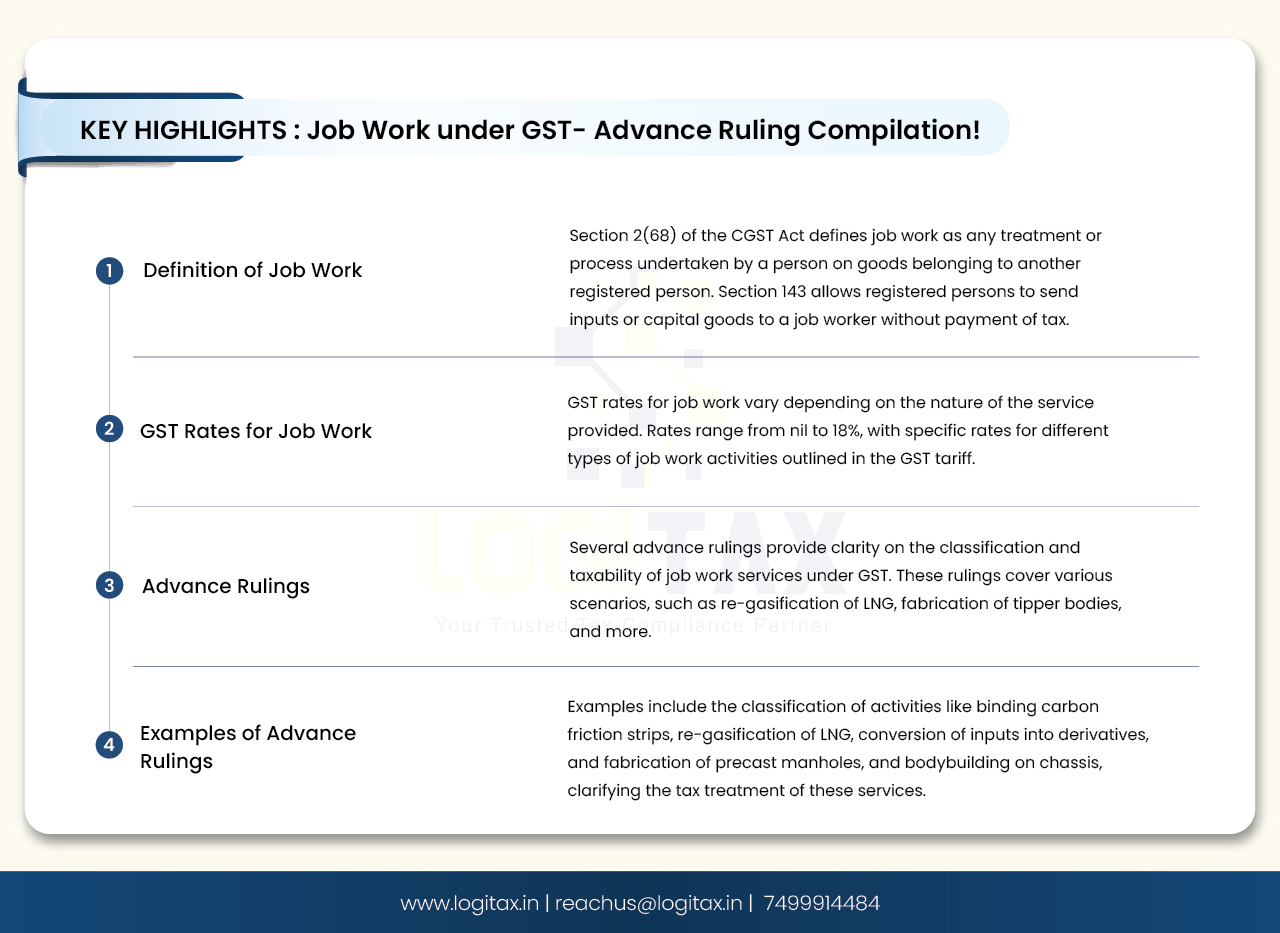

As per section 2(68) of the CGST Act, 2017, "job work" means any treatment or process undertaken by a person on goods belonging to another registered person, and the expression "job worker" shall be construed accordingly. As per section 143 of the CGST Act, 2017, a registered person may send any inputs or capital goods, without payment of tax, to a job worker for job work. However, there are certain conditions to be fulfilled to do so. They are as follows:

A) Bring back inputs, after completion of job work or otherwise, or capital goods, within one year and three years, respectively, of their being sent out, to any of his places of business.

B) Supply such inputs, after completion of job work or otherwise, or capital goods, within one year and three years, respectively, of their being sent out from the place of business of a job worker.

However, GST is charged by the job worker on his job work charges to be recovered from the principal. Following are the GST rates applicable for job work:

| Sr No. | Particulars | HSN | GST Rate |

|---|---|---|---|

| 1. | Carrying out an intermediate production process as job work in relation to the cultivation of plants and rearing of all life forms of animals, except the rearing of horses, for food, fiber, fuel, raw material, or other similar products or agricultural produce | 9986 | Nil |

| 2. | Services by way of job work in relation to (a) Printing of newspapers; (b) Textiles and textile products falling under Chapters 50 to 63 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975) (c) all products [other than diamonds]108 falling under Chapter 71 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975); (d) Printing of books (including Braille books), journals and periodicals; (da) printing of all goods falling under Chapter 48 or 49, which attract IGST å percent. or Nil; (g) all products falling under Chapter 23 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975), except dog and cat food put up for retail sale falling under tariff item 23091000 of the said chapter; (i) manufacture of handicraft goods. |

9988 | 5% |

| 3. | Services by way of job work in relation to (a) manufacture of umbrella; (b) printing of all goods falling under Chapter 48 or 49, which attract IGST å12 percent. | 9988 | 12% |

| 4. | Services by way of job work in relation to diamonds falling under chapter 71 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975); | 9988 | 1.5% |

| 5. | Services by way of job work in relation to bus bodybuilding; “Explanation- For the purposes of this entry, the term “bus body building” shall include the building of body on the chassis of any vehicle falling under chapter 87 in the First Schedule to the Customs Tariff Act, 1975 | 9988 | 18% |

| 6. | Services by way of job work in relation to the manufacture of alcoholic liquor for human consumption | 9988 | 18% |

| 7. | Services by way of job work other than above | 9988 | 12% |

There are plenty of Advance Rulings on Job work and GST implications thereon. We have compiled it for you!

| Sr No. | Name of the applicant | Order Date | State | Ruling |

|---|---|---|---|---|

| 1. | OERLIKON FRICTION SYSTEM (INDIA) PRIVATE LIMITED | 29/11/2023 | Tamil Nadu |

Classification of activity of binding the carbon friction strips on metal components (i.e. Synchronizer Core) received from the customer, under job work challan- Whether the activity undertaken by the Applicant amounts to supply of job-work service under the SAC code 9988?

The activity undertaken by the Applicant of Bonding imported Carbon friction strips to Synchronizer core received from customers amounts to the supply of job work services under SAC 9988. |

| 2. | DHAMRA LNG TERMINAL PRIVATE LIMITED | 05/09/2023 | Orissa |

Classification of activity of re-gasification of Liquified Natural Gas (LNG) into Re-gasified Liquefied Natural Gas (RLNG) - Whether the proving conversion of re-gasification of LNG owned by customers into RLNG amount to rendering of service by way of job work?

In terms of Circular No. 126/45/2019-GST dated 22.11.2019 applicant’s activity of re-gasification of LNG owned by its GST registered customers amounts to rendering of service by way of Job Work and covered by Heading 9988 at Sl. No. 26 of Notification No. 11/2017-CT (rate) dated 28.06.2017, as amended, and as such is liable to 12% GST. |

| 3. | SHREE AVANI PHARMA | 03/11/2023 | Gujarat |

Whether the process of converting the inputs viz. Nitroantraquinone (HSN 2909), Monon methyl Amine (HSN 2921) & Bromine (HSN 2801) into Antraquinone derivatives (HSN 2914) amounts to ‘services by way of job work’ and classifiable under SAC 9988 attracting 12% GST?

The service in question falls within the ambit of entry Sr. No. 26(id) of notification No. 11/2017-CT (Rate) dated 28.6.2017, as amended vide notification No. 20/2019-CT (Rate) dated 30.9.2019 and is classifiable under SAC 9988 and will attract 12% GST. |

| 4. | NATANI PRECAST | 22/03/2023 | Rajasthan |

Manufacture and supply Precast Manholes - Whether the supply of precast manholes using the steel and cement supplied by the principal is a supply of service or a supply of goods? Whether the stated supply to be made by the applicant constitute any form of job work?

The Precast Manholes and Rises are movable property, hence supply of Precast Manholes and Rises is the supply of goods and not a supply of services. The manufacturing activities carried out by the applicant do not fall under the ambit of job work as it involves the manufacturing of Precast Manholes and Rises and it cannot be termed as "any treatment or process undertaken by a person on goods belonging to another registered person". |

| 5. | PURVANCHAL VIDYUT VITRAN NIGAM LIMITED | 03/02/2023 | Punjab |

The activity of Bodybuilding on chassis owned and supplied by the customer - The applicant is engaged in tipper bodybuilding and fabrication and mounting the same on the Chassis supplied by the customers - Whether the activity of building and fabricating of Tipper Body and mounting the same by the applicant on the chassis owned and supplied by the customer will result in the supply of goods or supply of services?

If the activity of fabrication of the Tipper Body and mounting of the body is done on the chassis owned by the applicant and using his own inputs and capital goods, the same shall amount to a supply of goods and shall merit classification under HSN 8707, attracting 28% of GST. However, if the activity of fabrication of the Tipper Body and mounting of the body is done on the chassis supplied by the customer using their own inputs and capital goods amounts to the supply of service, in terms of CBIC Circular dated 09.08.2018 and merits classification under SAC 9988 (Job work), attracting 18% of GST. |

Taxpayers should analyze provisions of the GST Act and Rules and also check various advance rulings on the subject to understand the exact taxability of the service with job work.

job worker under gst

gst job work

what is job work

gst on job work charges

job work in gst

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More