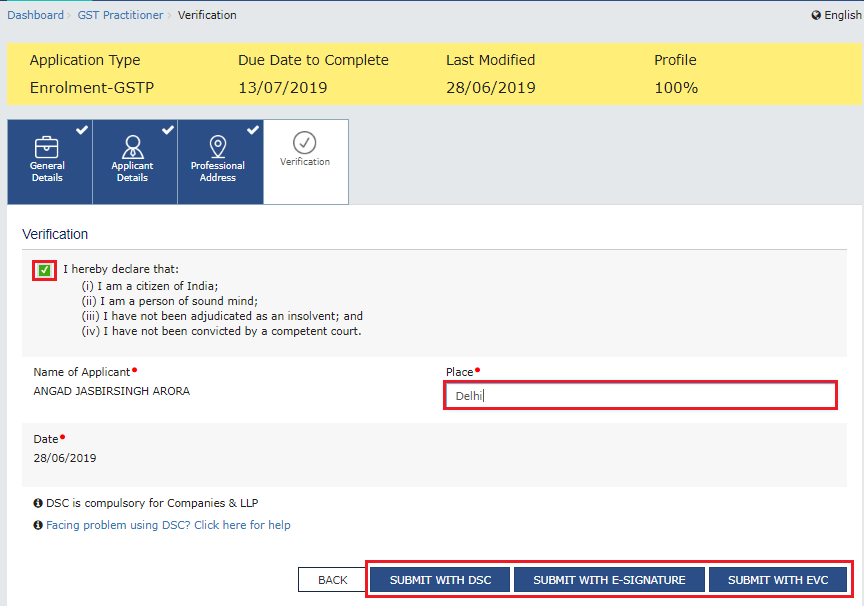

d. Click the SUBMIT WITH DSC button.

Note: In case, your DSC is not registered, you will need to register DSC.

Note:

To check if the emSigner is running on your laptop/ desktop, perform the following steps:

Note: To view the details of your DSC, click the View Certificate button.

In Case of E-Signature:

d. Click the SUBMIT WITH E-SIGNATURE button.

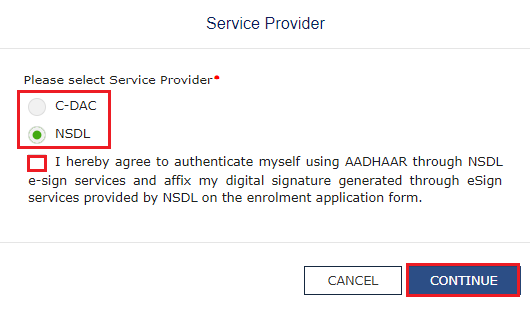

e. In the Please select Service Provider option, select the appropriate Service Provider.

Note: C-DAC and NSDL are e-sign Service Providers (Both are free of cost).

f. Select the checkbox for declaration.

Note: OTP will be sent to your e-mail address and mobile phone number registered with Aadhaar.

g. Click the CONTINUE button.

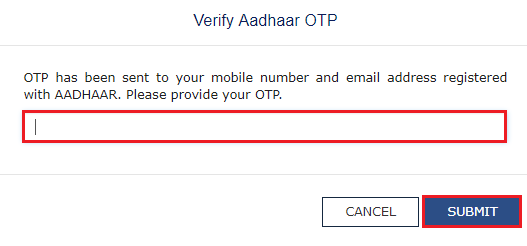

h. Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar. Click the SUBMIT button.

h. Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar. Click the SUBMIT button.

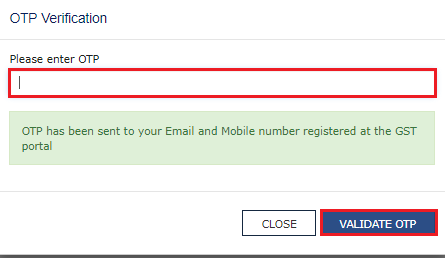

d. Click the SUBMIT WITH EVC button.

e. Enter the OTP sent to the email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

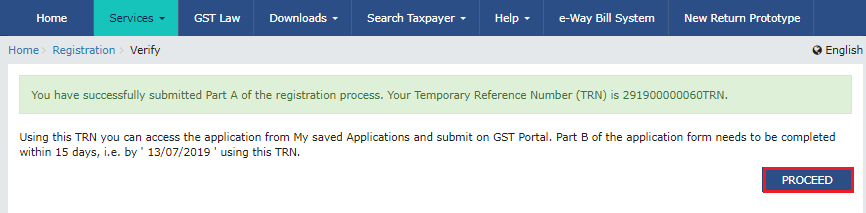

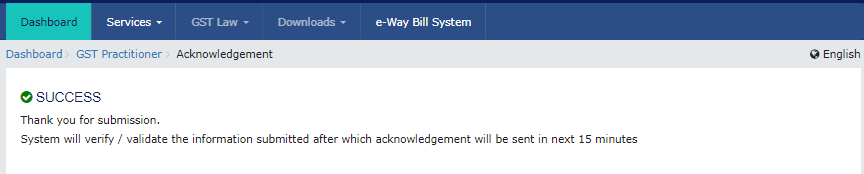

The success message is displayed. You will receive the acknowledgment in the next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent to your e-mail address and mobile phone number. After submission, you cannot make any changes to your application.

The success message is displayed. You will receive the acknowledgment in the next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent to your e-mail address and mobile phone number. After submission, you cannot make any changes to your application.

In conclusion, registering as a GST practitioner involves a systematic process outlined by the GST portal. By following the step-by-step instructions provided, individuals can ensure compliance with the eligibility criteria and complete the registration process seamlessly. Once registered, GST practitioners play a crucial role in assisting taxpayers with GST-related tasks and representing them before tax authorities. This streamlined registration process contributes to the efficient functioning of the GST system, enhancing transparency and accountability in tax administration.

gst practitioners

gst officer exam

how to become gst officer

gst practitioner registration

gst practitioner certificate

09-05-2024

GST

Mrudula Joshi

The GST common portal underwent enhancements and changes on May 3rd, 2024. Read More

08-05-2024

GST

Mrudula Joshi

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Read More

07-05-2024

GST

Mrudula Joshi

Taxpayers have the option to enlist the services of a GST practitioner through the GST portal. Read More

06-05-2024

GST

Mrudula Joshi

As per section 2(55) of the CGST Act, 2017, "goods and services tax practitioner" means any person who has Read More

04-05-2024

GST

Mrudula Joshi

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply Read More

03-05-2024

GST

Mrudula Joshi

GSTN has issued an advisory on 26th April, 2024 announcing Enhancement in the GST Portal. Read More

29-04-2024

GST

Mrudula Joshi

As per section 2(55) of the CGST Act 2017, "goods and services tax practitioner" Read More

23-04-2024

GST

Mrudula Joshi

On 10th April 2024, CBIC issued Notification No. 08/2024 - Central Tax announcing the Read More

22-04-2024

GST

Mrudula Joshi

Upon the arrival of imported goods, a legal document called a bill of entry must be filed Read More

19-04-2024

GST

Mrudula Joshi

DRC-01 means Demand and Recovery Certificate- 01. Rule 142 of the CGST Rules, 2017 Read More

19-04-2024

GST

Mrudula Joshi

DRC-01 means Demand and Recovery Certificate- 01. Rule 142 of the CGST Rules, 2017 Read More

18-04-2024

GST

Mrudula Joshi

As per section 2(68) of the CGST Act, 2017, "job work" means any treatment or process undertaken by a person on goods Read More

17-04-2024

GST

Mrudula Joshi

On 09th April 2024, the GSTN issued an advisory on the Reset and Re-filing of GSTR-3B of some taxpayers. Read More

15-04-2024

GST

Mrudula Joshi

On 09th April 2024, the GSTN issued an advisory on auto-populate the HSN-wise summary from e-Invoices Read More

12-04-2024

GST

Mrudula Joshi

As per Notification No.12/2017-Central Tax (Rate) dated 28.06.2017, services by way of generation Read More

11-04-2024

E-Invoicing

Mrudula Joshi

As the 2023-2024 financial year ends, businesses with turnover over INR 5 crores need to remember the new rule Read More

09-04-2024

GST

Mrudula Joshi

The GST portal offers the facility to retrieve information about a registered individual using their PAN Read More

05-04-2024

GST

Mrudula Joshi

As per Notification No. 12/2017 - Central Tax (Rate), services provided by an educational institution to its students, faculty Read More

04-04-2024

GST

Mrudula Joshi

The GST portal offers the facility to retrieve information about a registered individual using their PAN or GSTIN. Read More