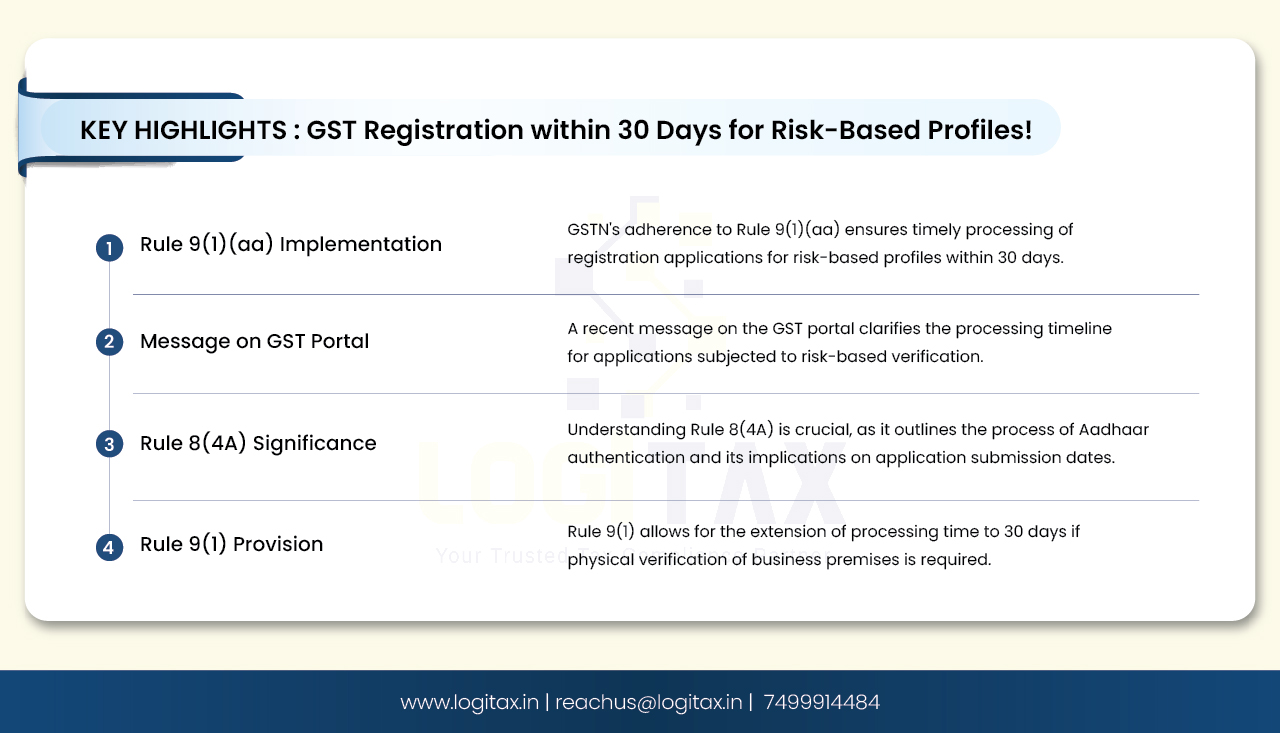

As per rule 9(1)(aa) of the CGST Rules, 2017, when a person has applied for GST registration and has done Aadhaar Authentication, but is identified as risk base profile, his registration application will be processed after carrying out physical verification of places of business.

As per this rule, the registration shall be granted within thirty days of application submission, after physical verification of the place of business.

However, this 30-day time limit is not properly implemented and such registrations are getting delayed.

Therefore, on 28th February 2024, GSTN issued a message on the common portal about the issue!

The following message is displayed on the GST common portal:

“Subject: Instances of Delay in Registration Reported by some Taxpayers Despite Successful Aadhar Authentication by Rule 8 and 9 CGST, Rules, 2017-reg

28/02/2024

Dear Taxpayers,

By Rule 9 of the Central Goods and Services Tax (CGST) Rules, 2017, about the verification and approval of registration applications, the following is informed:

Where a person has undergone Aadhaar authentication as per sub-rule (4A) of rule 8 but has been identified in terms of Rule 9(aa) by the common portal for detailed verification based on risk profile, your application for registration would be processed within thirty days of application submission.

Necessary changes would also be made to reflect the same in the online tracking module vis-à-vis processing of registration application.

Thank you for your attention.

Thanking you,

Team GSTN”

Rule 8 covers provisions related to the Application for Registration.

The text of Sub-rule 4A of the same is as follows:

“Where an applicant, other than a person notified under sub-section (6D) of section 25, opts for authentication of Aadhaar number, he shall, while applying sub-rule (4), undergo authentication of Aadhaar number and the date of submission of the application in such cases shall be the date of authentication of the Aadhaar number, or fifteen days from the submission of the application in Part B of FORM GST REG-01 under sub-rule (4), whichever is earlier.

Provided that every application made under sub-rule (4) by a person, other than a person notified under sub-section (6D) of section 25, who has opted for authentication of an Aadhaar number and is identified on the common portal, based on data analysis and risk parameters, shall be followed by biometric-based Aadhaar authentication and taking photograph of the applicant where the applicant is an individual or of such individuals concerning the applicant as notified under sub-section (6C) of section 25 where the applicant is not an individual, along with the verification of the original copy of the documents uploaded with the application in FORM GST REG-01 at one of the Facilitation Centres notified by the Commissioner for this sub-rule and the application shall be deemed to be complete only after completion of the process laid down under this proviso.”

To summarise this, rule 8(4A) states that when a person applying for registration opts for Aadhaar Authentication, the date of submission of the application should be considered as the date of authentication of the Aadhaar number, or fifteen days from the submission of the application, whichever is earlier.

Rule 9 covers provisions related to the Verification of the application of the GST registration and approval.

The text of it’s sub-rule 1 is as follows:

“(1) The application shall be forwarded to the proper officer who shall examine the application and the accompanying documents and if the same are found to be in order, approve the grant of registration to the applicant within seven working days from the date of submission of the application.

Provided that where-

(a) a person, other than a person notified under sub-section (6D) of section 25, fails to undergo authentication of Aadhaar number as specified in sub-rule (4A) of rule 8 or does not opt for authentication of Aadhaar number; or

(aa) a person, who has undergone authentication of an Aadhaar number as specified in sub-rule (4A) of rule 8, is identified on the common portal, based on data analysis and risk parameters, for carrying out physical verification of places of business; or

(b) the proper officer, with the approval of an officer authorized by the Commissioner not below the rank of Assistant Commissioner, deems it fit to carry out physical verification of places of business,

the registration shall be granted within thirty days of application submission, after physical verification of the place of business, in the manner provided under rule 25 and verification of such documents as the proper officer may deem fit.”

As per the above proviso (aa) to rule 9(1), if the officer identifies any application for which carrying out physical verification of the business premises is required, the time limit of 7 days from the date application shall be extended to 30 days.

Now, GSTN has issued a clear message on the common portal that such delayed applications will be processed within 30 days of the application. Alterations will be implemented to align the online tracking module with the processing of registration applications.

aadhar authentication

GST regime

GST Registration

GSTN

Goods and Services Tax

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More