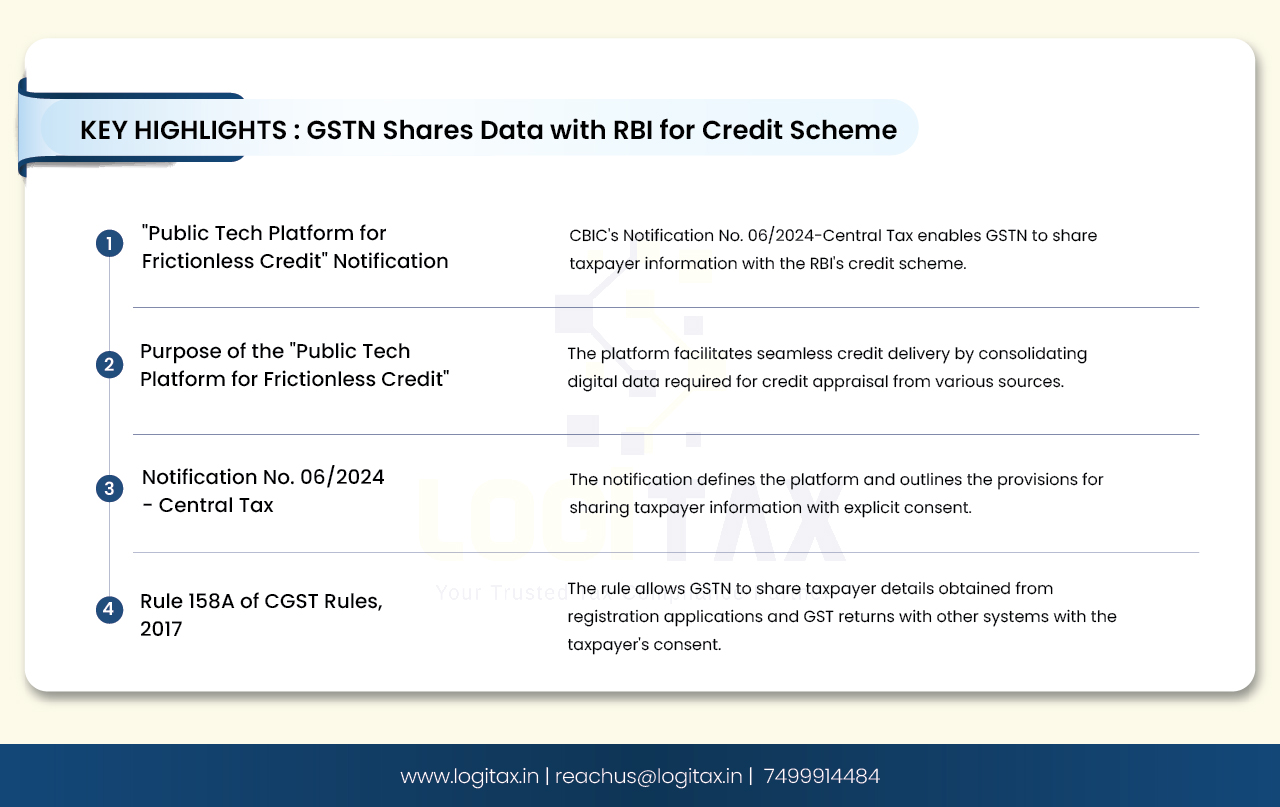

On 22nd of February, 2024, CBIC issued Notification No. 06/2024 - Central Tax. By way of this notification, CBIC has stated that it has notified “Public Tech Platform for Frictionless Credit” as the system with which the common portal may share information.

Let's understand this announcement in detail!

With rapid progress in digitalization, India has embraced the concept of digital public infrastructure which encourages banks, NBFCs, FinTech companies, and start-ups to create and provide innovative solutions in payments, credit, and other financial activities. For digital credit delivery, the data required for credit appraisal are available with different entities like Central and State governments, account aggregators, banks, credit information companies, digital identity authorities, etc. However, they are in separate systems, creating hindrances in the frictionless and timely delivery of rule-based lending.

“The Public Tech Platform for Frictionless Credit” is a platform that would enable the delivery of frictionless credit by facilitating a seamless flow of required digital information to lenders. The end-to-end digital platform will have an open architecture, open Application Programming Interfaces (APIs), and standards, to which all financial sector players can connect seamlessly in a ‘plug and play’ model.

The platform, created by the Reserve Bank of India (RBI) subsidiary Reserve Bank Innovation Hub, is intended to enable a seamless flow of necessary information to lenders to help in disbursing credit.

The financial service providers and multiple data service providers can converge on the platform using standard and protocol-driven architecture.

The Public Tech Platform for Seamless Credit Integration will systematically aggregate data from diverse agencies, presenting it in a format and method tailored for lenders on the platform to facilitate informed credit decisions. This streamlined process will significantly diminish operational timelines, fostering increased opportunities for borrowing and lending.

Following are the wordings of the Notification No. 06/2024 – Central Tax dated 22nd of February, 2024:

S.O. 818(E).—In exercise of the powers conferred by section 158A of the Central Goods and Services Tax Act, 2017 (12 of 2017) and section 20 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), the Central Government, on the recommendations of the Council, hereby notifies “Public Tech Platform for Frictionless Credit” as the system with which the common portal may share information based on consent under sub-section (2) of Section 158A of the Central Goods and Services Tax Act, 2017 (12 of 2017).

Explanation.— For this notification, “Public Tech Platform for Frictionless Credit” means an enterprise-grade open architecture information technology platform, conceptualized by the Reserve Bank of India as part of its “Statement on Developmental and Regulatory Policies” dated the 10th August 2023 and developed by its wholly owned subsidiary, Reserve Bank Innovation Hub, for the operations of a large ecosystem of credit, to ensure access of information from various data sources digitally and where the financial service providers and multiple data service providers converge on the platform using standard and protocol-driven architecture, open and shared Application Programming Interface (API) framework.

[F. No. CBIC-20001/1/2024-GST]

Rule 158A covers provisions relating to Consent-based sharing of information furnished by taxable persons.

The text of this rule is as follows:

By way of this notification, CBIC has notified the “Public Tech Platform for Frictionless Credit” platform as the system with which the common portal may share information. It means GSTN may share information of the taxpayer with the “Public Tech Platform for Frictionless Credit” platform by obtaining the consent of the taxpayer.

With explicit consent from the taxpayer/recipient, the Goods and Services Tax Network (GSTN) is authorized to disclose precise details provided in the GST registration application, data derived from outward tax returns, monthly and annual tax returns, as well as invoice preparations.

This framework guarantees that borrowers cannot withhold any transactional information shared with lenders or the government portal. It optimizes credit efficiency by reducing costs and streamlining the processing time required for transactions. Furthermore, lenders are granted access to verified monthly sales and purchase data directly sourced from government-approved channels, enabling a more precise and timely credit risk evaluation. GST filings will emerge as a pivotal determinant for businesses aspiring to secure credit and capitalize on government-backed credit programs in the future.

monetary policy

Indian trade

RBI GSTN data

GST-registered businesses

RBI

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More