A person with multiple business locations within a State or Union Territory can obtain separate GST registrations for each location. If a registered person with multiple GST registrations within a State /UT wants to transfer unutilized matched Input Tax Credit (ITC) from one entity (transferor) to another (transferee), the transferor must file Form GST ITC-02A on the GST Portal within 30 days of obtaining the new registration. The transferee (newly registered entity) can then accept or reject the ITC transfer.

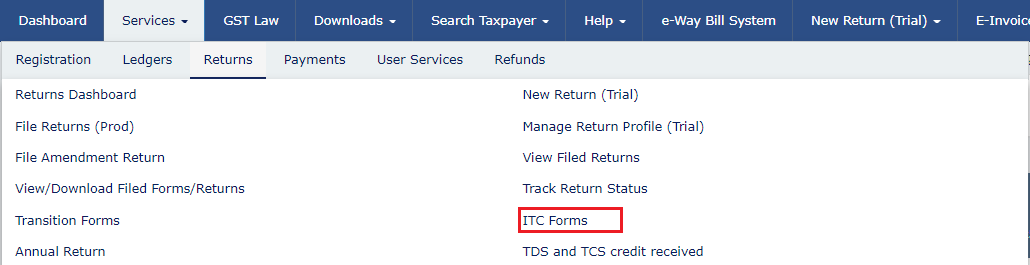

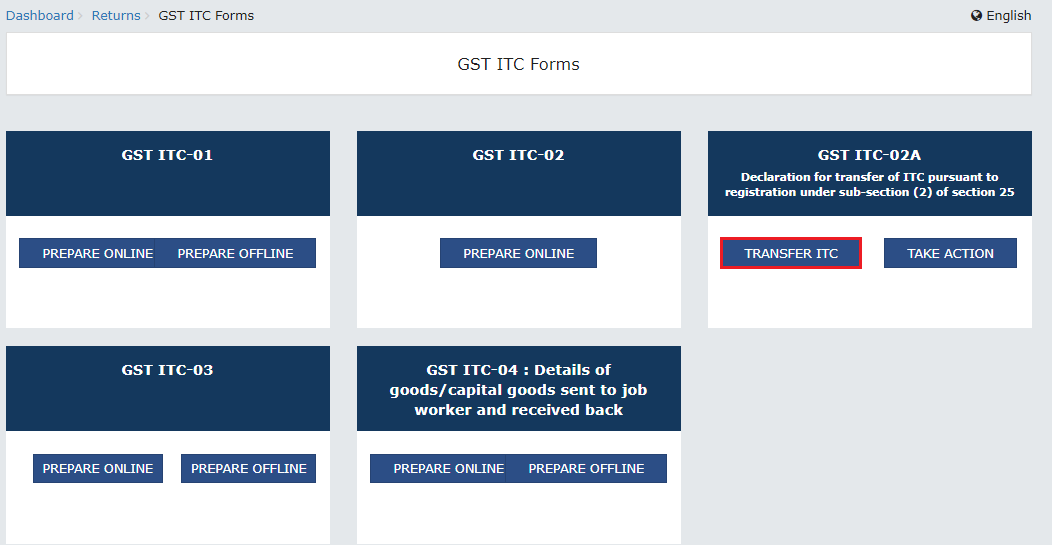

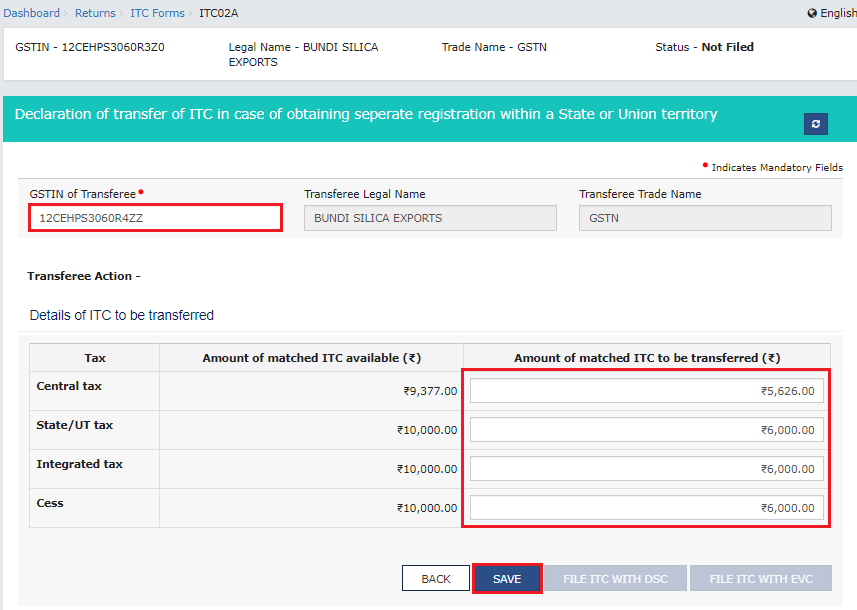

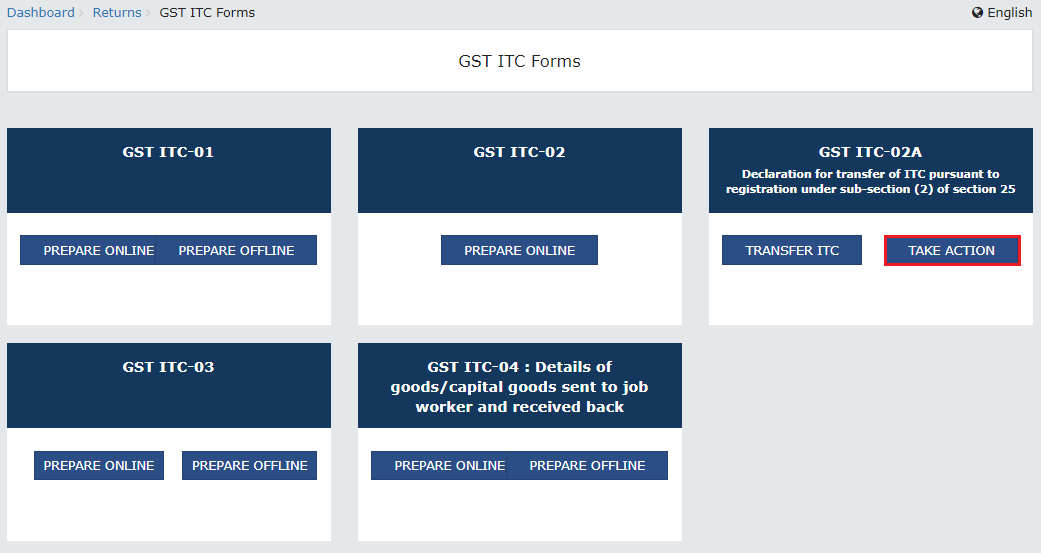

To transfer ITC and file Form GST ITC-02A as a transferor entity, perform the following steps:

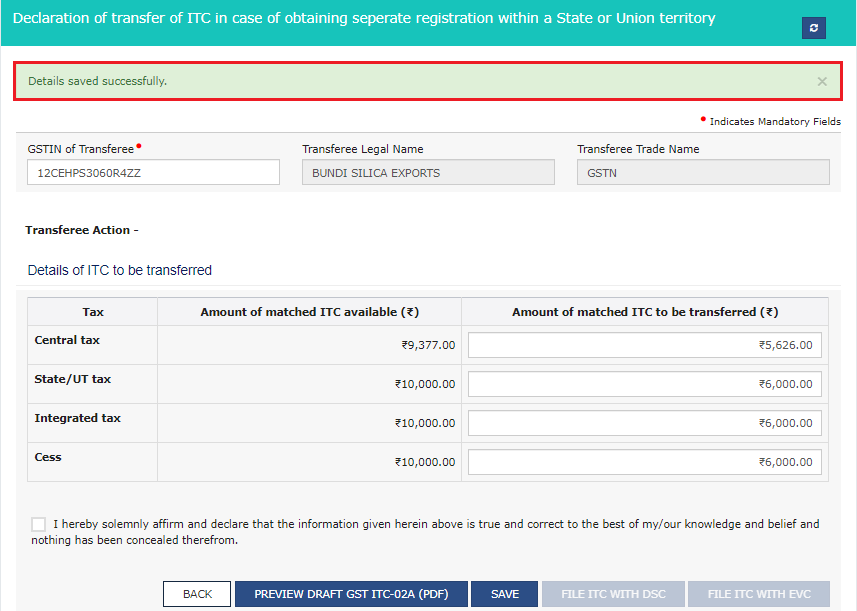

5a. A confirmation message is displayed that data is saved successfully.

5a. A confirmation message is displayed that data is saved successfully.

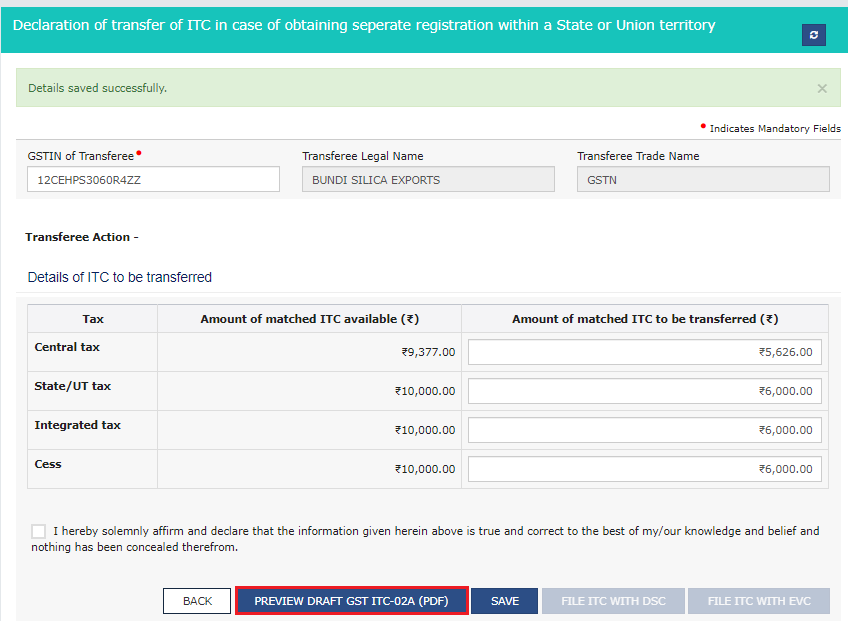

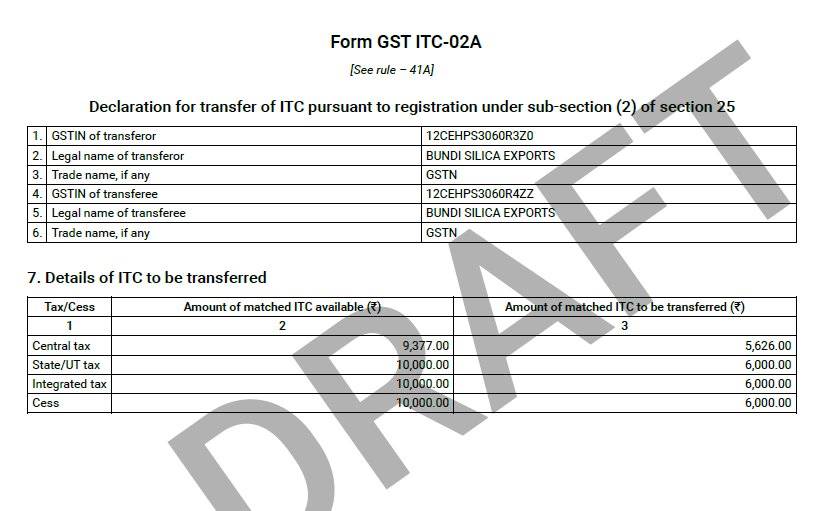

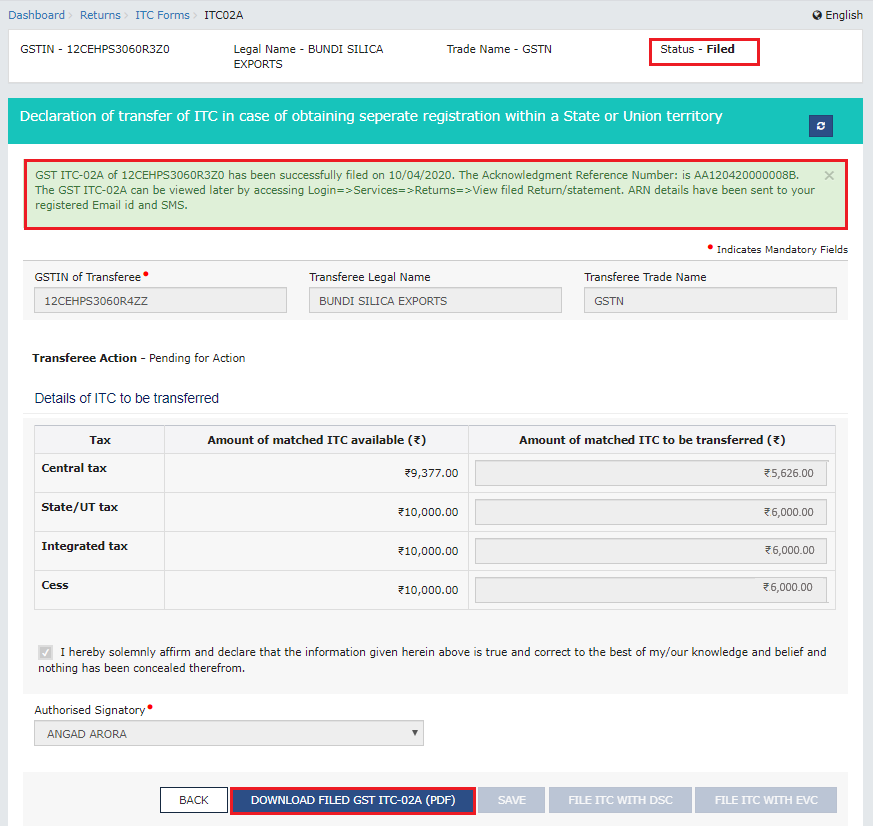

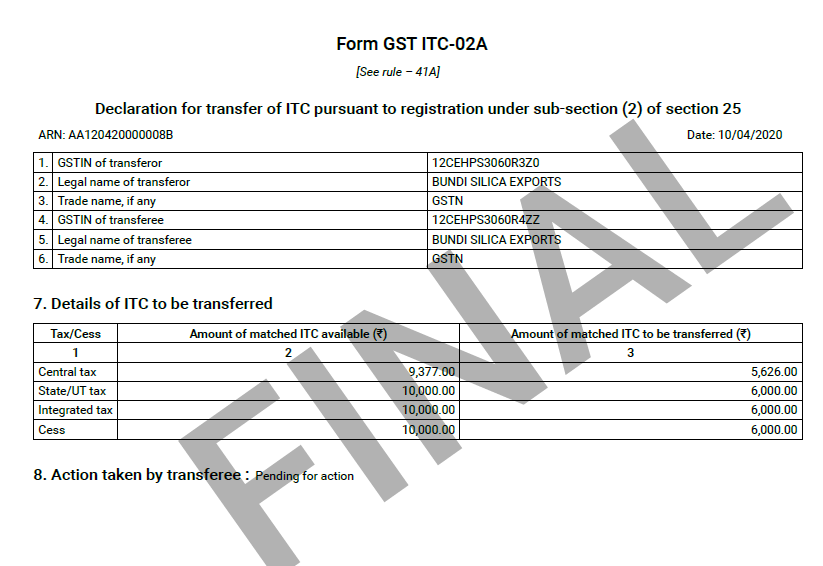

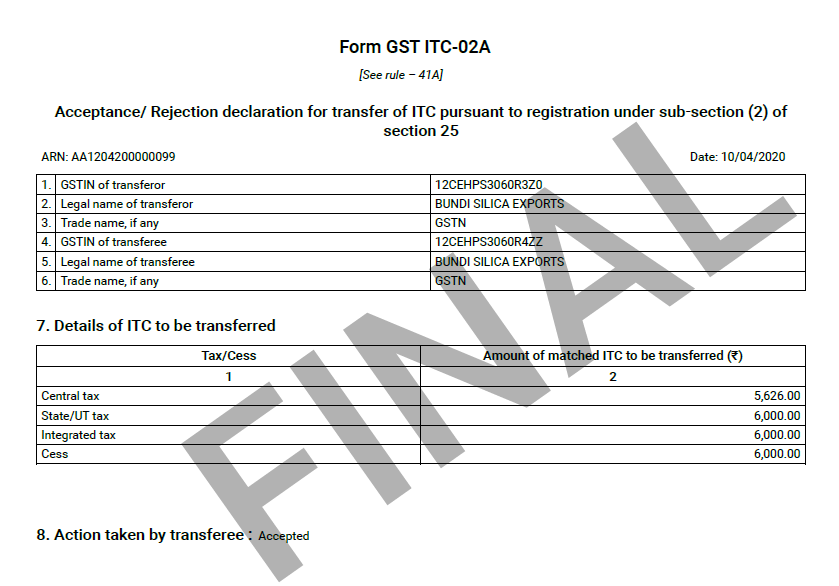

6a. The summary page of Form GST ITC-02A in PDF format is displayed.

6a. The summary page of Form GST ITC-02A in PDF format is displayed.

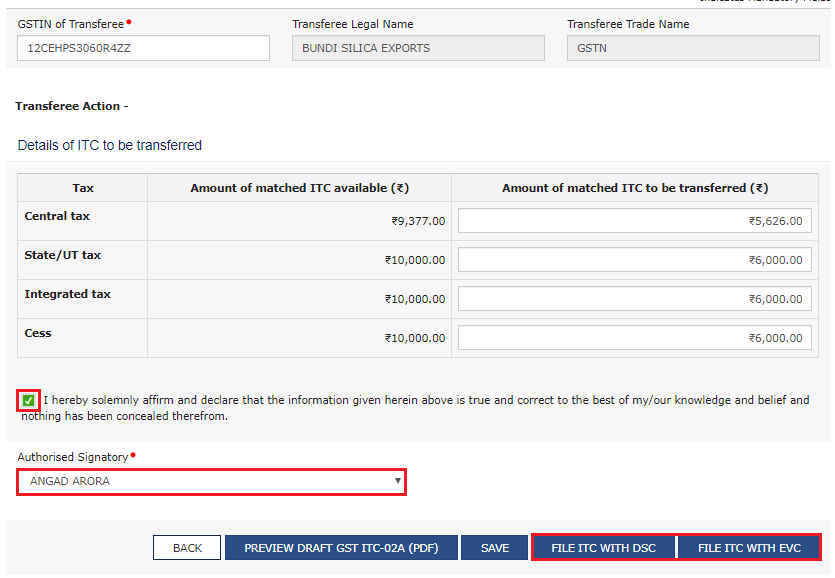

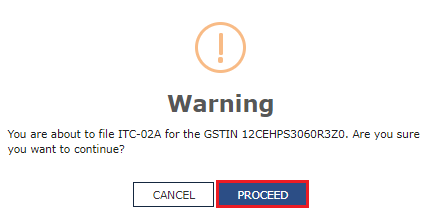

(a) To FILE ITC WITH DSC: Click the PROCEED button and then select the certificate and click the SIGN button.

(a) To FILE ITC WITH DSC: Click the PROCEED button and then select the certificate and click the SIGN button.

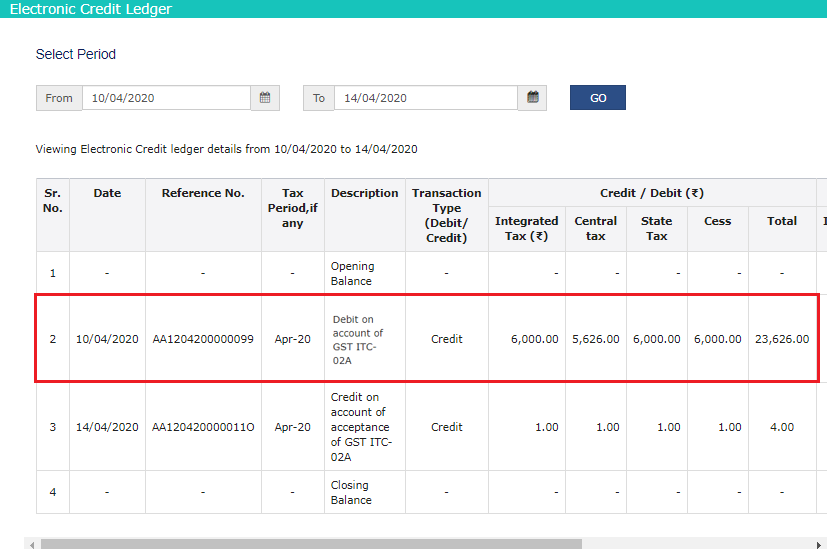

Note: After Form GST ITC-02A is successfully filed by the transferor entity:

Note: After Form GST ITC-02A is successfully filed by the transferor entity:

A person having multiple places of business in a State or Union territory may be granted separate registration for each place of business.

Suppose a registered person, who has obtained separate registration for multiple places of business in a State/UT and intends to transfer unutilized matched Input Tax Credit lying in his/her Electronic Credit Ledger of an existing entity (the transferor entity) to a newly registered entities/place of businesses (transferee entity). In that case, the transferor entity (existing entity) has to file Form GST ITC-02A on the GST Portal, within 30 days of obtaining such registration, and the transferee entity (newly registered entity) can accept or reject the same.

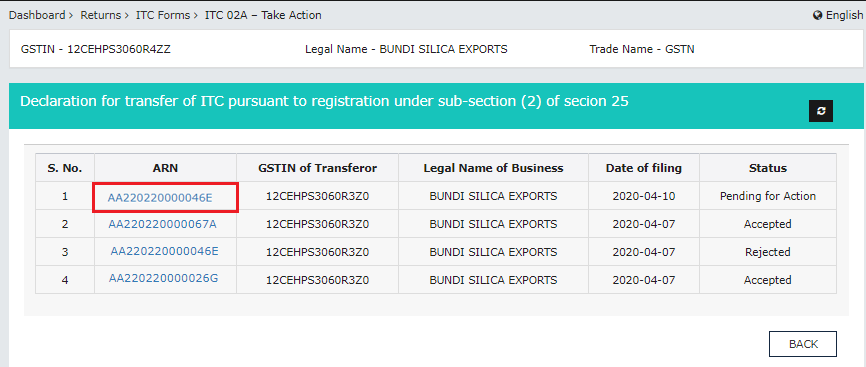

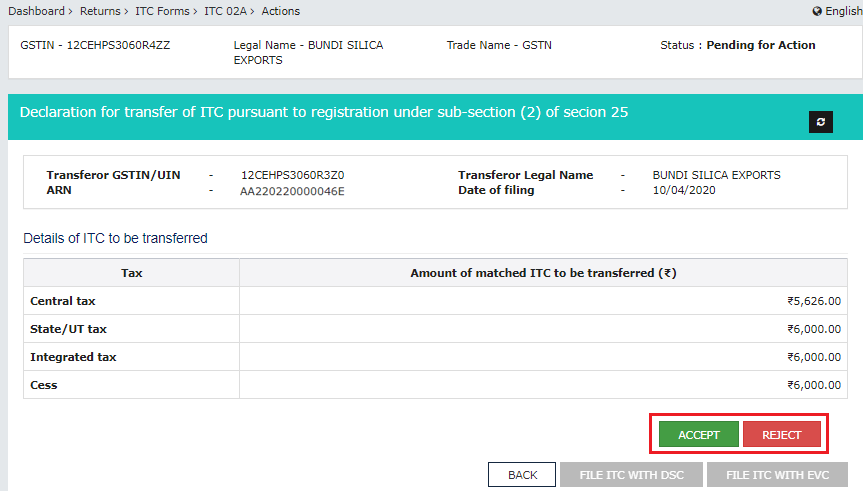

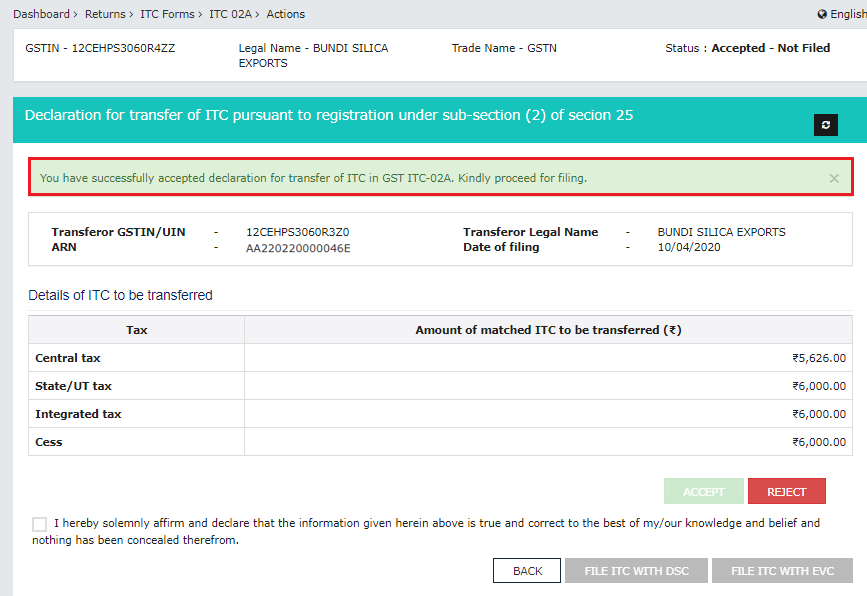

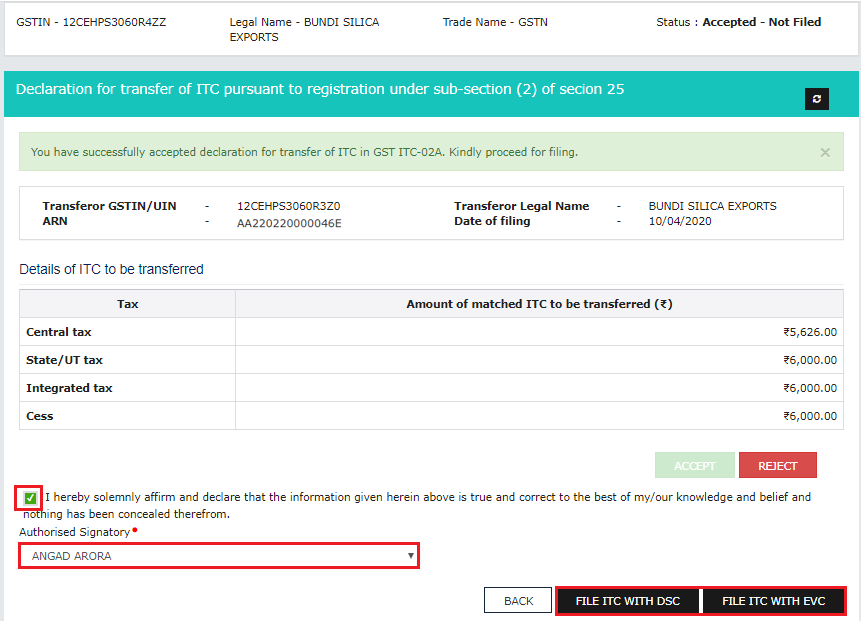

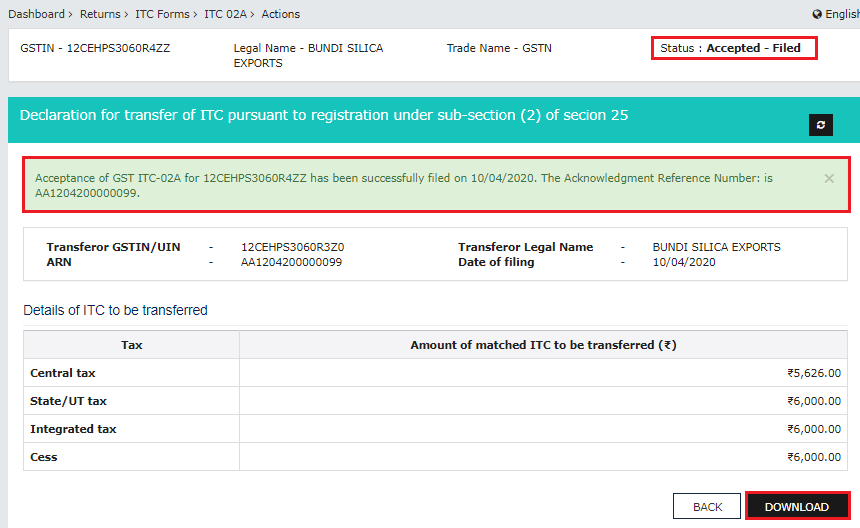

After the transferor entity successfully files Form GST ITC-02A, transferee entity needs to accept or reject Form ITC-02A, in order to transfer or reject the Input tax credit being transferred.

To take action and file Form GST ITC-02A as a transferee entity, perform the following steps:

Note :

Note :

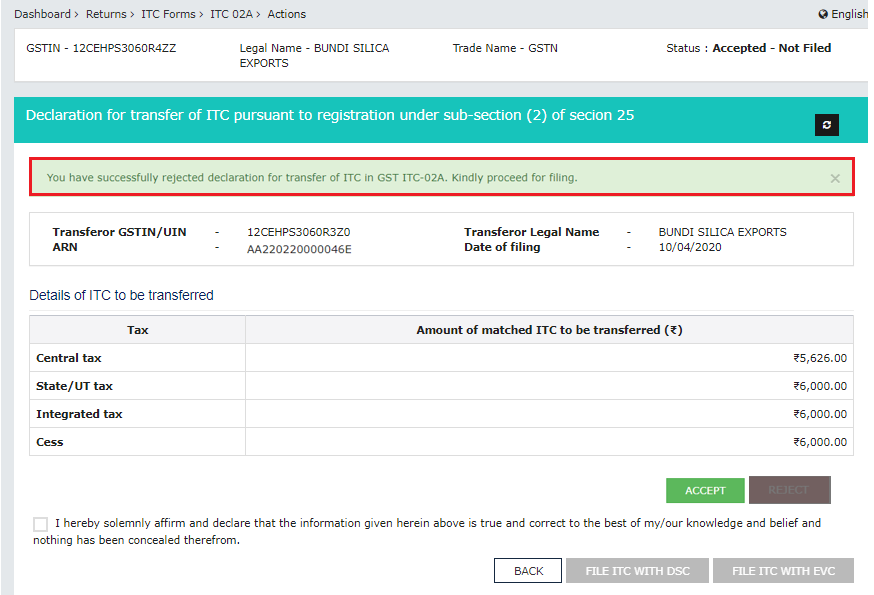

(b) In case of rejection: A confirmation message is displayed on the screen that you have successfully rejected the declaration of transfer of ITC in Form GST ITC-02A.

(b) In case of rejection: A confirmation message is displayed on the screen that you have successfully rejected the declaration of transfer of ITC in Form GST ITC-02A.

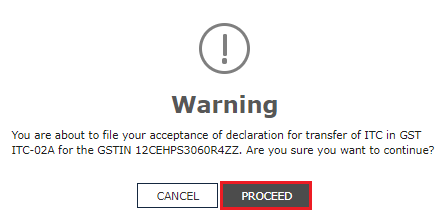

(a) To FILE ITC WITH DSC: Click the PROCEED button and then select the certificate and click the SIGN button.

(a) To FILE ITC WITH DSC: Click the PROCEED button and then select the certificate and click the SIGN button.

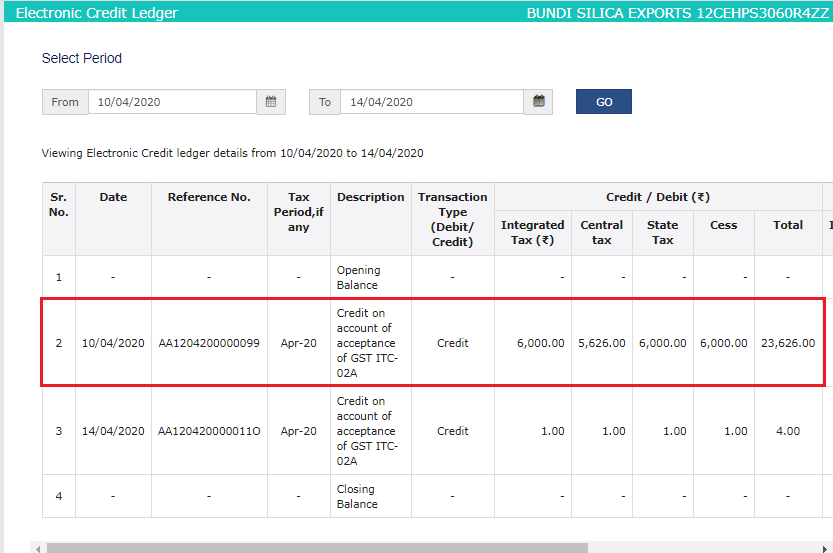

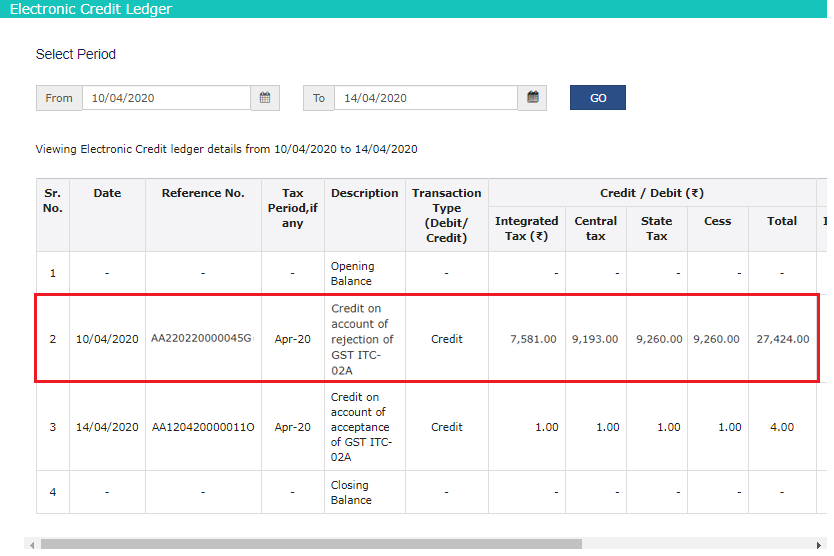

Note: After Form GST ITC-02A is successfully filed by the transferee entity:

Note: After Form GST ITC-02A is successfully filed by the transferee entity:

Transferring Input Tax Credit (ITC) within multiple business locations under the same GST registration is a straightforward process with the help of Form GST ITC-02A. By following the outlined steps on the GST Portal, both the transferor and transferee entities can ensure a smooth transfer of unutilized ITC. This procedure helps maintain compliance and optimize the use of available tax credits, enhancing financial efficiency. Always remember to complete the process within the stipulated 30 days to avoid any complications. Stay informed and utilize the GST portal effectively to manage your ITC transfers.

itc in gst

itc 02

itc 02 ca certificate format

gst verification

gst on register

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More