On 26th July, 2023, CBIC had issued Notification No. 06/2023- Central Tax (Rate). By way of this notification, a new form was introduced for Goods Transport Agencies (GTAs) who earlier used to pay GST under forward charge, but now wish to pay GST under reverse charge mechanism. GSTN issued an advisory on 01st January 2024 about functionalities for Goods Transport Agencies (GTAs) that are made available on the portal in this regard.

By way of this notification, CBIC provided that the option of paying taxes under the forward charge mechanism by GTAs shall be exercised on or after the 1st of January of the preceding Financial Year but not later than the 31st of March of the preceding Financial Year. Earlier, it was to be exercised on or before the 15th of March of the preceding Financial Year.

Also, it is specified in this notification that the option exercised by GTA to pay GST on the services supplied by it during a Financial Year shall be deemed to have been exercised for the next and future financial years unless the GTA files a declaration to revert under reverse charge mechanism on or after the 1st January of the preceding Financial Year but not later than31st March of the preceding Financial Year. Earlier, if the GTA, who opted for a forward charge mechanism last year, missed filing a fresh declaration for such an option in the current year, GSTN used to automatically change its option to reverse charge mechanism. Now, this requirement is relaxed by CBIC. Once, the forward charge mechanism is opted for any financial year, it will be continued unless specifically opted out by the GTA.

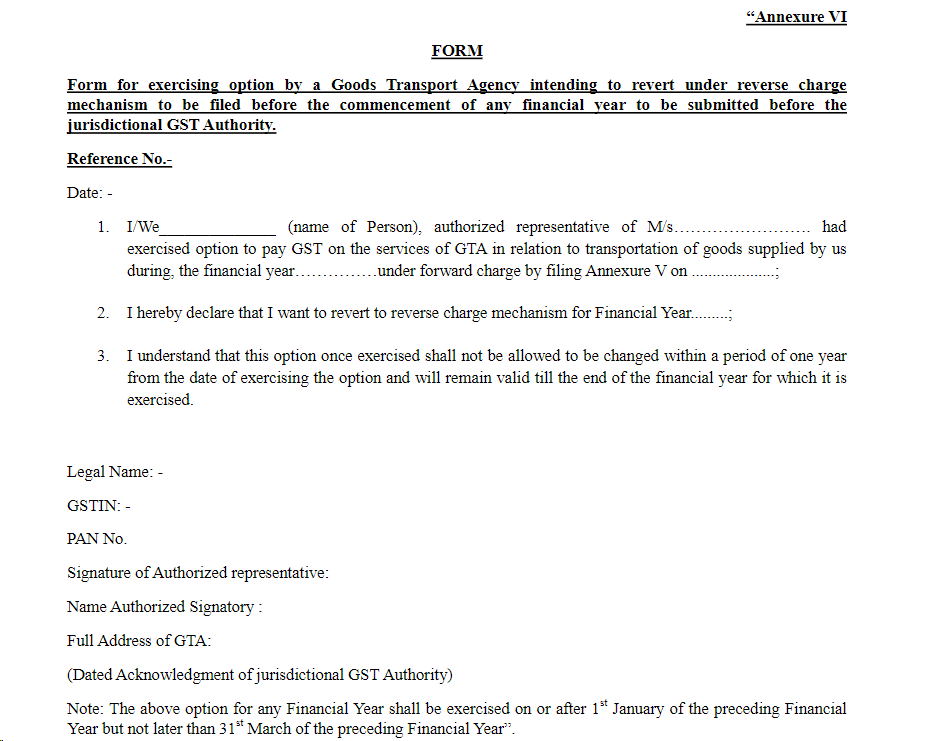

A significant update in this notification is the introduction of the declaration in Annexure VI. A new form is prescribed for exercising option by a Goods Transport Agency intending to revert under the reverse charge mechanism. It is to be filed by GTAs who used to pay GST under forward charge, but now wish to pay GST under reverse charge mechanism. Following is the format of such a declaration:

The GSTN has eased the burden on GTAs paying taxes through the forward charge mechanism by exempting them from the requirement to file declarations annually. Additionally, the transformation of manual form compliance into an electronic format will significantly streamline the process, making it more accessible and user-friendly.

goods transport agency

gta services under gst

gta under gst

goods transport agency under gst

what is gta in gst

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More