The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Filing GST returns is a crucial aspect of regulatory adherence for businesses enrolled in the system.

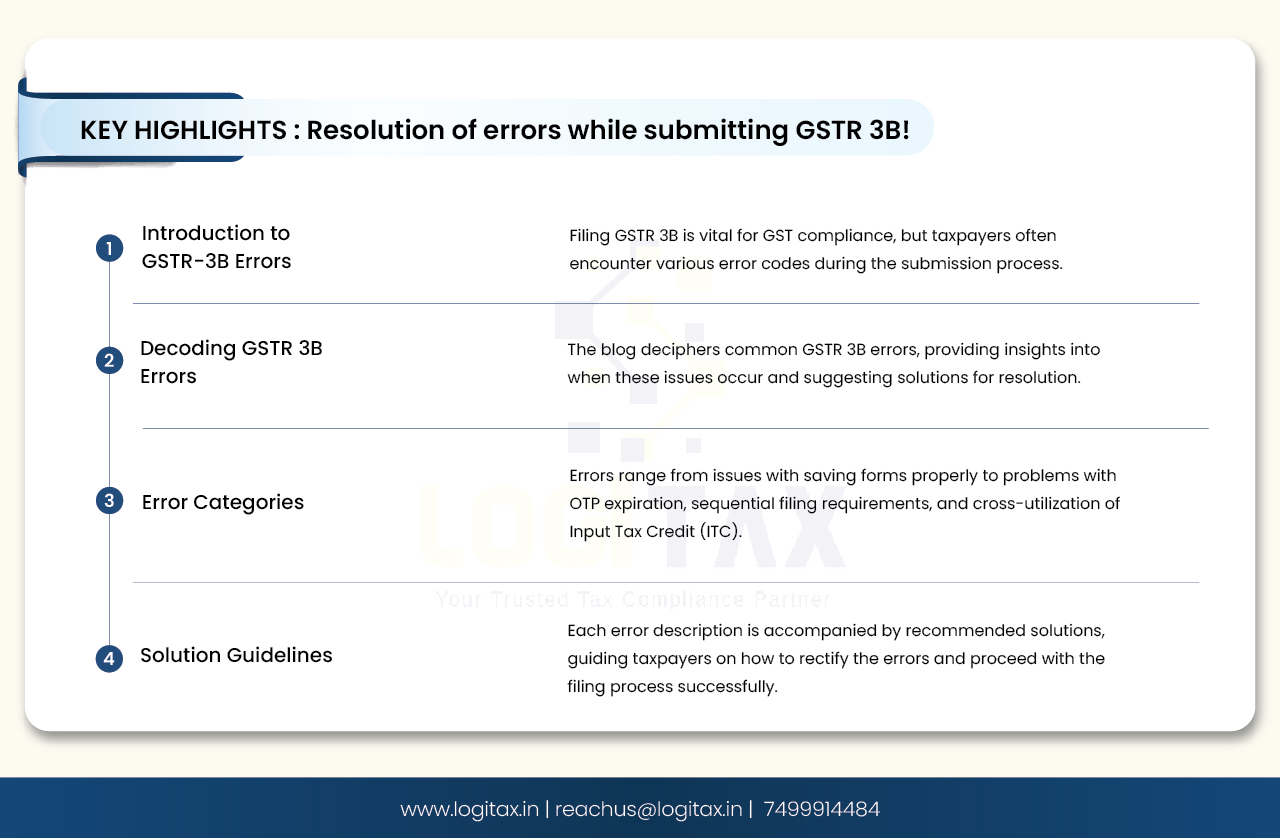

Taxpayers may encounter various GST error codes during the return submission process, each signaling a distinct issue necessitating resolution. Proficiency in decoding these error codes is indispensable for ensuring precise and punctual compliance.

In this blog, known errors while filing GSTR 3B are decoded!

| Sr.No. | Error description | When does this issue/error occur? | Suggested solution |

|---|---|---|---|

| 1 | The information provided in the form earlier is not saved properly. Please save your form again in each section and then try to proceed with Payment. | It occurs when data saved by the taxpayer in a return period for GSTR3B has expired and now he is trying to offset after many days. | Please proceed with the following steps: 1) Go back to the tiles page where all the data has been saved. 2) Verify the data and save again using the 'Save GSTR3B' button. 3) Once you see a message saying 'GSTR3B details saved successfully', go to the payment page [6.1] 4) Press the 'Make Payment' button to offset and complete the process and proceed with the filing. |

| 2 | GSTR3B is not filed for the previous period- Error Code: RT 3BAS1076 | The error comes when the taxpayer is trying to file a new return without filing the previous return. GSTR3B form should be filed sequentially, as the system does not allow to filing of the form in any random order. | You are advised to save, offset, and file returns for all previous periods first i.e. Starting from the month of your registration approval in the GST system. You are also advised to file GSTR 3B sequentially and not in any random order. |

| 3 | OTP is either expired or incorrect. Error Code: RT 3BAS1043 | The error occurs mainly due to two reasons: a) If the OTP for EVC is not used for 10 minutes, it expires and the system shows it as incorrect. b) If the taxpayer has entered the wrong OTP. | In case the OTP has expired, you are advised to re-generate the EVC OTP and fill in the latest OTP received through SMS or Email. While entering the OTP, please make sure that all the digits are entered correctly. |

| 4 | Your OTP is expired please try again. Error Code: RT- 3BWC1007 | The error occurs during filing GSTR 3B and the OTP to file the GSTR3B form has expired, as there is an expiry time of 10 minutes for every EVC OTP. | As the EVC OTP is valid for only 10 minutes, you are advised to re-generate the OTP and fill in the latest OTP received through SMS/E-Mail. |

| 5 | Your previous GSTR3B filing request is still in progress. Please wait for the same to complete or raise another request after 10 minutes. | The message occurs when a taxpayer attempts to file a NIL GSTR 3B return within a span of 10 minutes. If we allow the taxpayer to file the NIL return again when one request is already in progress, he might end up filing twice which is not acceptable by the system. | You are advised to wait for at least 10 minutes and retry the entire process of NIL filing of GSTR3B for the said return period. 1) Please go to select return period again from the return dashboard. 2) Go to the questionnaire page and select the first question as 'Yes'. All other options will automatically be disabled. 3) Click on the 'Next' button on the questionnaire page, and you will be directed to the filing page as it is a nil return. 4) Choose signatory from the dropdown and file with the desired option to file either with 'DSC' or 'EVC' in one go. |

| 6 | Authentication has failed at emas. Error Code: RT-3BAS1031 | This error is seen at the filing page while filing with DSC. The error generally comes because the taxpayer may be trying to sign the return filing with a signature associated with a PAN different than the PAN of the selected signatory. | You are advised to carefully select the correct signatory from the drop-down list of signatories and choose the signature of the same signatory on the Emsigner tool while signing the return. |

| 7 | Offset the CGST credit first before cross-utilization of SGST credit against IGST tax liability. Error Code: LG 9074 | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to follow the rules as mentioned in point 2 of the link given below to cross-utilize Input Tax Credit (ITC): https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 8 | Please offset the IGST credit against the IGST liability first before cross-utilization | This error is only seen when a taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 9 | Offset CGST or SGST/UTGST liability first with IGST credit before utilizing CGST credit | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 10 | Offset CGST liability with CGST credit before utilizing it for IGST liability | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 11 | Please offset the CGST tax Liability before cross-utilization of IGST credit against SGST tax liability | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 12 | Offset CGST liability first with IGST credit before utilizing it for SGST/UTGST liability. | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the link given below: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 13 | Offset IGST liability with CGST credit before utilizing SGST/UTGST credit. | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 14 | Something seems to have gone wrong while processing your request. Not a valid cross utilization Scenario. Please try again. | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 15 | Please offset the IGST credit against the IGST liability first before cross-utilization. | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 16 | Please offset the SGST credit against the SGST liability first before cross-utilization | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 17 | Offset SGST/UTGST liability with SGST/UTGST credit before utilizing it for IGST liability. | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | Taxpayers must be advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 18 | Please offset the SGST credit against the SGST liability first before cross-utilization | This error is only seen when the taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return but is not following the rules defined by GSTN correctly. | You are advised to cross-utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the below link: https: //tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t =Utilization_Principles.htm |

| 19 | Your Save Request for GSTR 3B is already being processed for the Current Return Period. | This error is typically seen when a request to save data in a particular return period of GSTR3B return is already under process and the taxpayer tries to send another save request. In such situations, the taxpayer will not be allowed to save a request and must wait until this existing request is processed successfully. | You will not be able to send another save request into the system for the same return period of the GSTR3B return unless the previous request has been processed successfully. Please wait till the existing request is successfully processed. |

Navigating through the complexities of GSTR 3B filing can be daunting, especially when encountering various error codes. However, understanding these errors and their solutions is essential for seamless compliance. By decoding common errors and implementing suggested solutions, taxpayers can ensure precise and timely submission of their returns, ultimately fostering smoother operations within the GST framework.

gstr-3b

gstr 3b due date

what is gstr-3b

gstr-3b due date for quarterly return

how to file gstr 1

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More