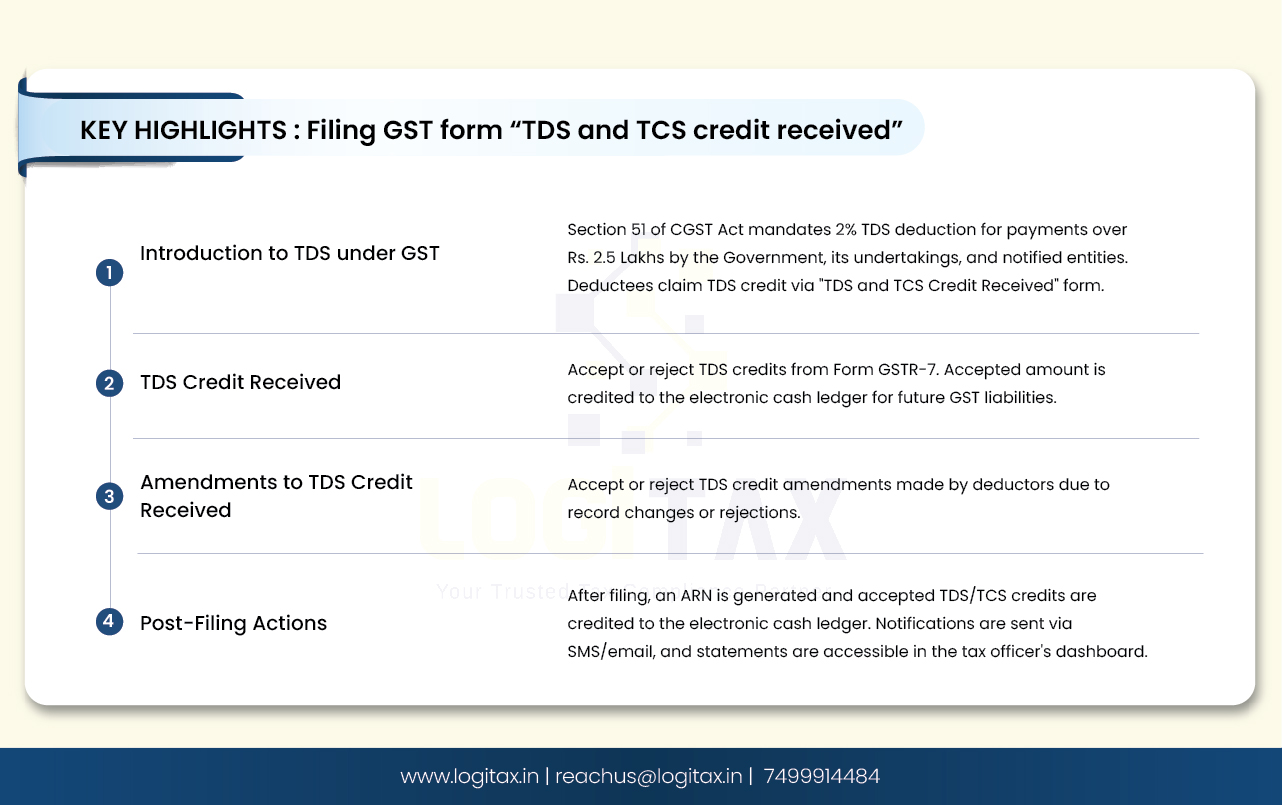

As per section 51 of the CGST Act, 2017, Government undertakings and other notified entities should deduct TDS @ 2% while making contractual payments where total value of such supply under contract exceeds Rs. 2.5 Lakhs to suppliers. Such TDS should be deposited to respective head of GST. The deductee can claim such TDS while paying his output taxes.

Read more about TDS under GST.

For claiming credit of such TDS, the deductee should file the form “TDS and TCS Credit received”. This form basically enables the dedcutee to accept or rejects his TDS reflected online. Once he files such form, accepted TDS amount will be credited to his electronic cash ledger. He can use balance in electronic cash ledger for payment of GST liability.

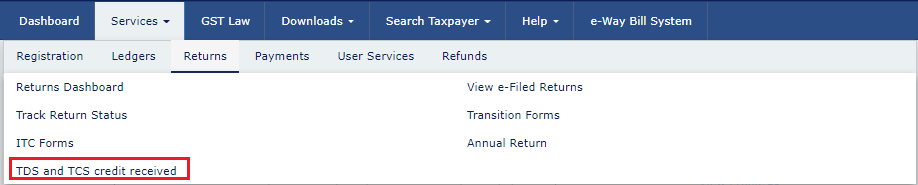

Access the www.gst.gov.in URL. The GST Home page is displayed. Login to the GST Portal with valid credentials. Click the Services > Returns > TDS and TCS credit received command.

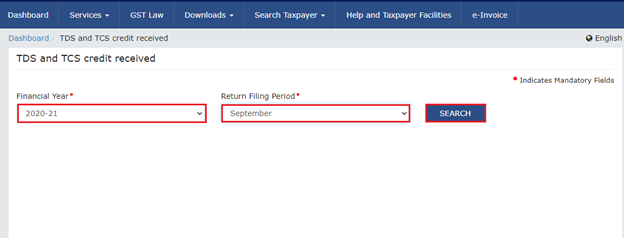

The TDS and TCS credit received page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the TDS and TCS Credit Received from the drop-down list. Click the SEARCH button.

The TDS and TCS credit received page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the TDS and TCS Credit Received from the drop-down list. Click the SEARCH button.

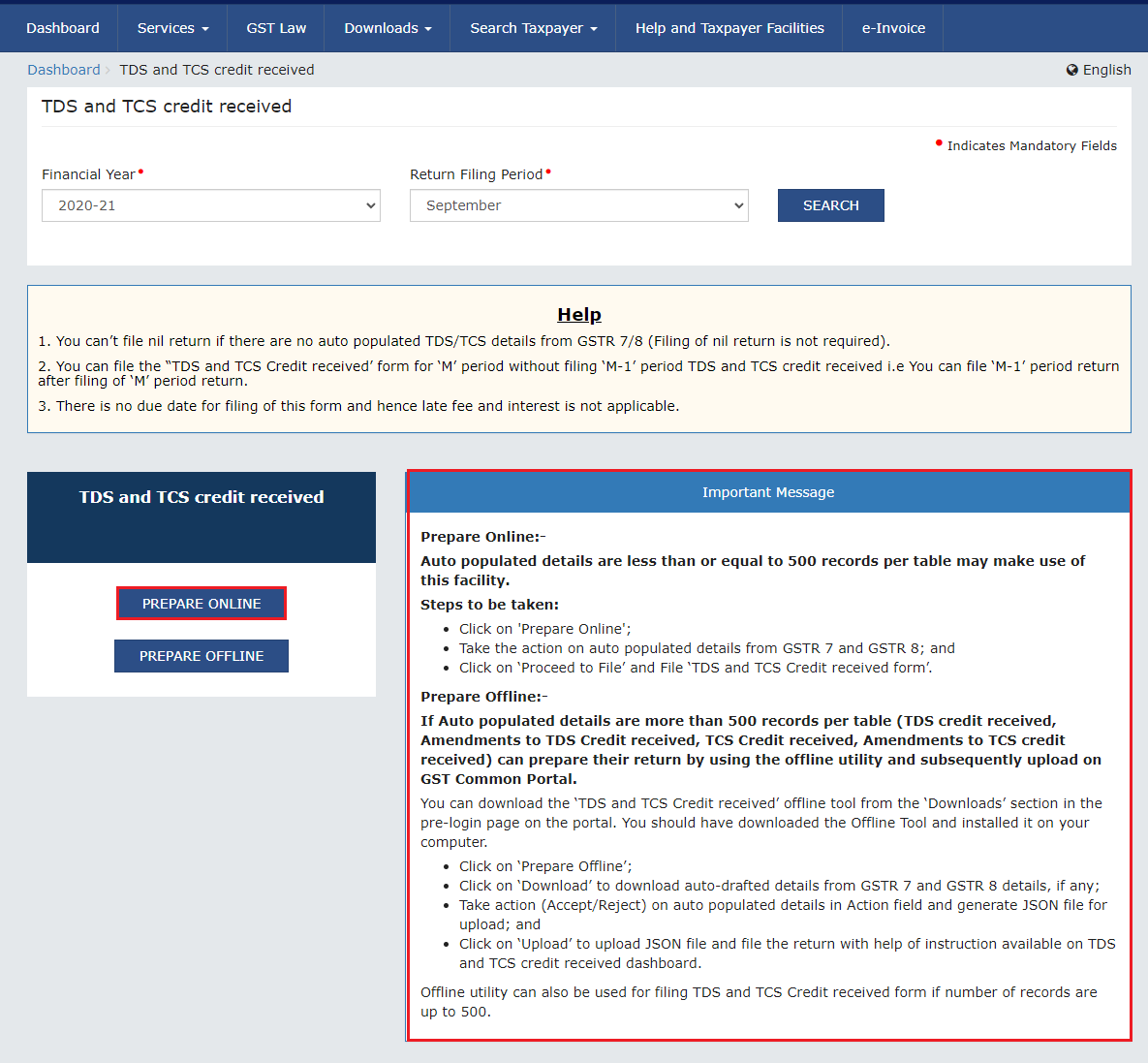

In the TDS and TCS credit received tile, click the PREPARE ONLINE button if you want to prepare the statement by making entries on the GST Portal.

In the TDS and TCS credit received tile, click the PREPARE ONLINE button if you want to prepare the statement by making entries on the GST Portal.

NOTE :

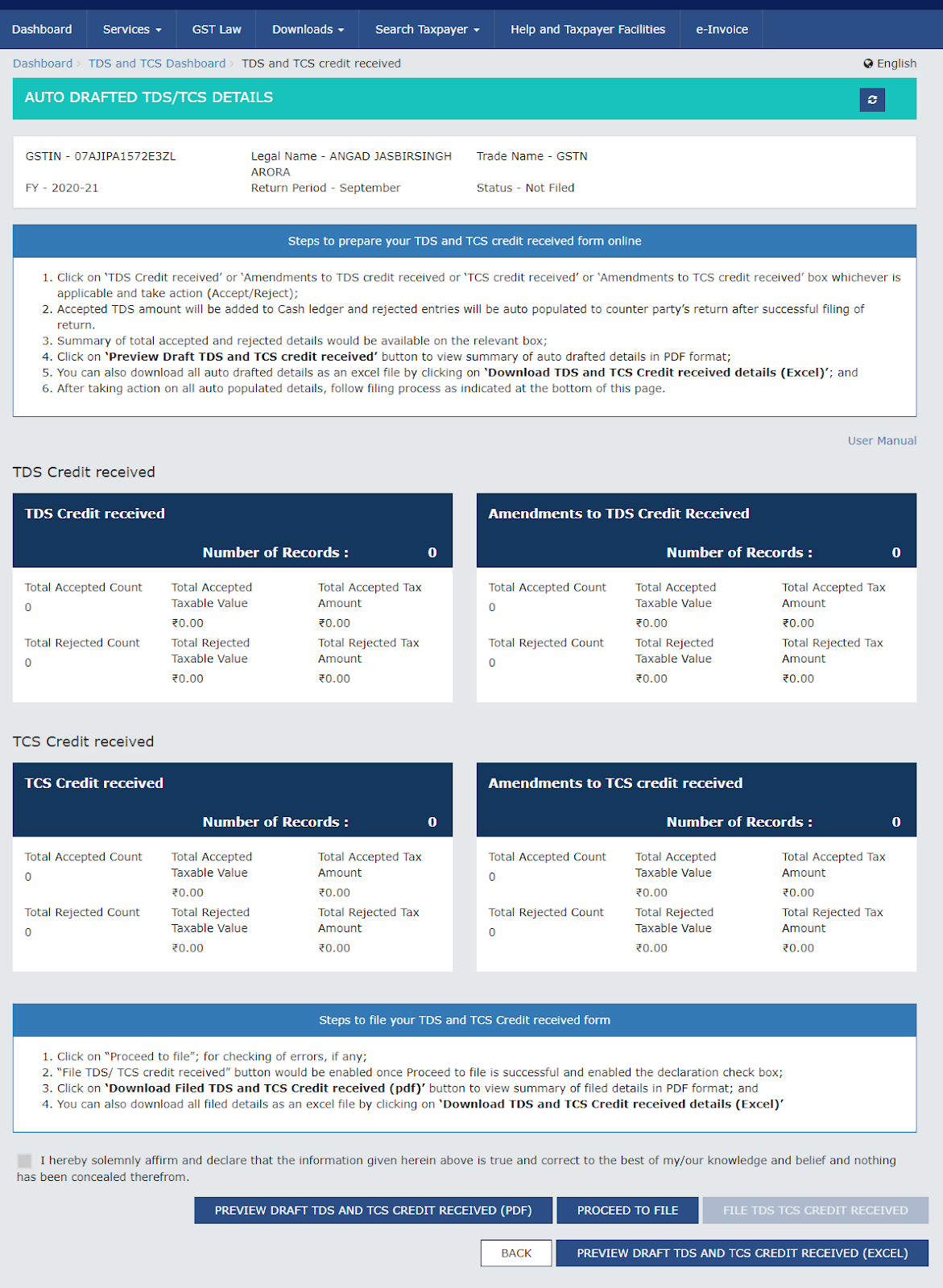

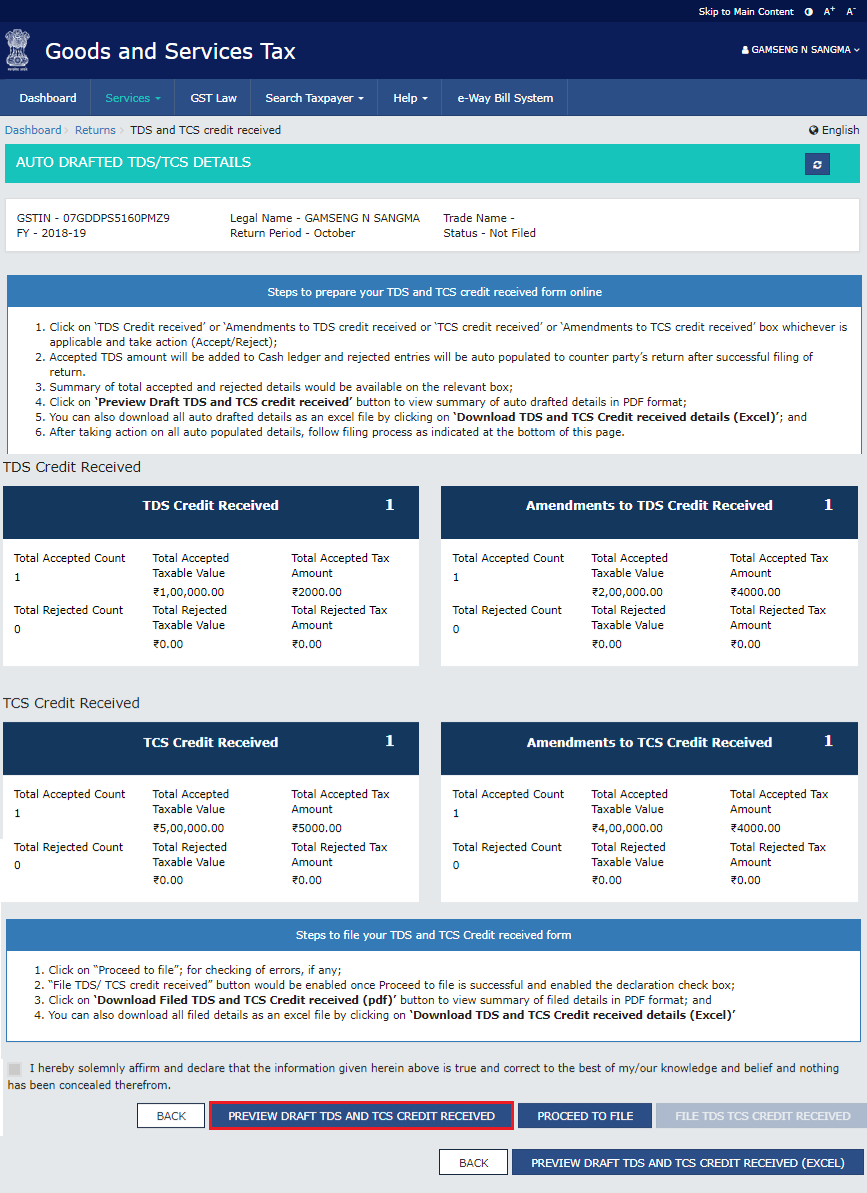

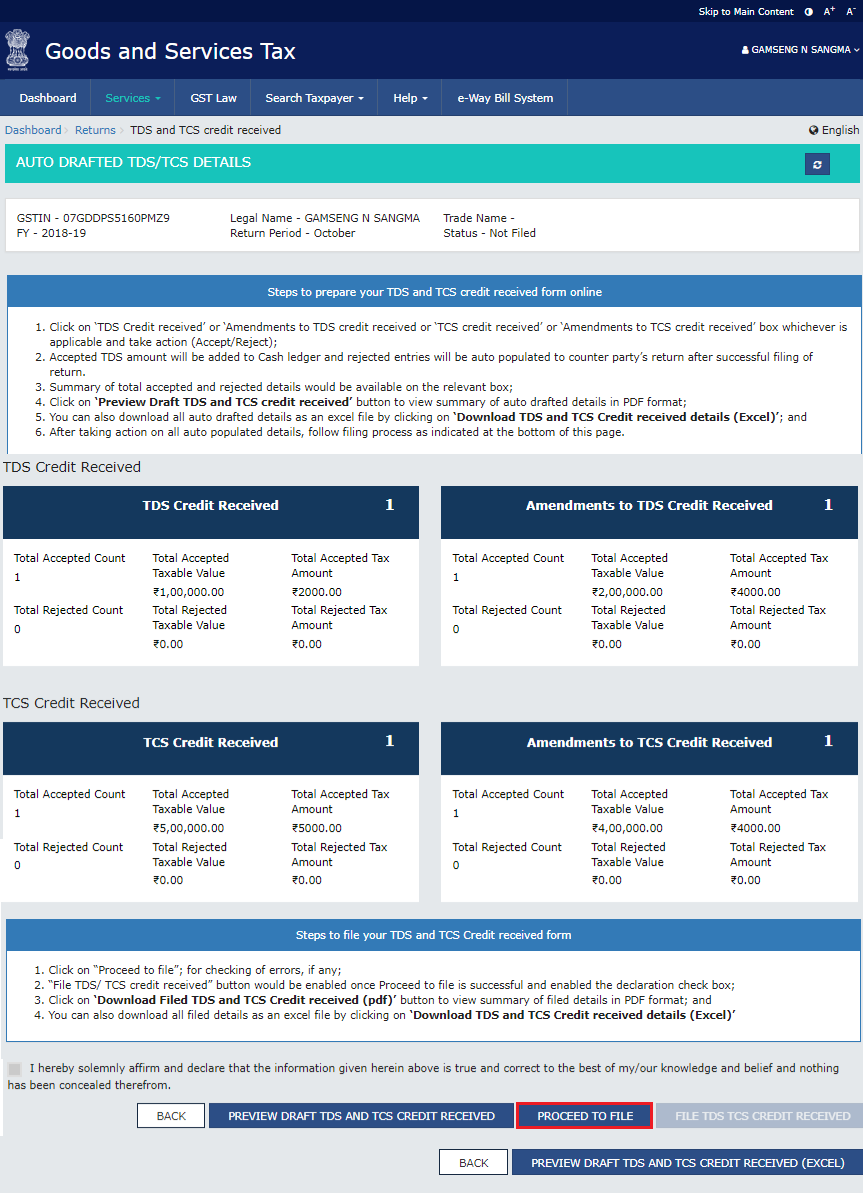

The AUTO DRAFTED TDS/TCS DETAILS page is displayed.

Click the TDS Credit Received tile, to accept/ reject TDS credit received details populated from Form GSTR-7 of the deductors.

The TDS Credit Received - Summary page is displayed.

Select the checkbox for GSTIN of Deductor and click the ACCEPT / REJECT button to accept or reject the record.

Note:

In case of accepting the record, the status is changed to ACCEPTED.

Click the BACK button.

You will be directed to the Dashboard page and the TDS Credit Received tile will reflect the Total Accepted Count, Total Accepted Taxable Value and Total Accepted Tax Amount.

In case of rejecting the record, the status is changed to REJECTED.

Click the BACK button.

You will be directed to the Dashboard page and the TDS Credit Received tile will reflect the Total Rejected Count, Total Rejected Taxable Value and Total Rejected Tax Amount.

Click the Amendments to TDS Credit Received tile, to accept/ reject amendments to TDS Credit Received details populated from Form GSTR-7, filed by the deductors.

Note: Amendments to TDS Credit Received tile will come in two scenarios:

The TDSA Credit Received - Summary page is displayed.

Select the checkbox for GSTIN of Deductor and click the ACCEPT / REJECT button to accept or reject the record.

Note :

In case of accepting the record, the status is changed to ACCEPTED.

Click the BACK button.

You will be directed to the Dashboard page and the TCS Credit Received tile will reflect the Total Accepted Count, Total Accepted Taxable Value and Total Accepted Tax Amount.

In case of rejecting the record, the status is changed to REJECTED.

Click the BACK button.

You will be directed to the Dashboard page and the Amendments to TDS Credit Received tile will reflect the Total Rejected Count, Total Rejected Taxable Value and Total Rejected Tax Amount.

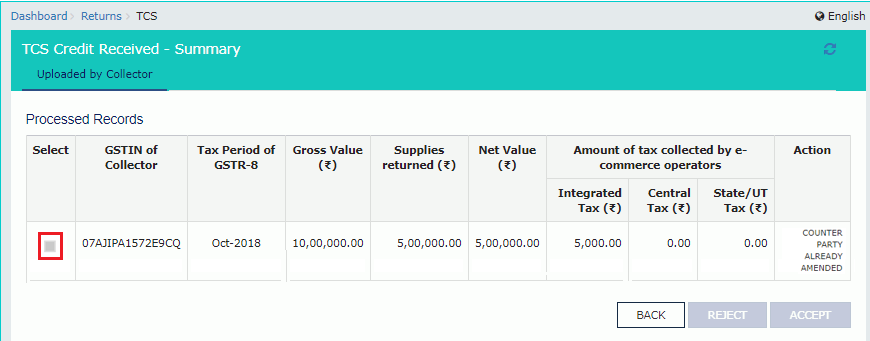

Click the TCS Credit Received tile, to accept/ reject TCS Credit Received details populated from Form GSTR-8 of the TCS collectors.

The TCS Credit Received - Summary page is displayed.

Select the checkbox for GSTIN of Collector and click the ACCEPT / REJECT button to accept or reject the record.

Note :

In case of accepting the record, the status is changed to ACCEPTED.

Click the BACK button.

You will be directed to the Dashboard page and the TCS Credit Received tile will reflect the Total Accepted Count, Total Accepted Taxable Value and Total Accepted Tax Amount.

In case of rejecting the record, the status is changed to REJECTED.

Click the BACK button.

You will be directed to the Dashboard page and the TDS Credit Received tile will reflect the Total Rejected Count, Total Rejected Taxable Value and Total Rejected Tax Amount.

Click the Amendments to TCS Credit Received tile, to accept/ reject amendments to TCS Credit Received details populated from Form GSTR-8 of the collectors.

Note: Amendments to TCS Credit Received tile will come in two scenarios:

The TCSA Credit Received - Summary page is displayed.

Select the checkbox for GSTIN of Collector and click the ACCEPT / REJECT button to accept or reject the record.

Note :

In case of accepting the record, the status is changed to ACCEPTED.

Click the BACK button.

You will be directed to the Dashboard page and the TCS Credit Received tile will reflect the Total Accepted Count, Total Accepted Taxable Value and Total Accepted Tax Amount.

In case of rejecting the record, the status is changed to REJECTED.

Click the BACK button.

You will be directed to the Dashboard page and the Amendments to TCS Credit Received tile will reflect the Total Rejected Count, Total Rejected Taxable Value and Total Rejected Tax Amount.

Once you have entered all the details, click the PREVIEW DRAFT TDS AND TCS CREDIT RECEIVED button. This button will download the draft summary page for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully. The PDF file generated would bear watermark of draft as the details are yet to be submitted.

The downloaded PDF is displayed.

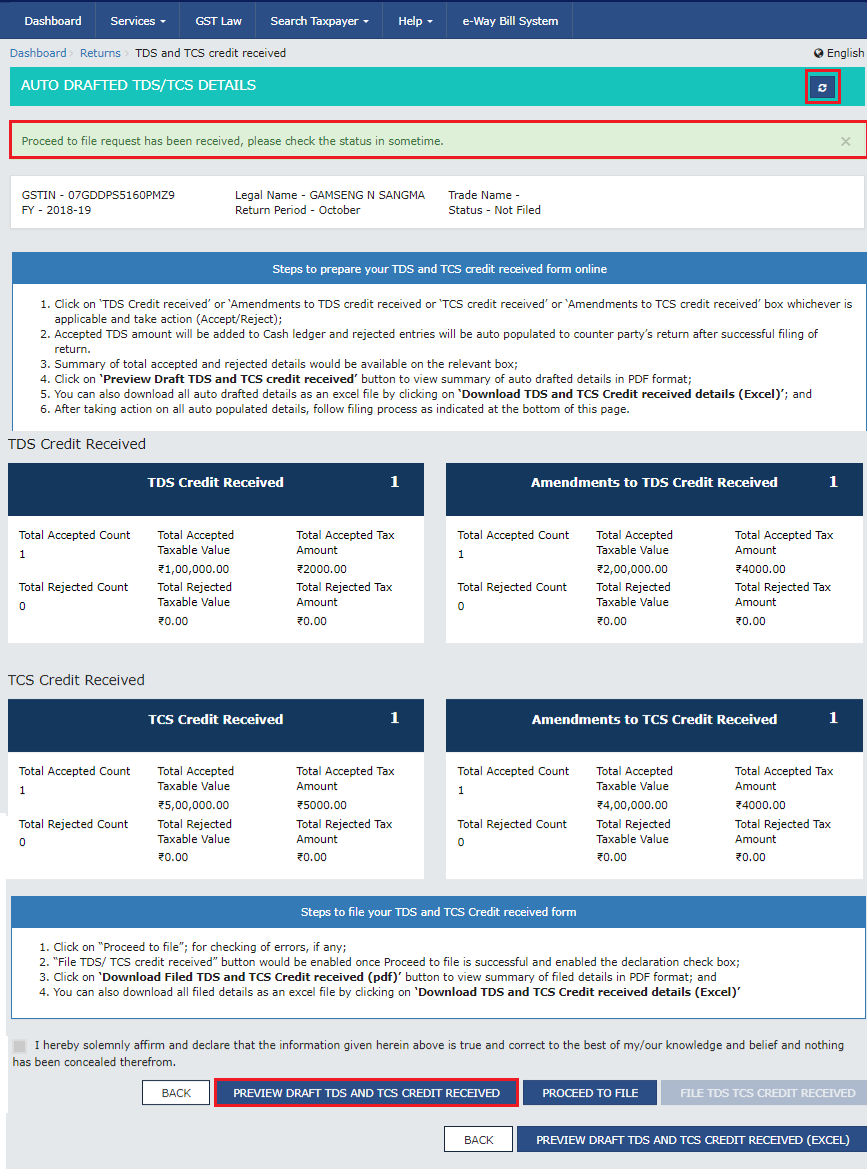

Click the PROCEED TO FILE button.

A message is displayed on top page of the screen that 'Proceed to file' request has been received. Please check the status after sometime. Click the Refresh button.

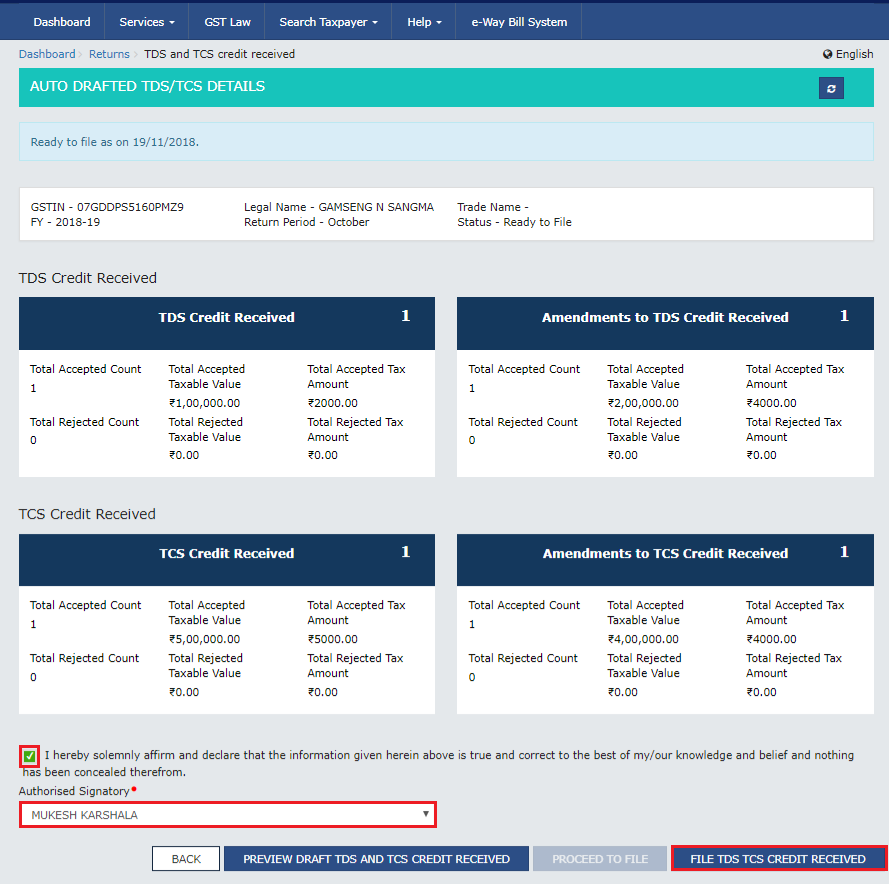

Select the Declaration checkbox. Select the Authorized Signatory from the drop-down list. Click the FILE TDS TCS CREDIT RECEIVED button.

Click the YES button.

The Submit Application page is displayed. Click the SUBMIT WITH DSC or SUBMIT WITH EVC button.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

The success message is displayed and ARN is displayed. Status of the TDS and TCS Credit Received statement changes to "Filed".

Note: After TDS and TCS Credit received statement is filed:

Filing GST Form "TDS and TCS Credit Received" is a crucial step for both deductors and deductees in the GST framework. As outlined in Section 51 of the CGST Act, deductors need to deduct TDS while making payments exceeding Rs. 2.5 Lakhs. To claim credit for such TDS, deductees must file the "TDS and TCS Credit Received" form.

Both parties need to stay compliant with the CGST Rules, ensuring seamless record-keeping and facilitating subsequent actions like appeals and recoveries. The recent CBIC instruction emphasizes the electronic service of notices, streamlining the entire process for better transparency and accessibility.

tds in gst

gst tds applicability

gst tds rate

gst on tds

gst deduction rules

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More