GST registration of the taxpayer can be cancelled voluntarily by the taxpayer himself or by the GST authorities.

The cancellation of GST registration implies that the individual or entity will no longer hold the status of a GST-registered person. Consequently, they are exempt from the obligations of paying or collecting GST, claiming input tax credits, and are relieved from the requirement to file GST returns.

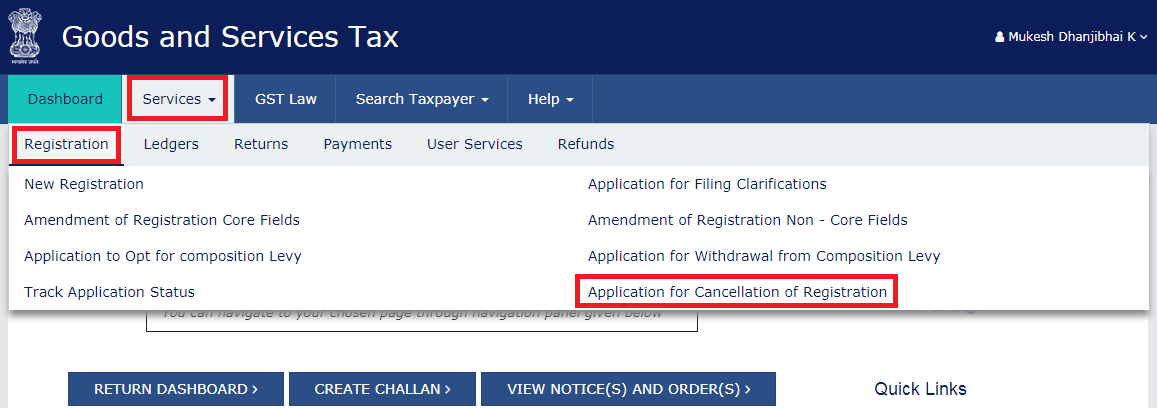

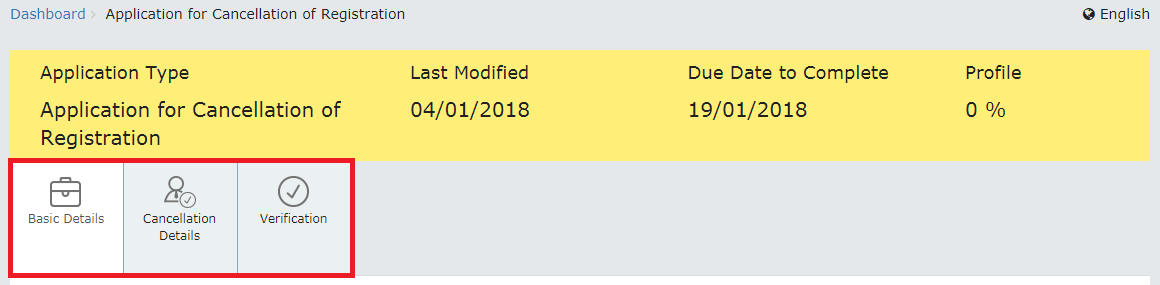

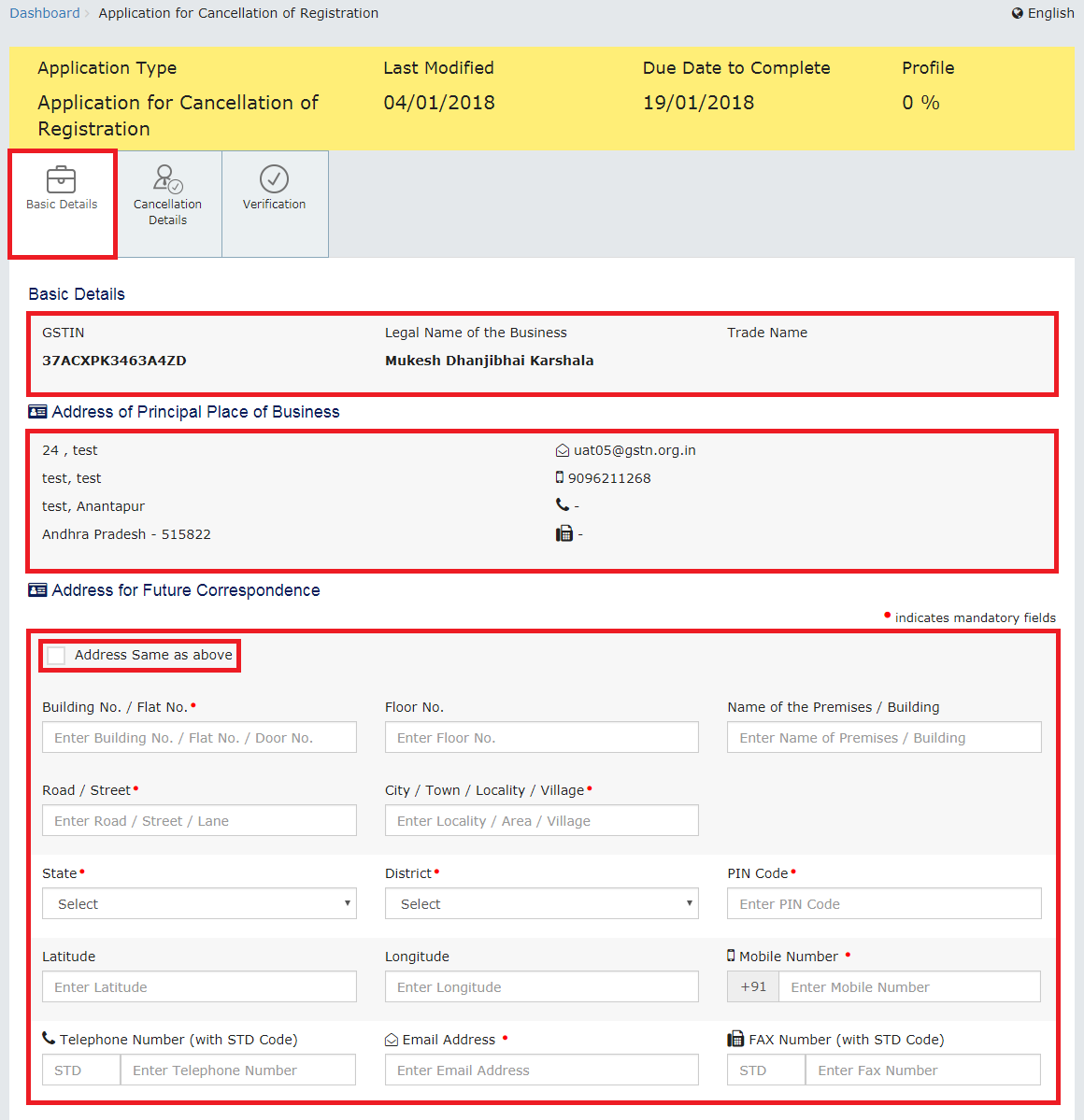

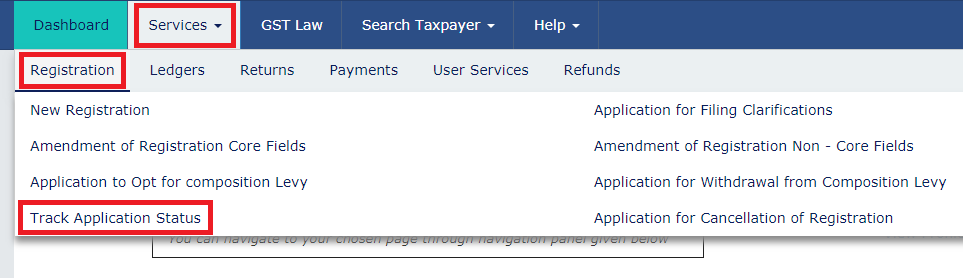

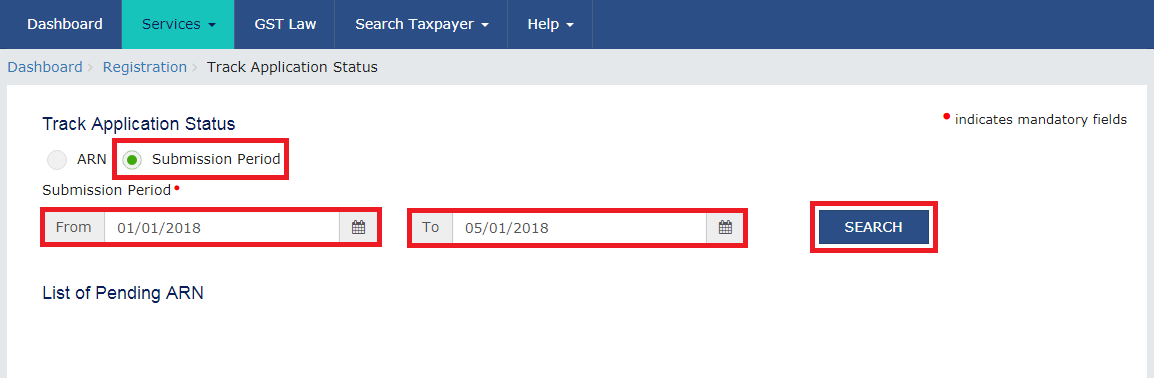

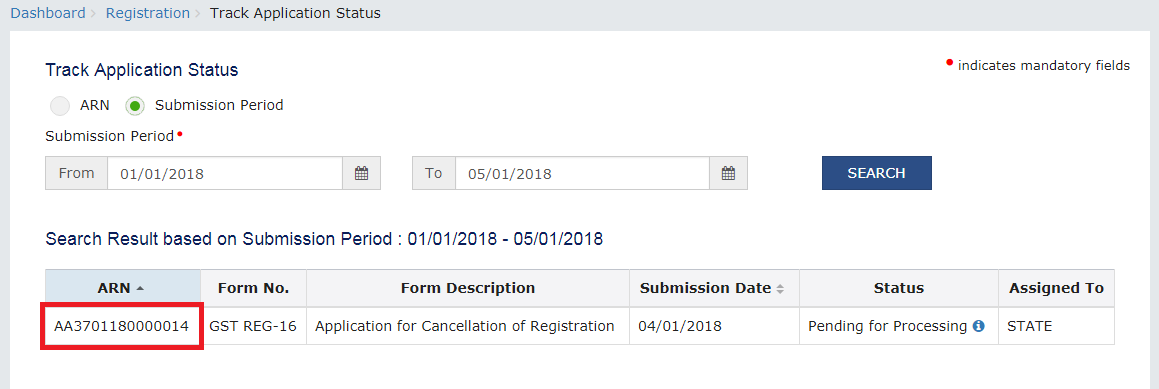

Following is the procedure for cancellation of GST registration:

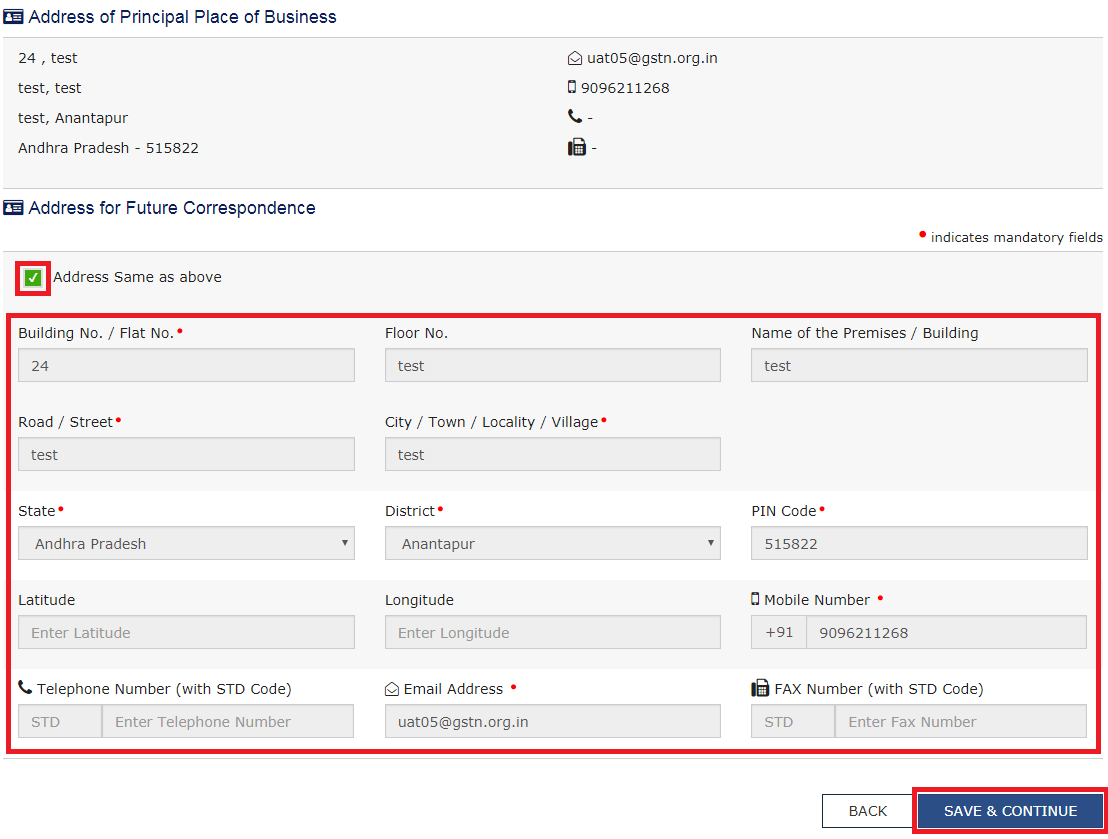

Note: The first tab contains pre-filled information in sections of Basic Details and Address of Principal Place of Business.

Notes:

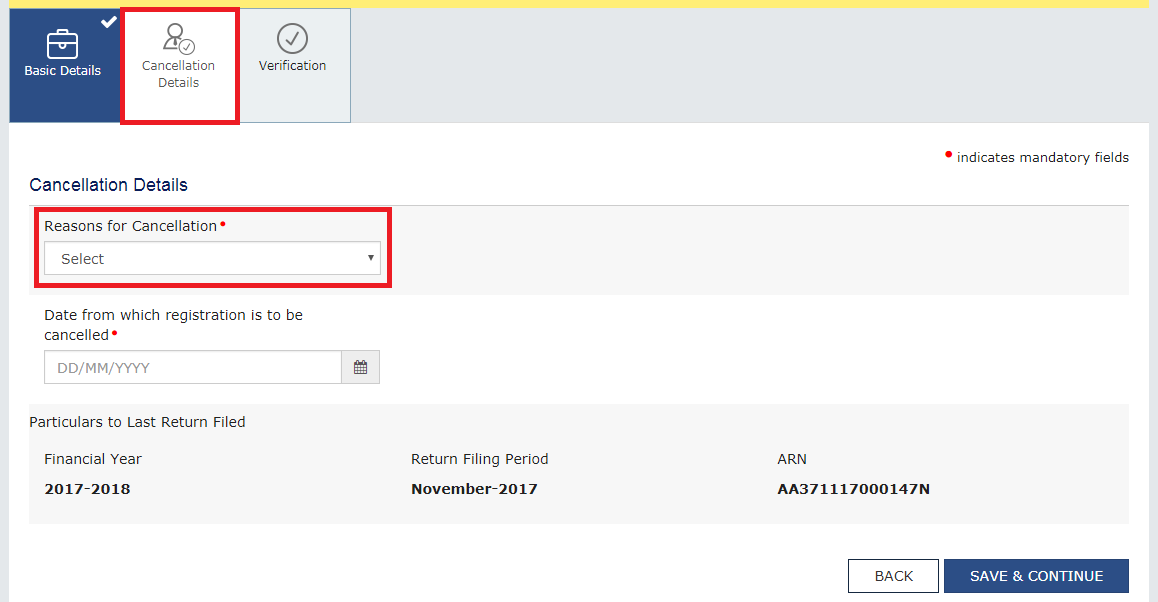

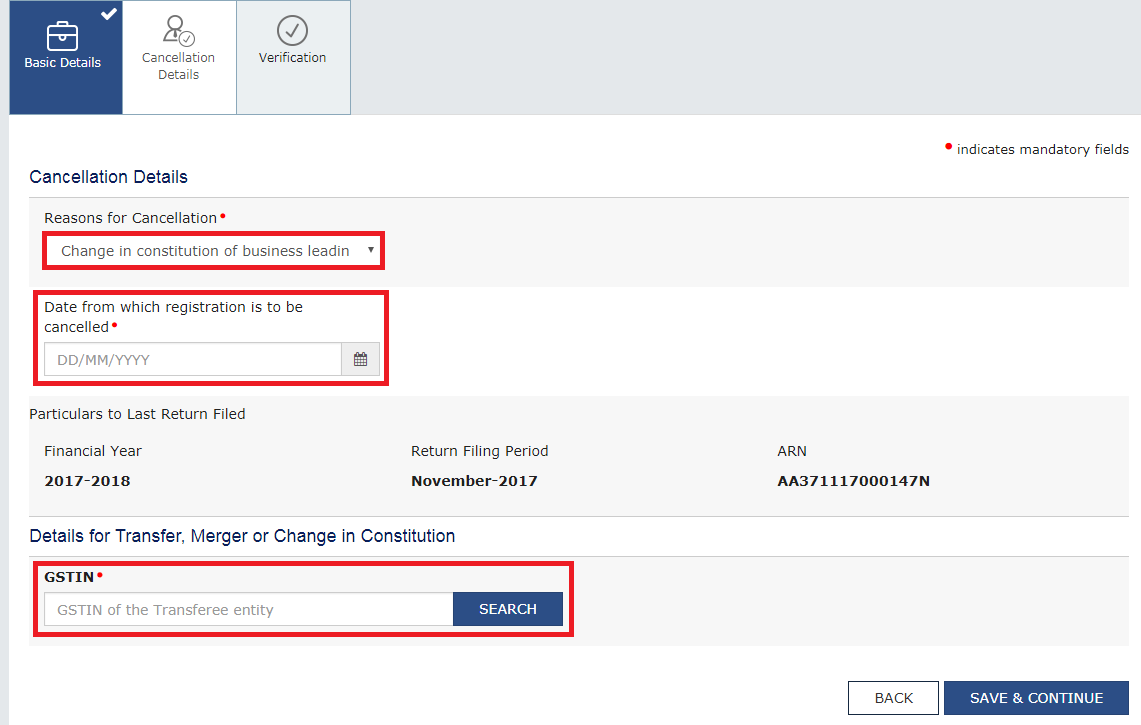

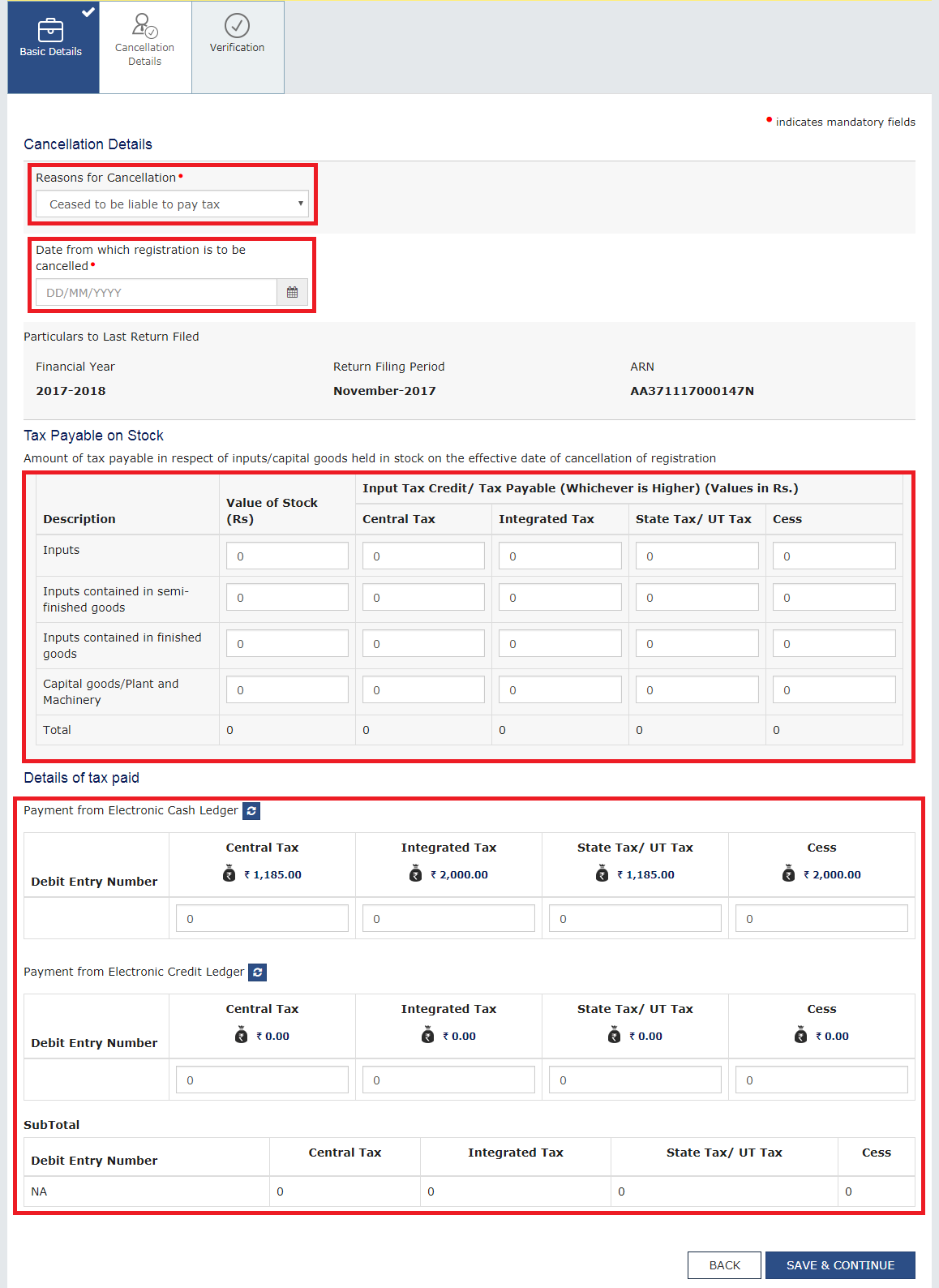

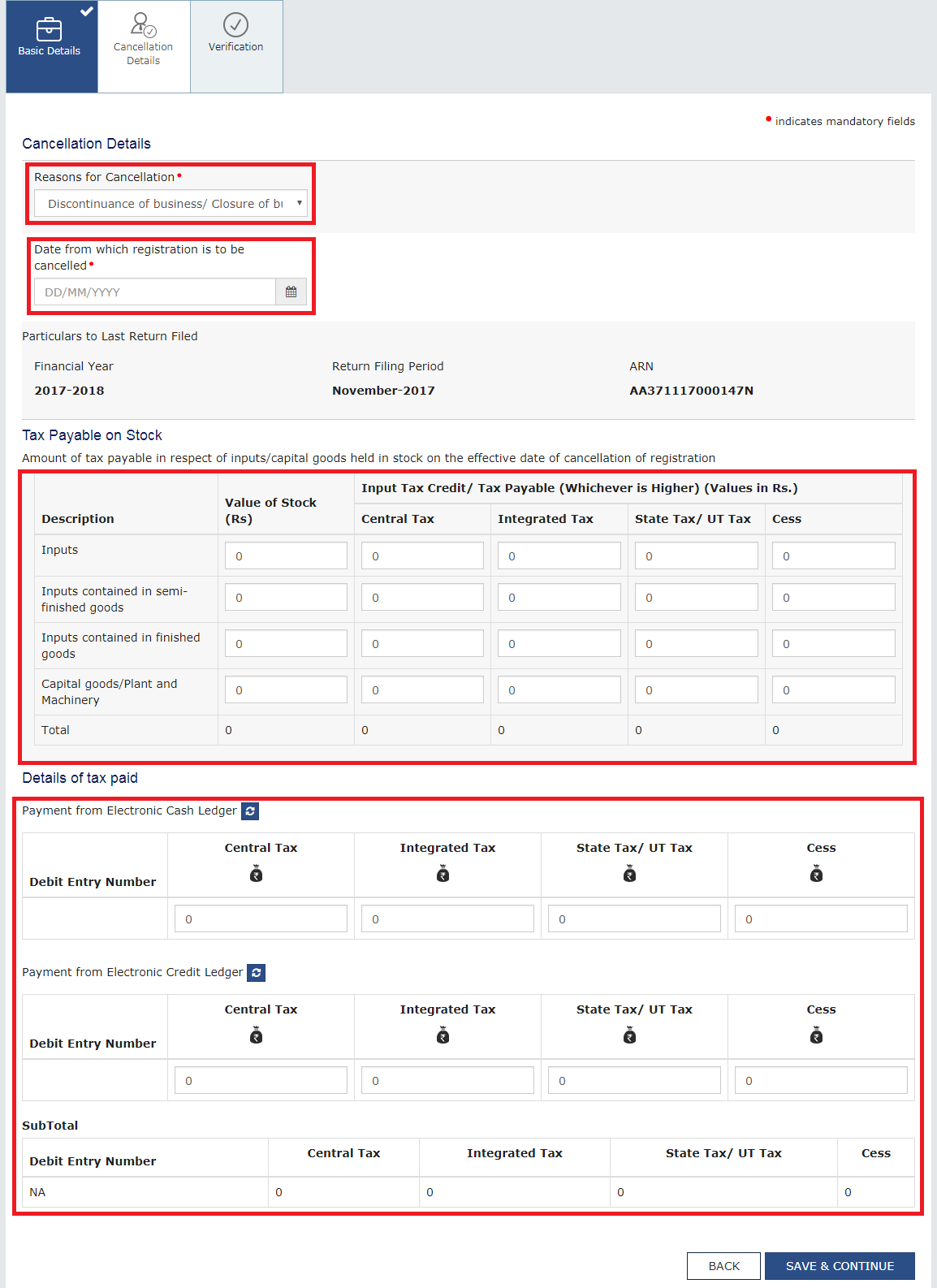

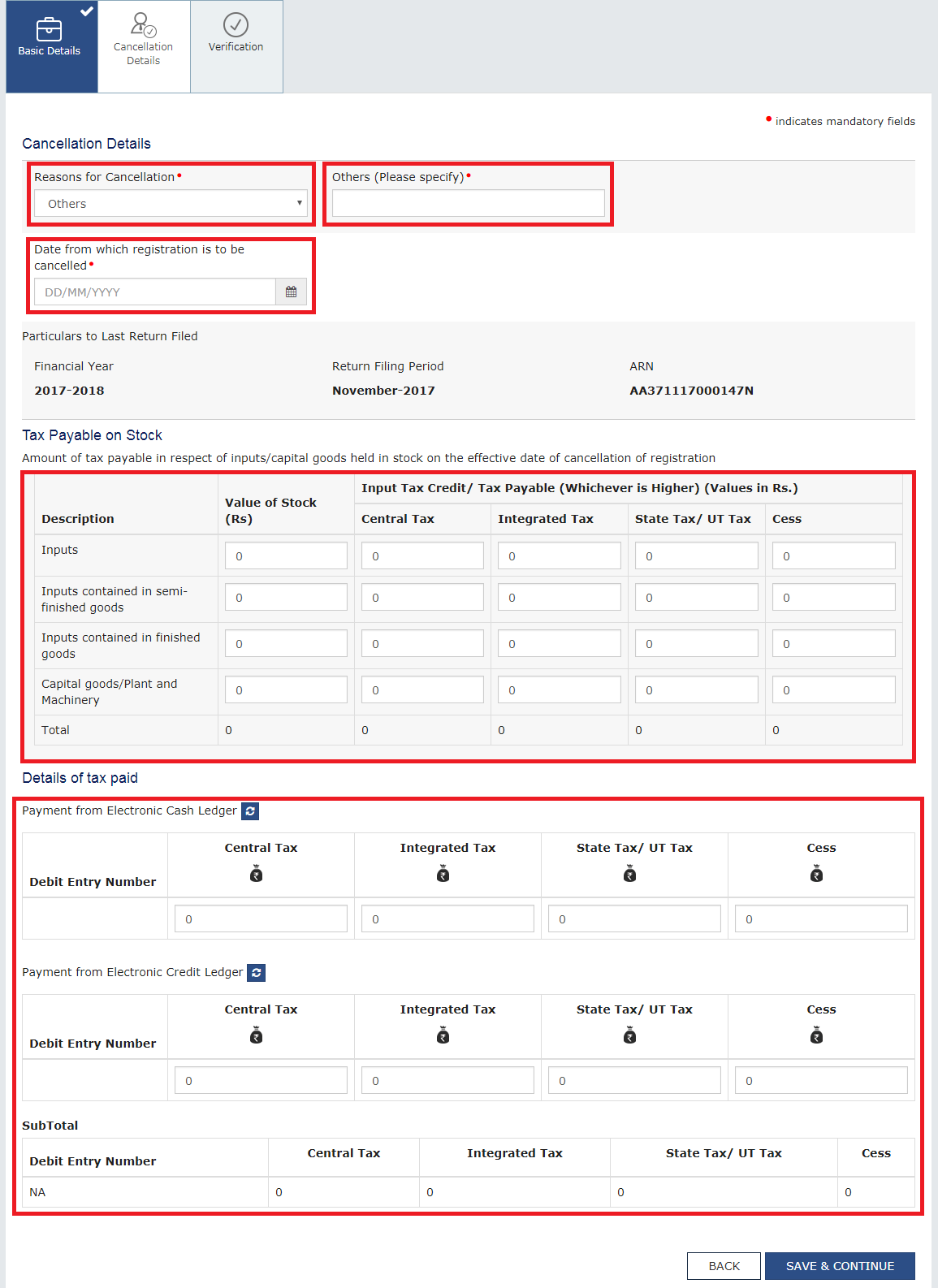

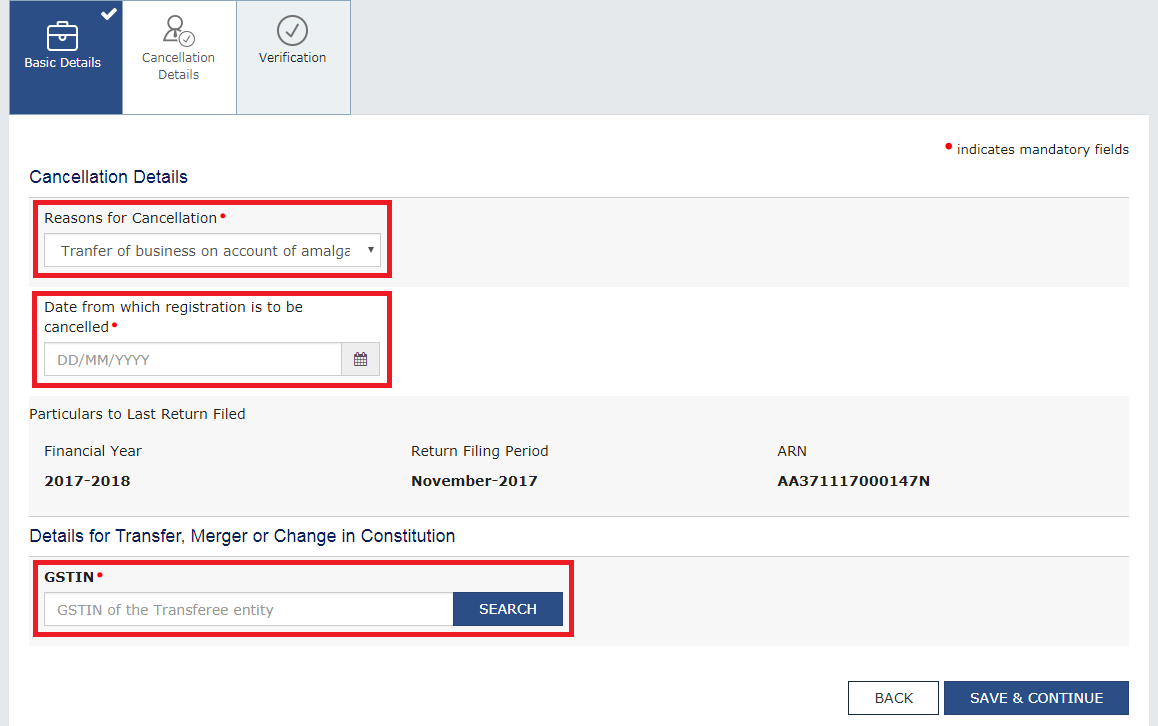

Notes: The following five reasons are available for selection:

Notes:

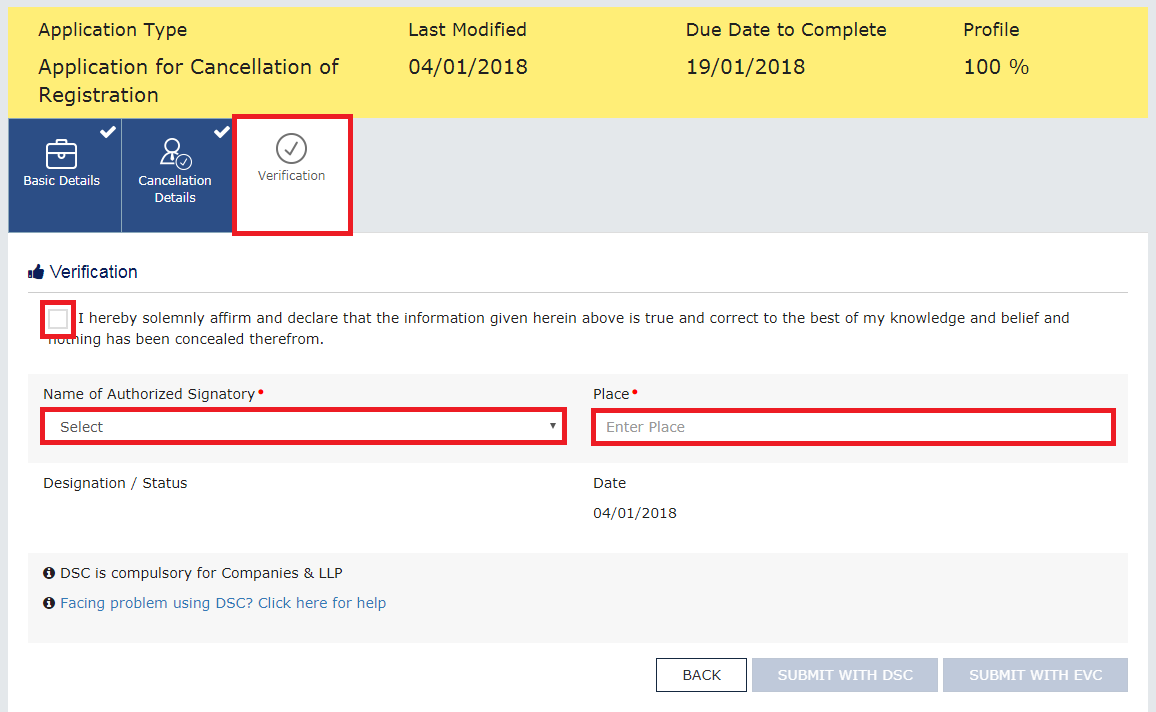

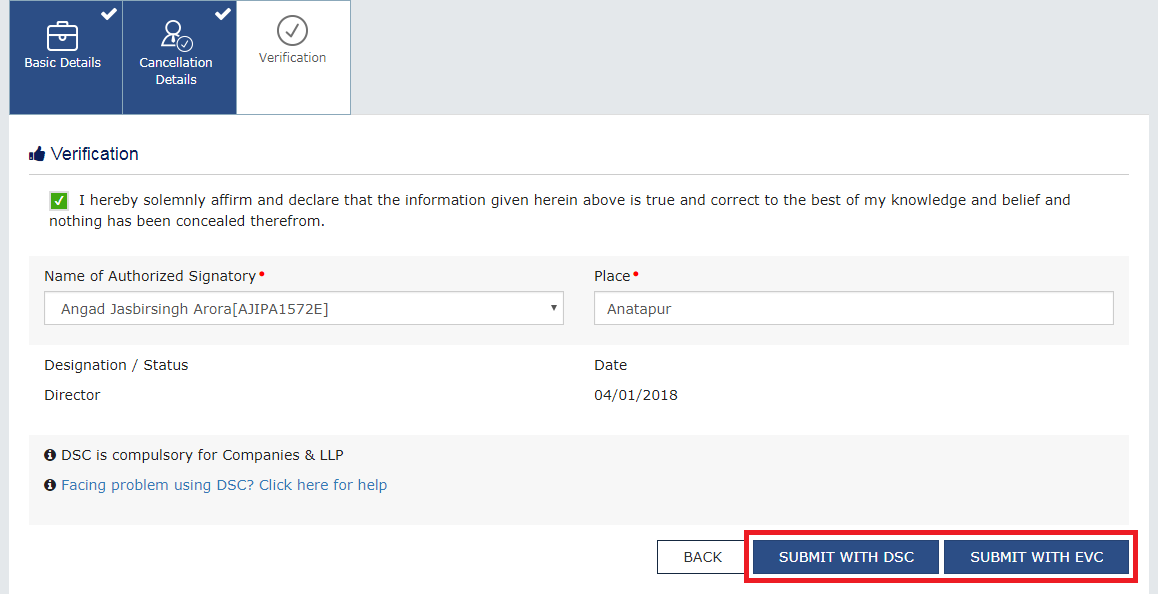

Note: Notice that the system auto-populates the authorized signatory’s designation or status.

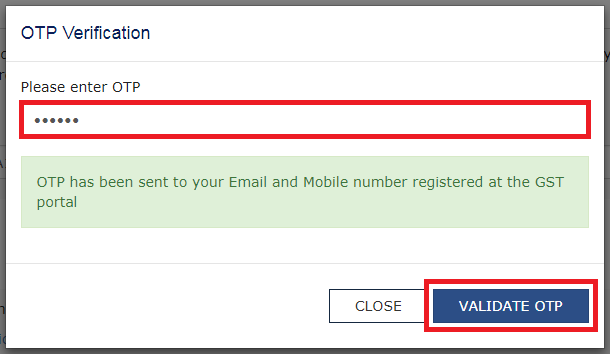

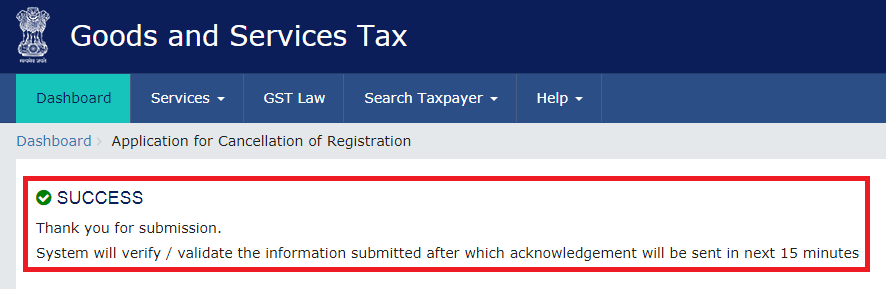

Notes:

Notes:

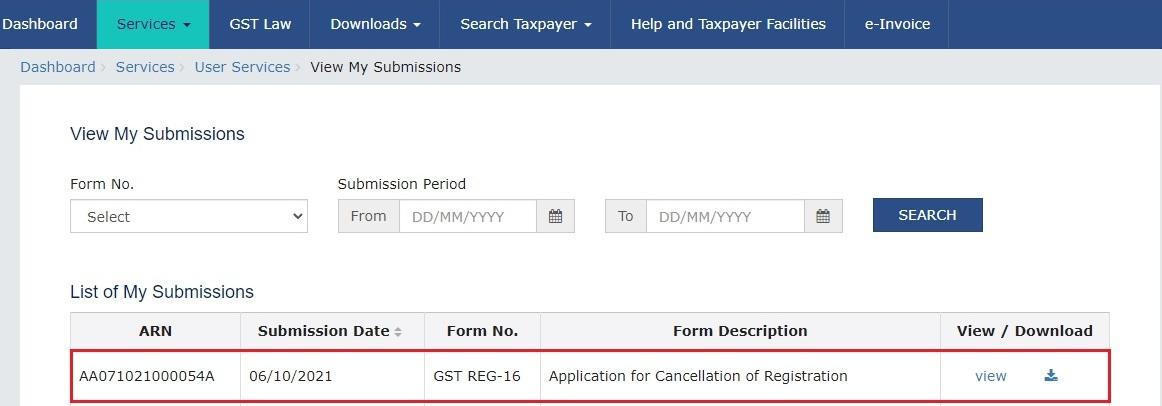

Note: The search result will display the ARN corresponding to your filed application.

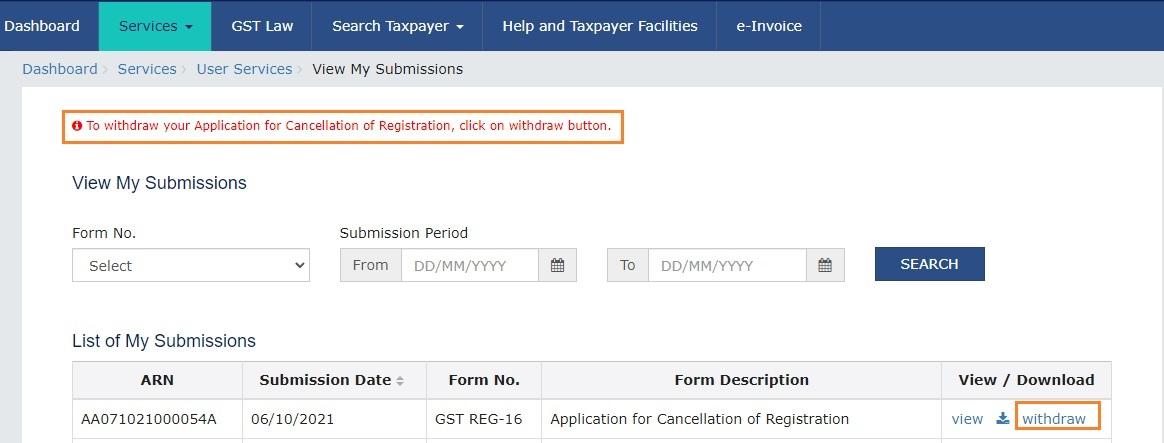

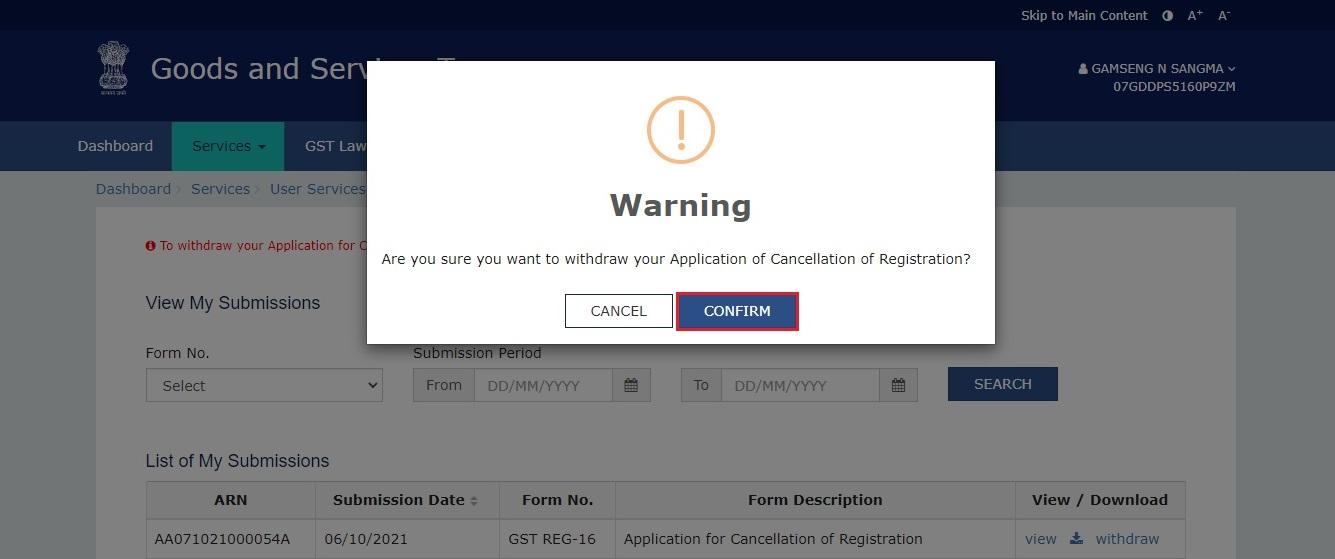

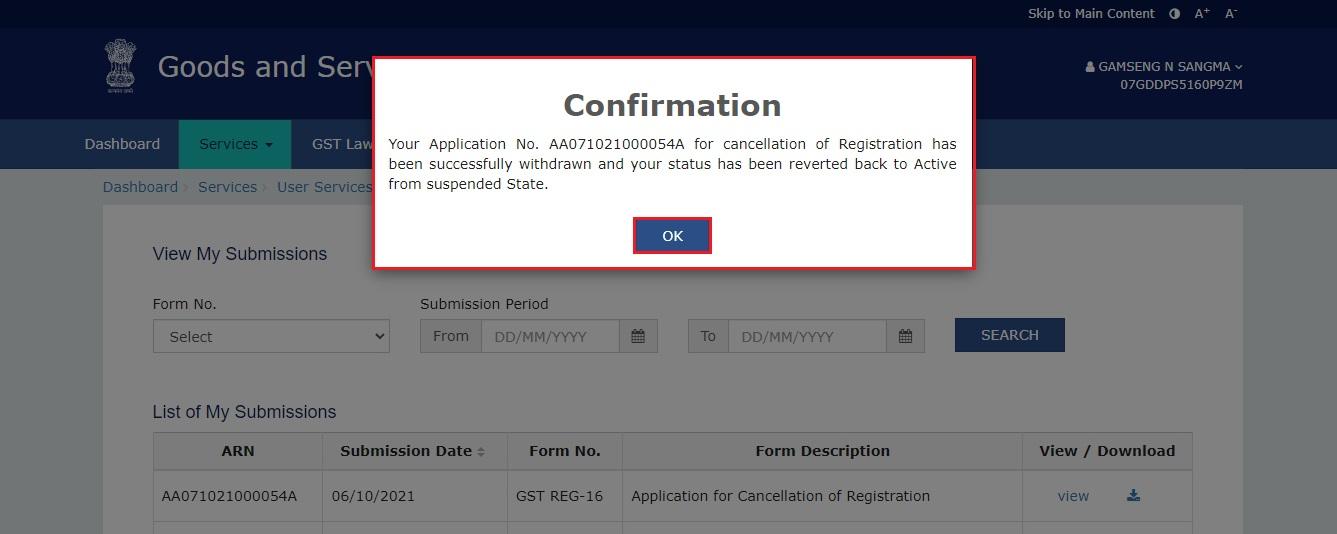

Taxpayer can withdraw his/her request for cancellation of registration till the time the authorized tax officer has not taken any action on the application. To withdraw the request for cancellation of registration, perform the following steps:

Note: The withdraw option will only be available till the time the authorized tax officer has not taken any action on the application i.e. the status of the Application is in “Pending for Processing” status. In case, tax officer has initiated some action on the application, there would be no withdraw button available for the taxpayer to withdraw his/her application.

Understanding the GST cancellation procedure is essential for individuals and entities looking to deregister voluntarily. With a clear step-by-step guide, taxpayers can navigate the cancellation process seamlessly through the GST Portal. Additionally, the provision for withdrawal of cancellation requests adds flexibility and ease to the procedure, ensuring a smooth experience for all stakeholders.

registration of gst

procedure for registration under gst

gst cancellation

gst

cancel gst

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More