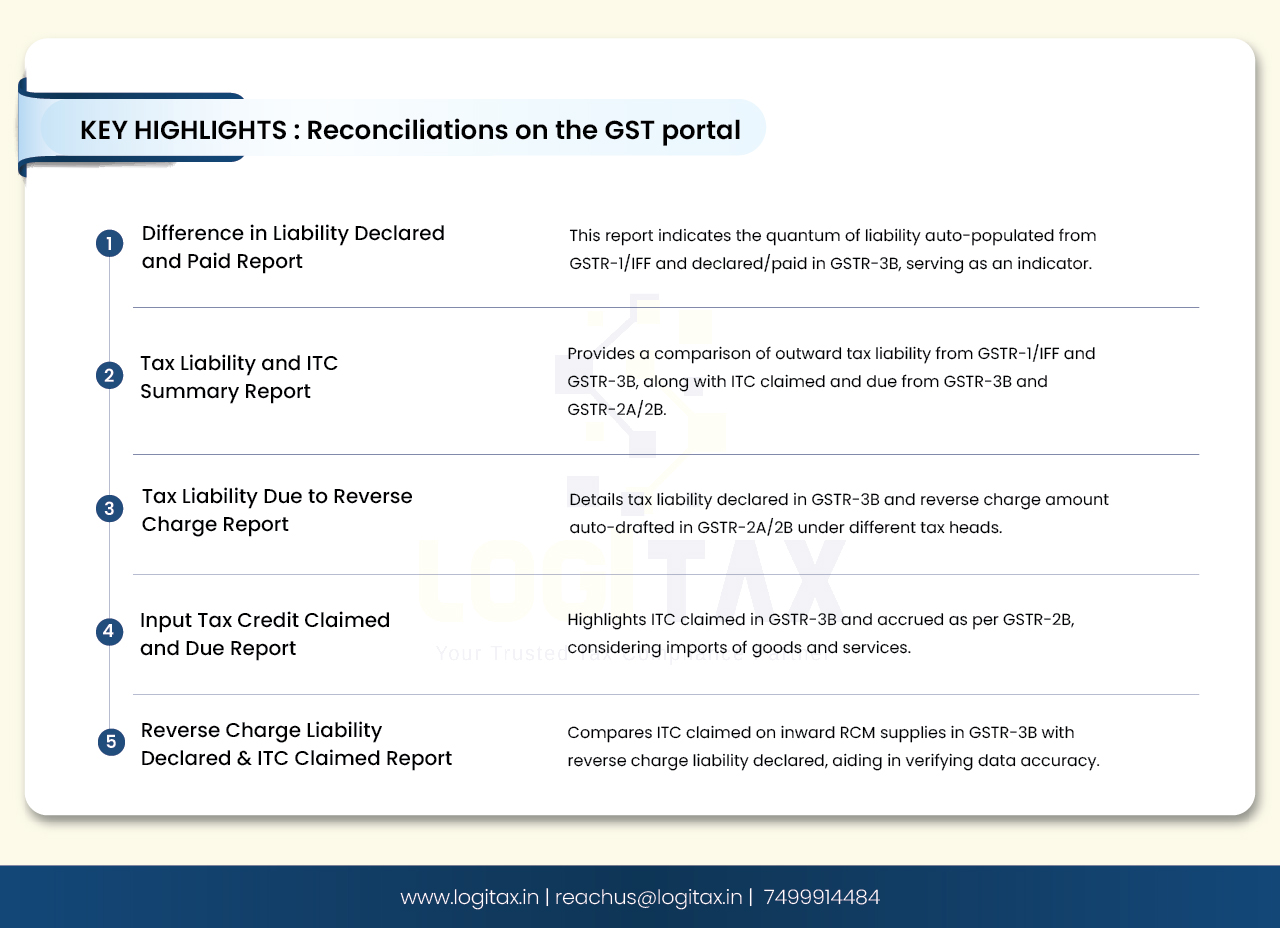

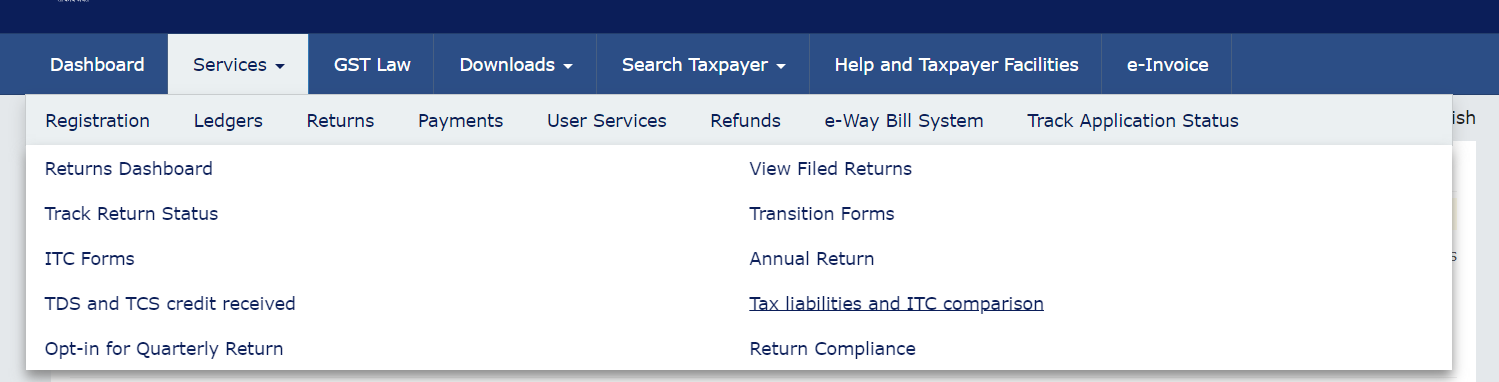

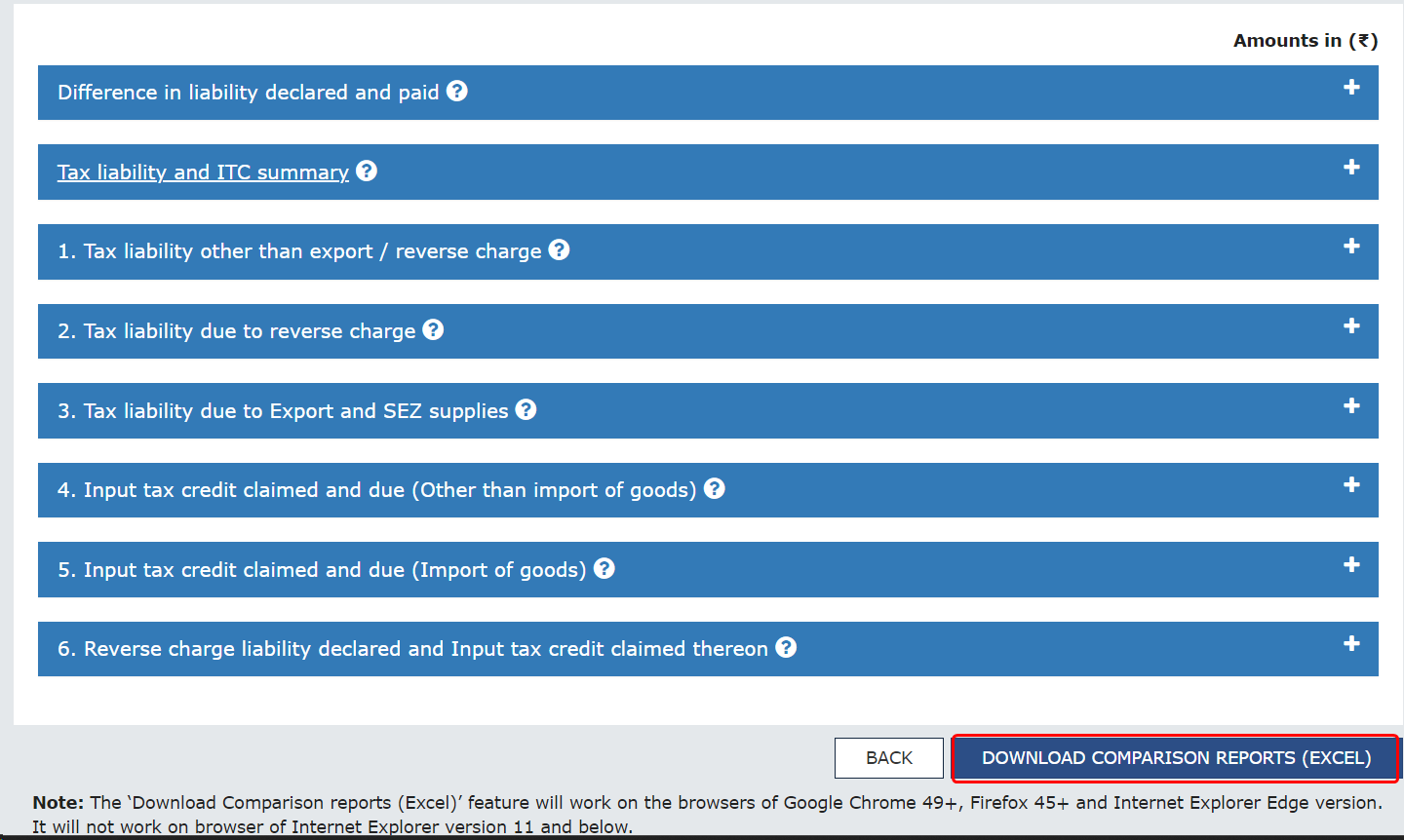

Multiple reconciliation options are accessible on the GST portal, aiding taxpayers in aligning their data across different returns. These tools facilitate the process of determining the final tax liability for the annual return.

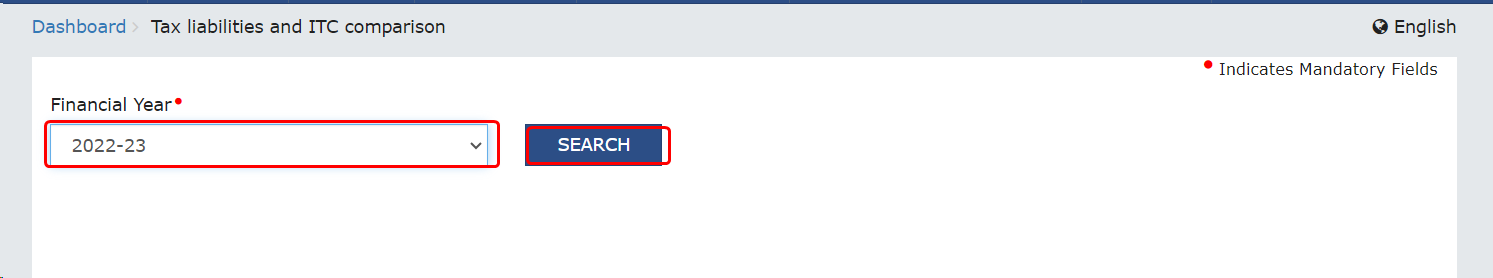

Let's understand the process!

Let's understand each report one by one!

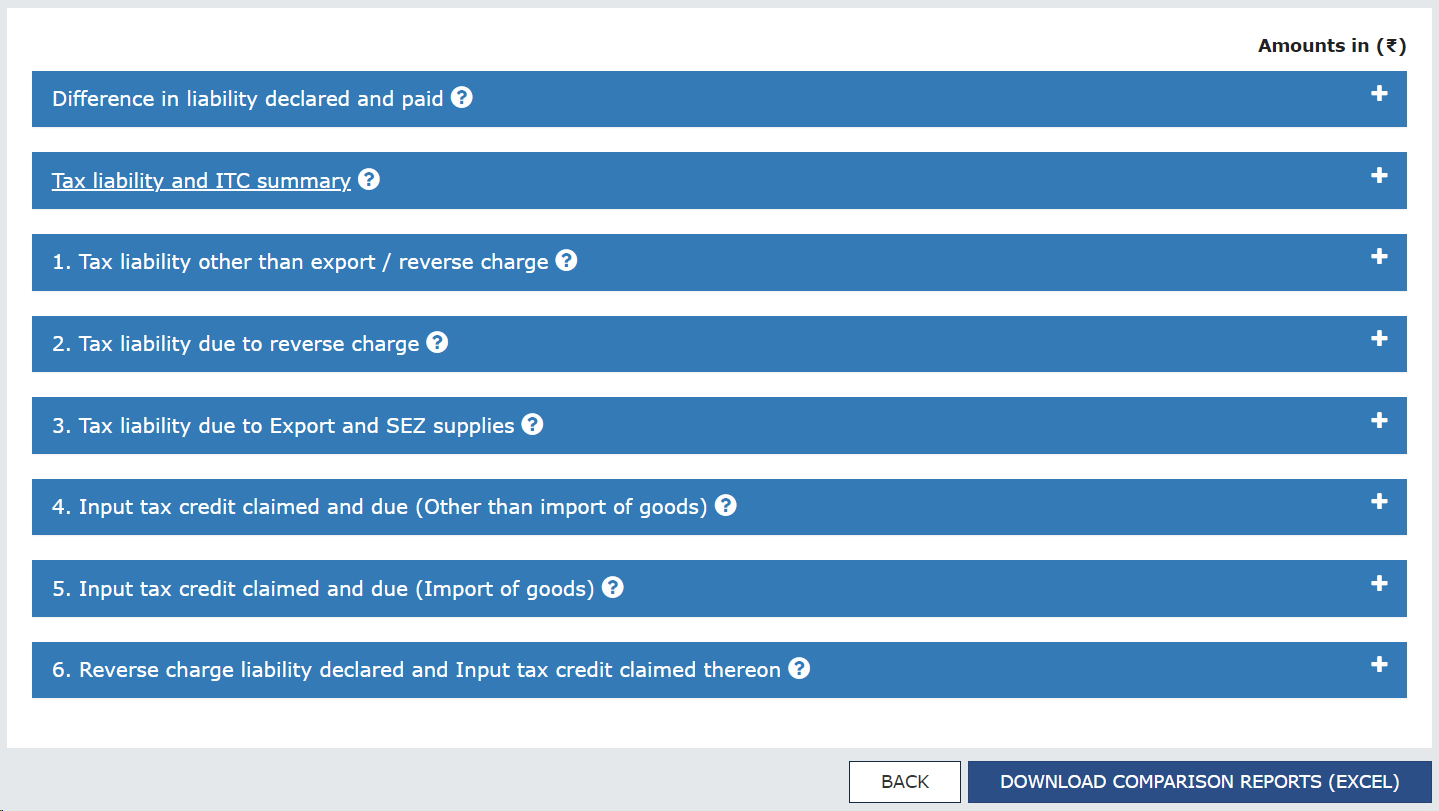

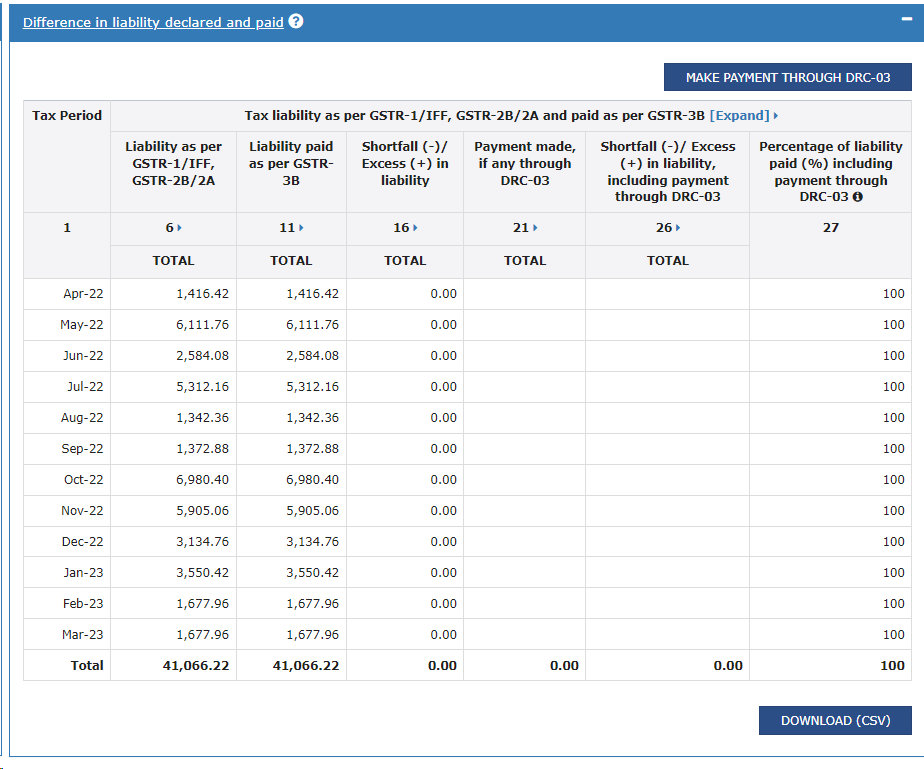

This is a report to represent the quantum of liability auto-populated from GSTR-1 /IFF and declared /paid in GSTR-3B. In case, any payment is made through Form GST DRC-03 with the Cause of payment as Liability mismatch –

GSTR-1 to GSTR-3B, then such payment(s) are also treated as payment towards liability and the percentage of liability paid is updated accordingly for a tax period. The liability paid percentage is displayed for a particular period when both GSTR-1 and GSTR-3B for the month /quarter are filed and GSTR-2B is generated.

This report is prepared as an indicator of the compliance behavior of the taxpayer.

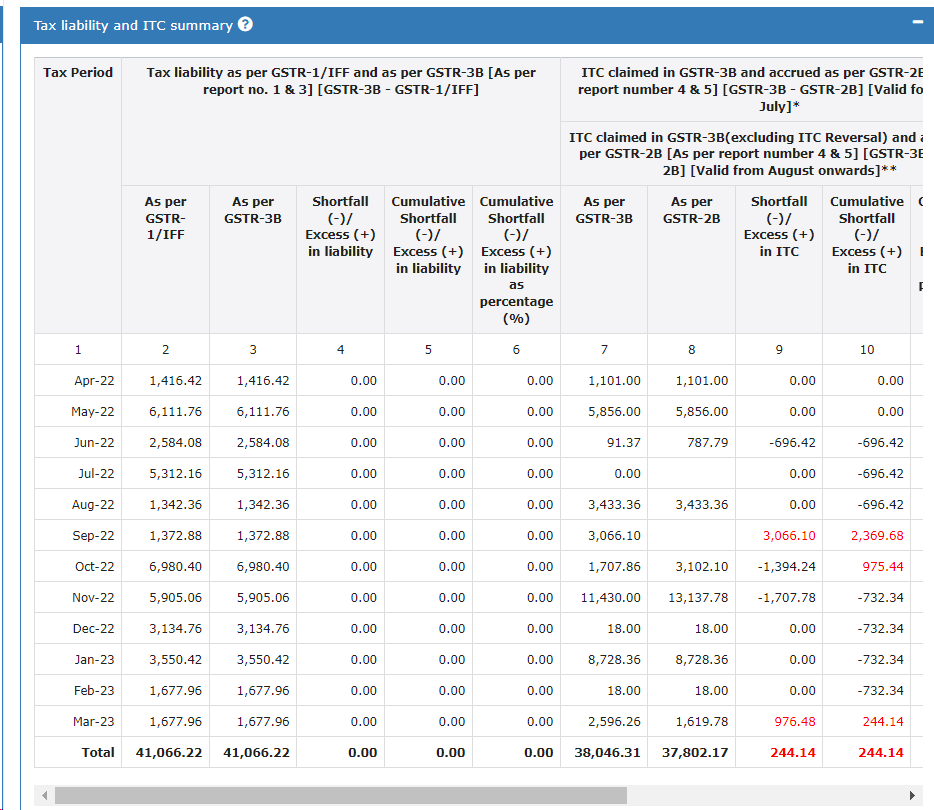

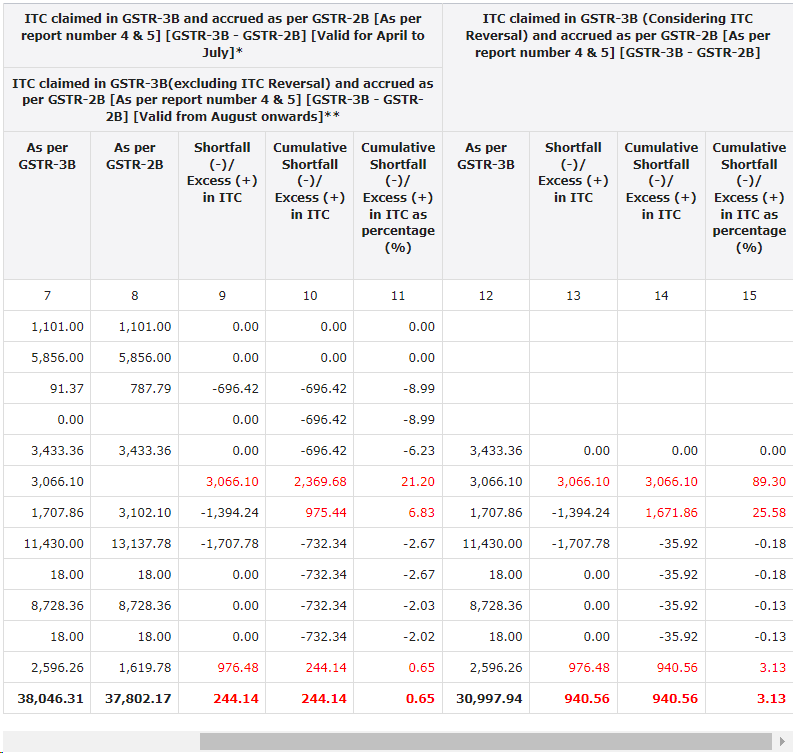

This report contains 2 parts. One is a comparison of the sum of outward tax liability from GSTR-1/IFF and GSTR-3B and the other is the Input tax credit claimed and due from GSTR-3B and GSTR-2A /2B.

Note :

Note :ITC claimed in GSTR-3B is net of reversal of ITC and includes reversal made on account of reverse charge. Therefore, ITC reflected in GSTR-3B might be lesser than that is auto-populated in GSTR-2B.

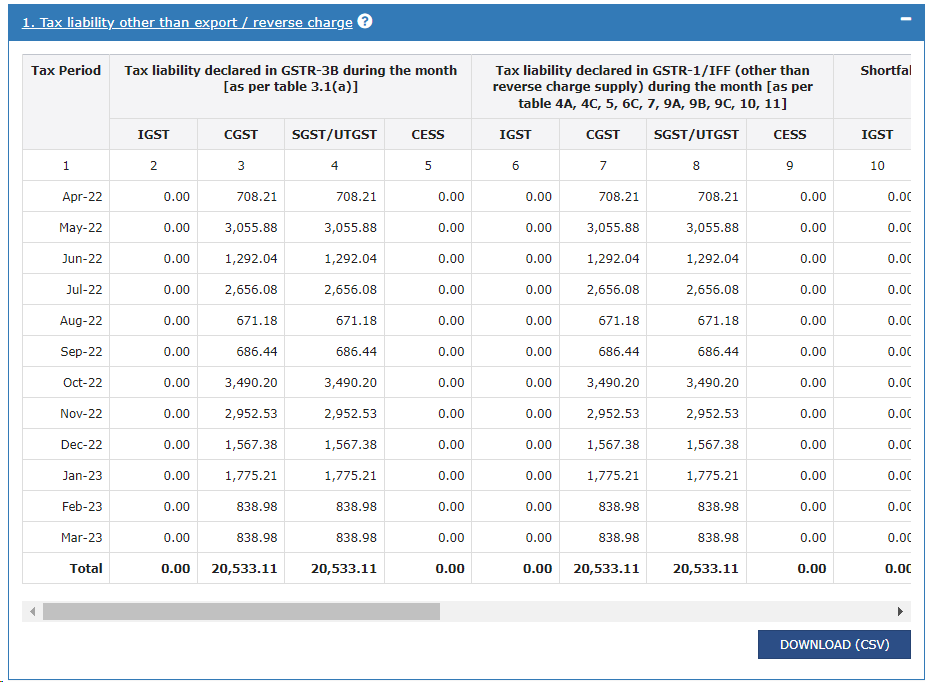

This report contains the details of tax liability declared in GSTR-1/IFF and GSTR-3B.

following tables of GSTR-1/IFF have been considered for computing the liabilities:

From GSTR-3B, table 3.1(a) is considered for the comparison of liabilities.

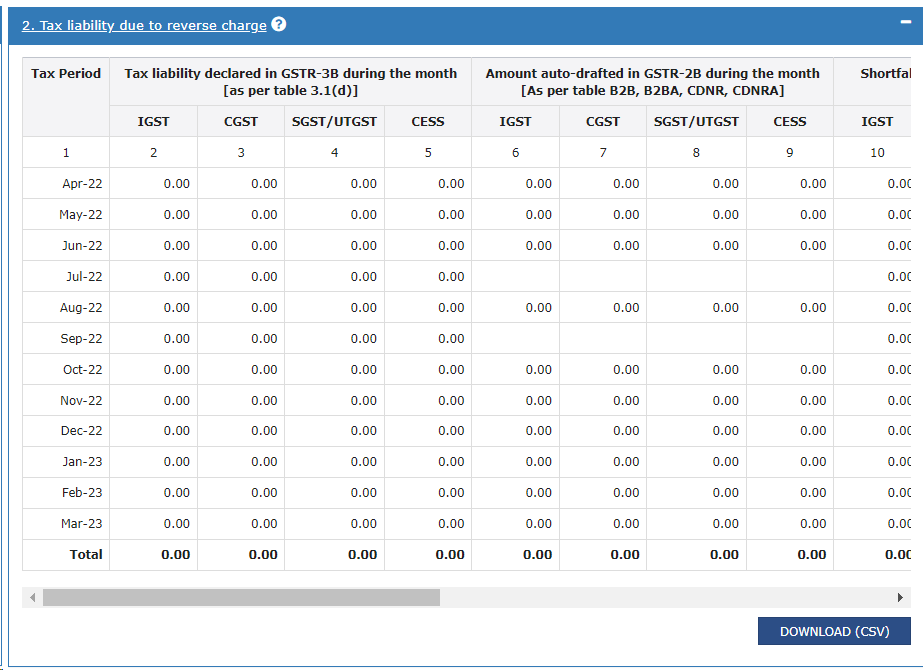

This report contains the details of tax liability declared in GSTR-3B and reverse charge amount auto-drafted in GSTR-2A/2B under different tax heads.

From GSTR-3B, table 3.1(d) is considered for the comparison of liabilities.

The following tables of GSTR-2A have been considered for computing reverse charge liabilities:

The following tables of GSTR-2B have been considered for computing reverse charge liabilities:

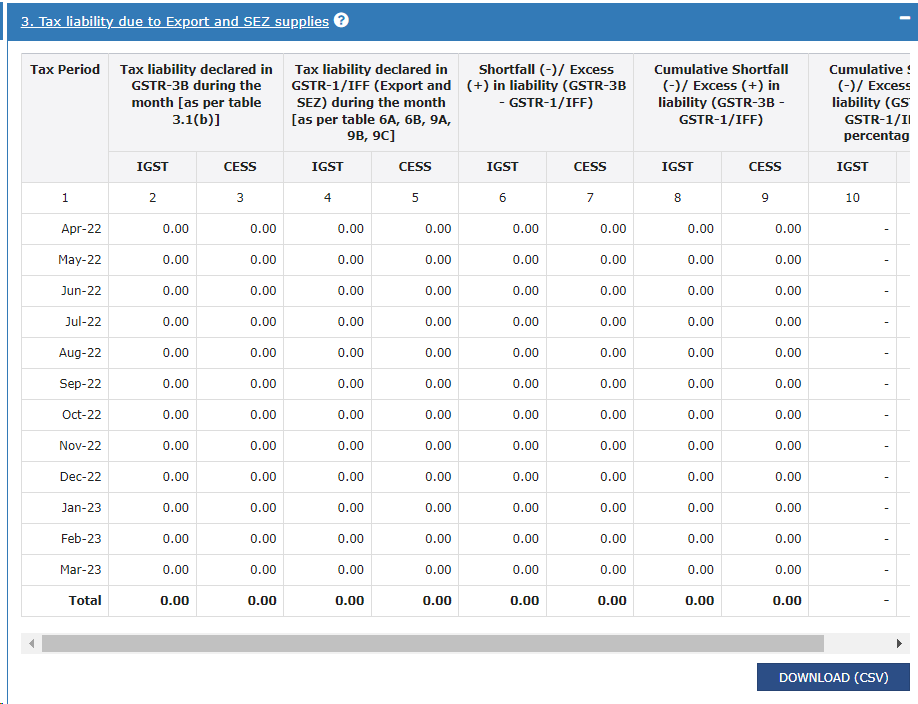

This report contains the details of tax liability declared in GSTR-1/IFF and GSTR-3B under different tax heads.

The following tables of GSTR-1/IFF have been considered for computing the liabilities:

From GSTR-3B, table 3.1(b) is considered for the comparison of liabilities.

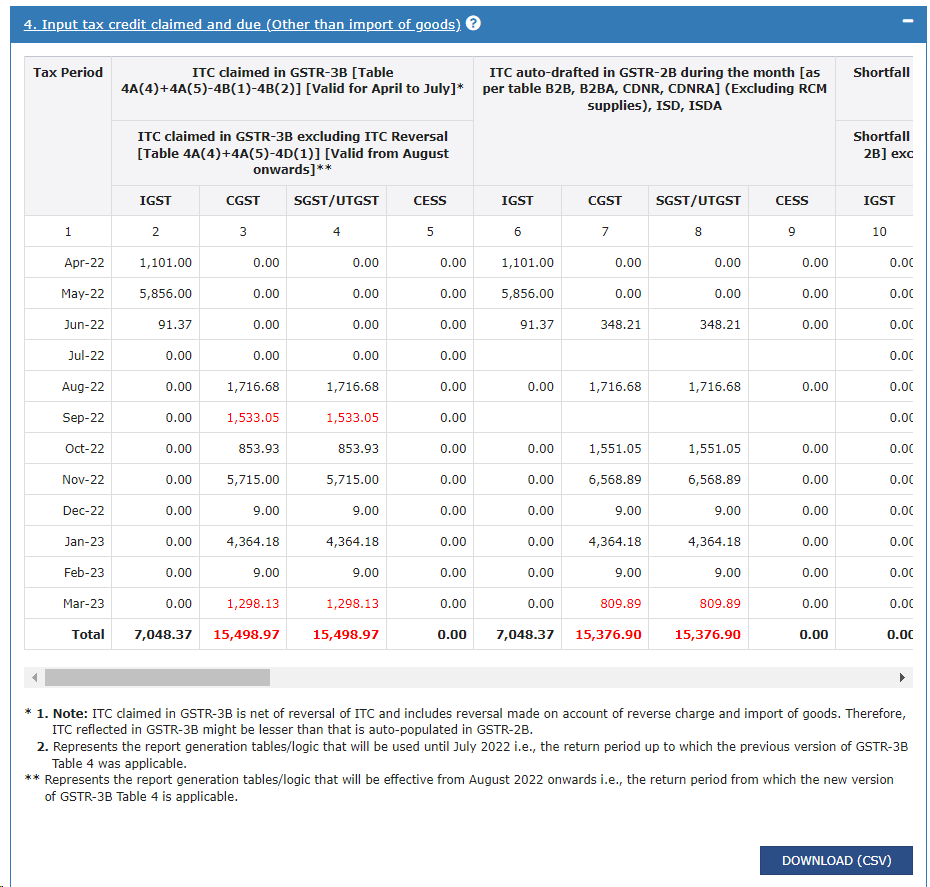

This report contains the details of ITC claimed in GSTR-3B and accrued as per GSTR-2B.

The following tables of GSTR-3B have been considered for computing the ITC claimed excluding ITC reversal (applicable from August 2022 onwards):

The following tables of GSTR-3B have been considered for computing the ITC claimed considering ITC reversal (applicable from August 2022 onwards):

The following tables of GSTR-2B have been considered for computing ITC accrued:

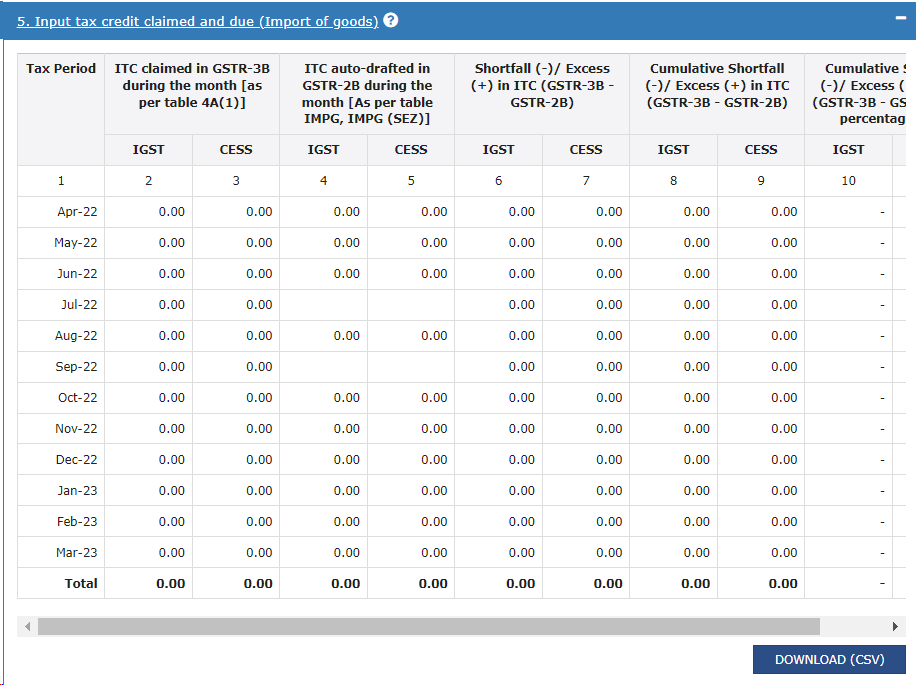

This report contains the details of ITC claimed in GSTR-3B and accrued as per GSTR-2B.

From GSTR-3B, table 4(A)(1) is considered for the ITC claimed on import of goods.

The following tables of GSTR-2B have been considered for computing ITC accrued:

Note:

In case of amendments only differential amount (Amended – Original) are considered.

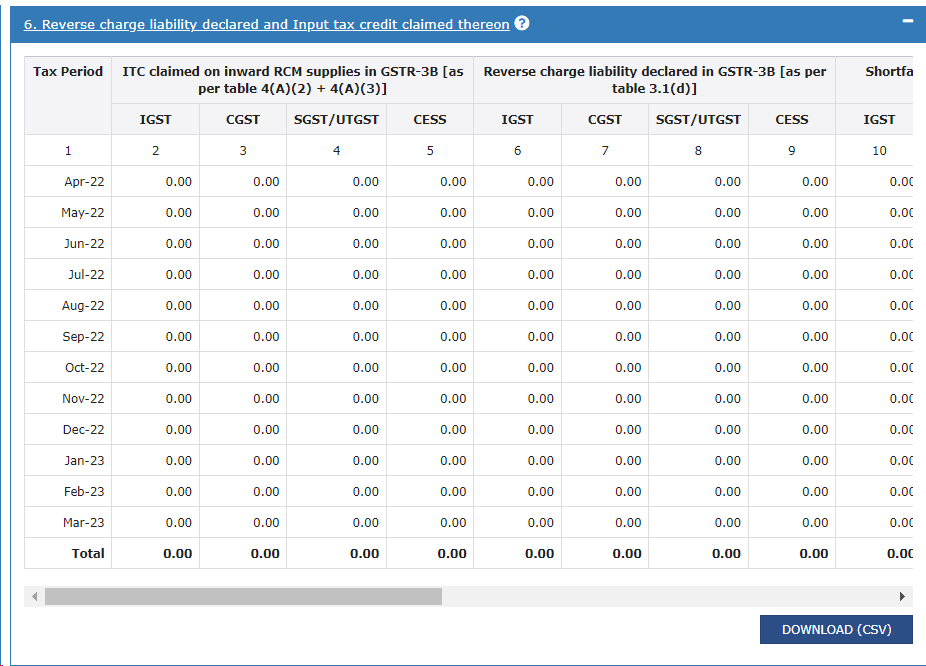

This report contains difference in ITC claimed on inward RCM supplies in GSTR-3B and Reverse charge liability declared in GSTR-3B.

The following tables of GSTR-3B have been considered for computing ITC claimed on inward RCM supplies:

The following tables of GSTR-3B have been considered for reverse charge liability declared:

Table 3.1(d) – Inward supplies liable to reverse charge

The assortment of comparative reports accessible on the GST portal empowers taxpayers to verify the accuracy of their data and facilitates the seamless preparation of their annual return.

gst reconciliation

gst reconciliation software

gstr 2a and 2b reconciliation

gst reconciliation format

automate gst reconciliation

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More