Presently, two automatically generated statements are accessible on the GST common portal. Interestingly, both statements comprise data related to inward supplies. Those are “GSTR 2A - Details of auto-drafted supplies” and “GSTR 2B- Auto-drafted ITC statement”. Let's understand both these statements one by one.

GSTR 2A is a statement automatically generated for a taxpayer from his seller’s GSTR-1. It contains details of inward supplies of taxpayers by capturing data from his seller's GSTR 1. GSTN selects those entries in the seller’s GSTR 1 in which the taxpayer’s GSTIN is mentioned. Those entries are reflected in GSTR 2A of the taxpayer.

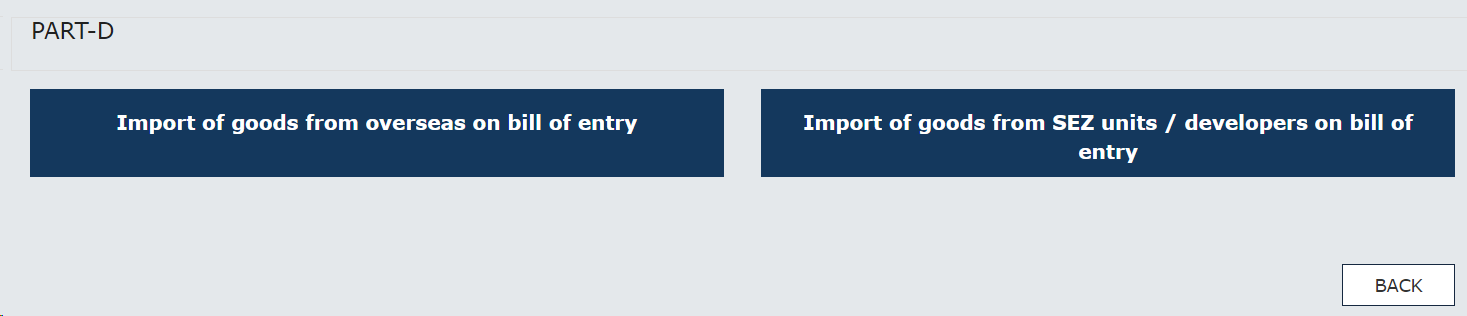

GSTR 2A will be auto-populated from the following returns:

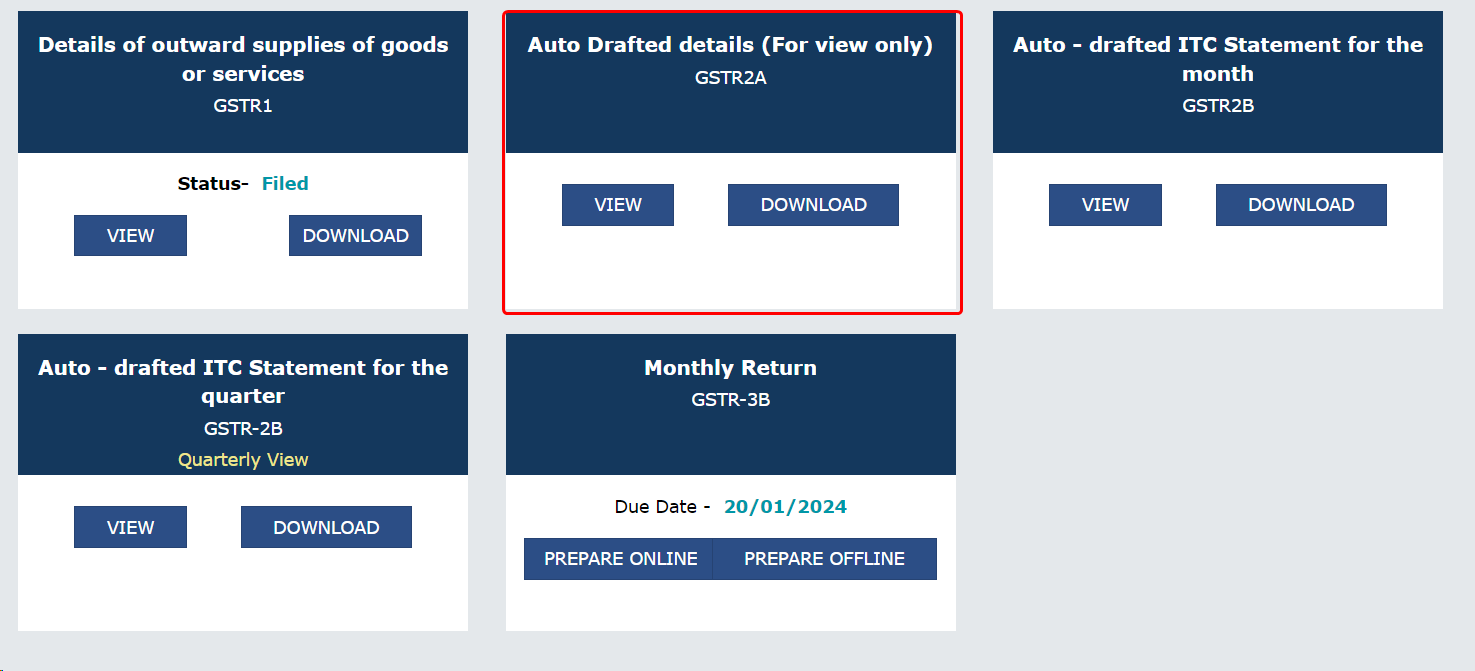

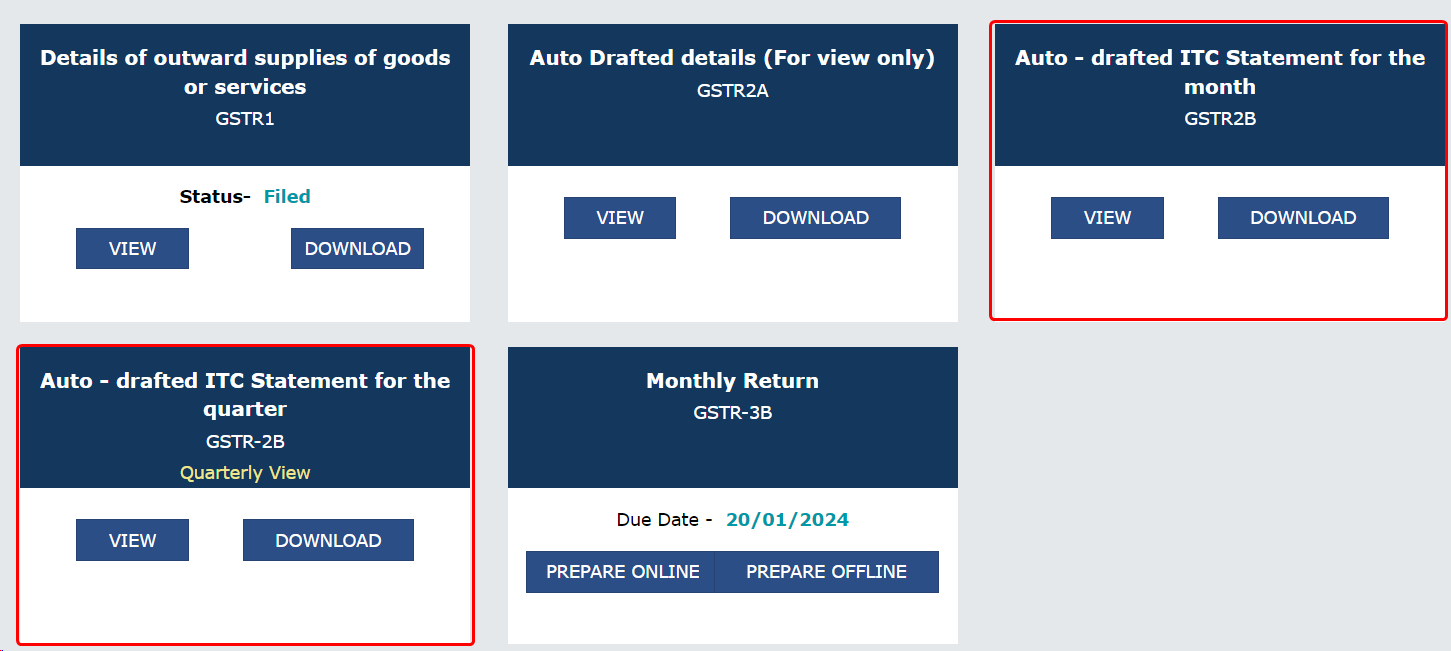

Taxpayers can access their GSTR 2A on the GST common portal in Services>>Returns>>GSTR 2A.

It can be viewed or downloaded in Excel/JSON format.

It can be viewed or downloaded in Excel/JSON format.

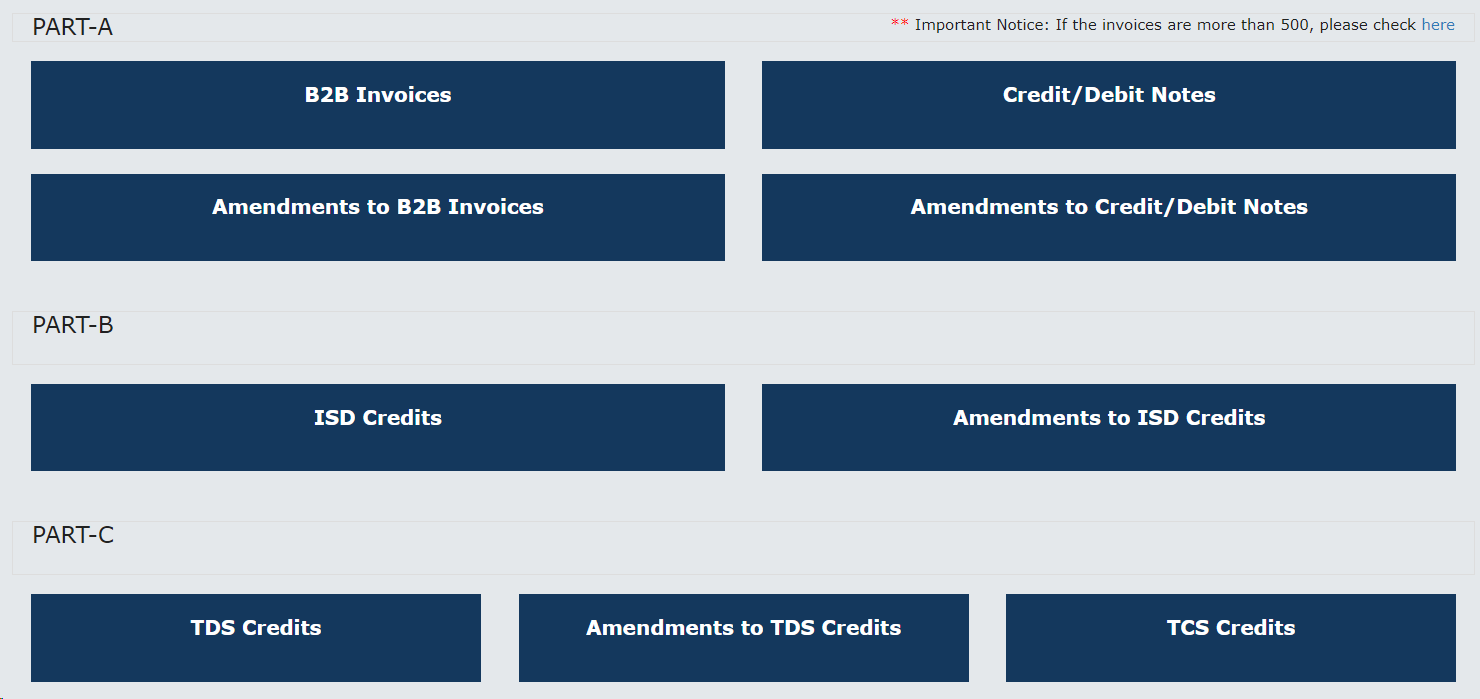

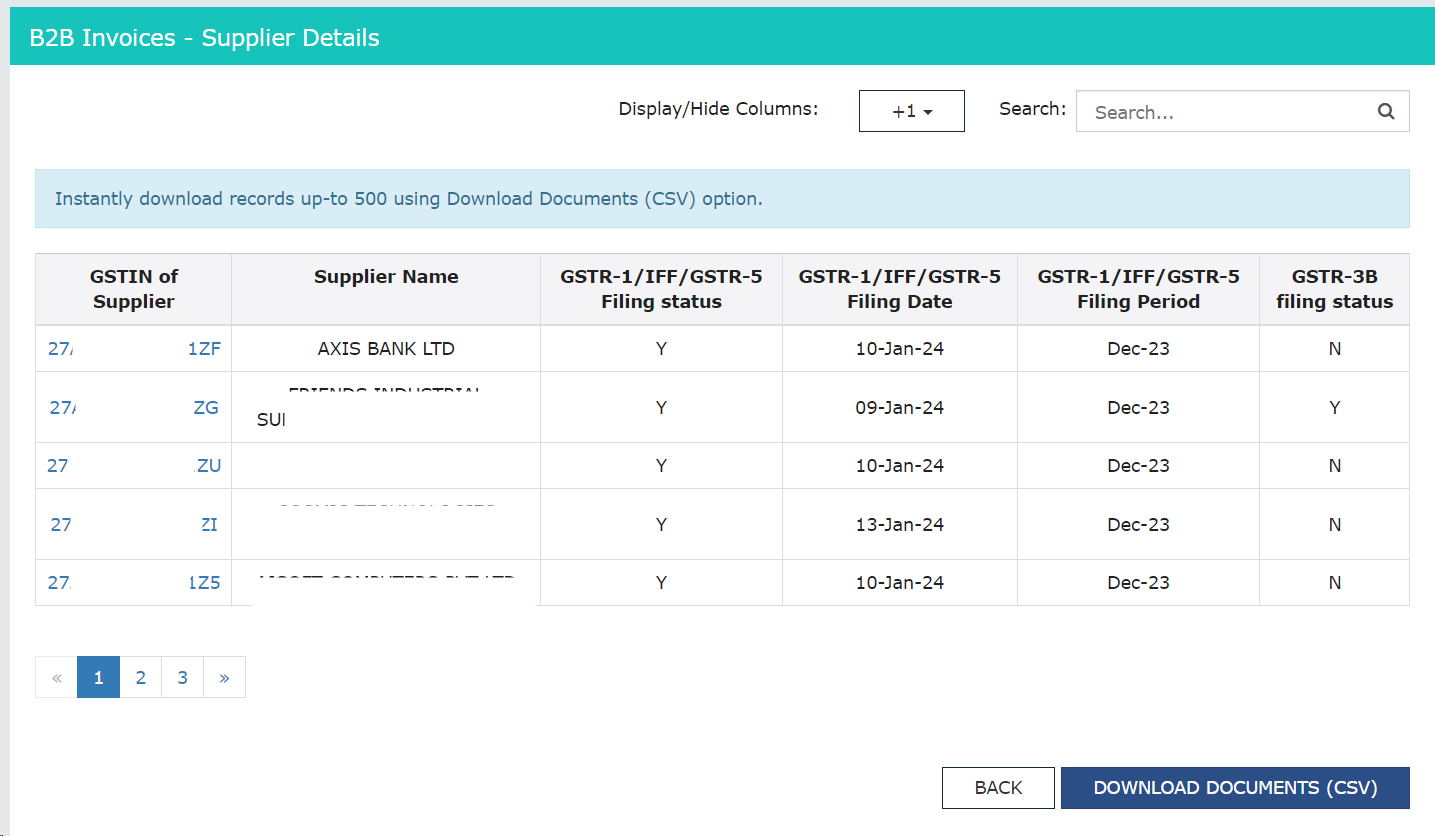

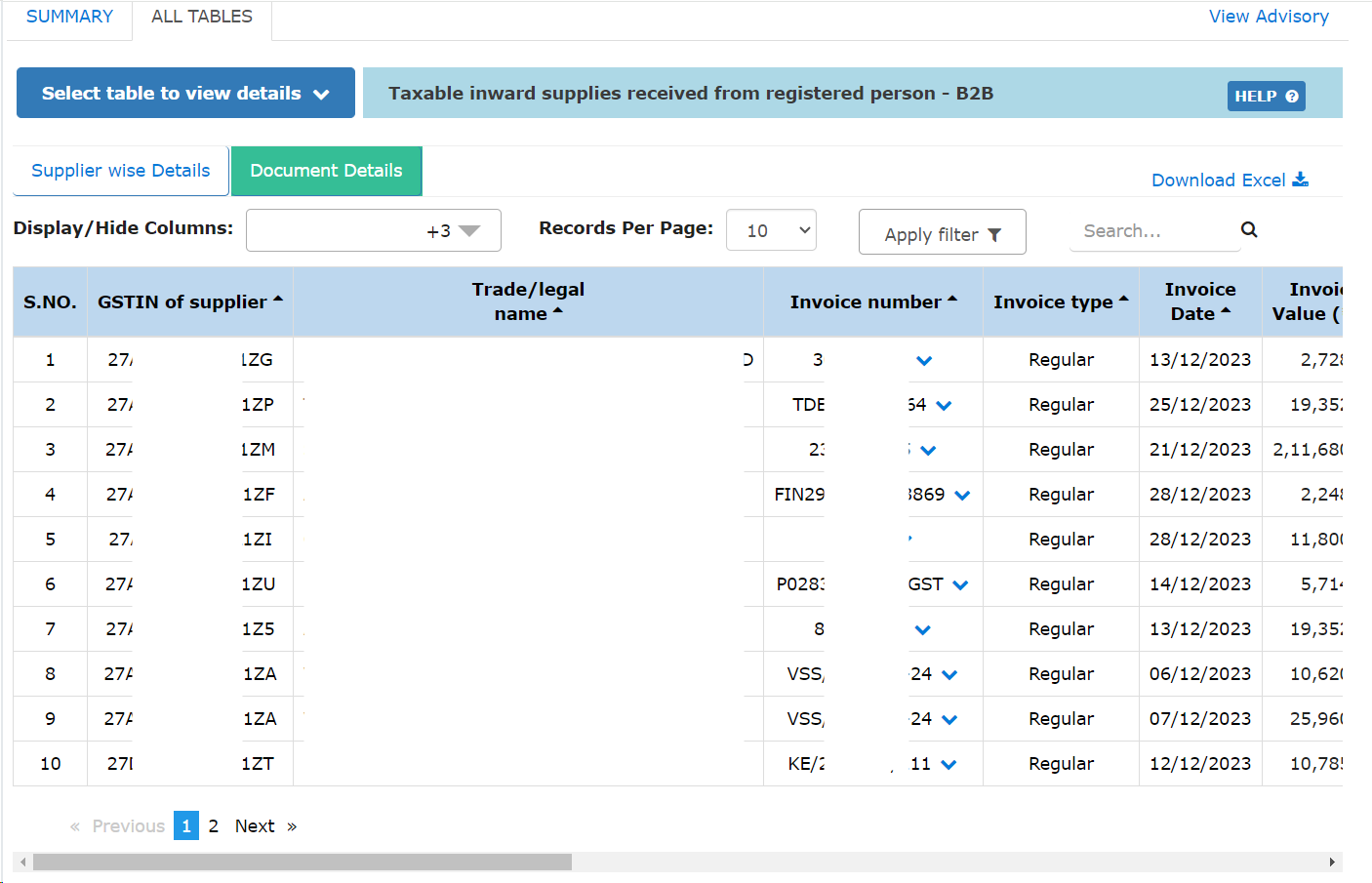

GSTR-2B is an auto-drafted ITC statement that is generated for every normal taxpayer based on the information furnished by his suppliers in their respective GSTR-1 /IFF, GSTR-5 (non-resident taxable person), and GSTR-6 (input service distributor). The statement indicates the availability and nonavailability of input tax credits to the taxpayer against each document filed by his suppliers.

It may be noted that the process of GSTR-2B generation starts after the ending of IFF, GSTR-5 and GSTR-6 due date on the 13th at midnight and therefore GSTR-2B can be made available to the taxpayer in the afternoon of the 14th of the month. Further, GSTR-2B is a static statement made available for each month on the 14th day of the succeeding month. For example, for July 2023, the statement was generated and made available to the registered person on 14th August 2023. Details of all the documents in GSTR-2B are available online and through a download facility.

Taxpayers can access their GSTR 2B on the GST common portal in Services>>Returns>>GSTR 2A. It can be viewed in Monthly or Quarterly view.

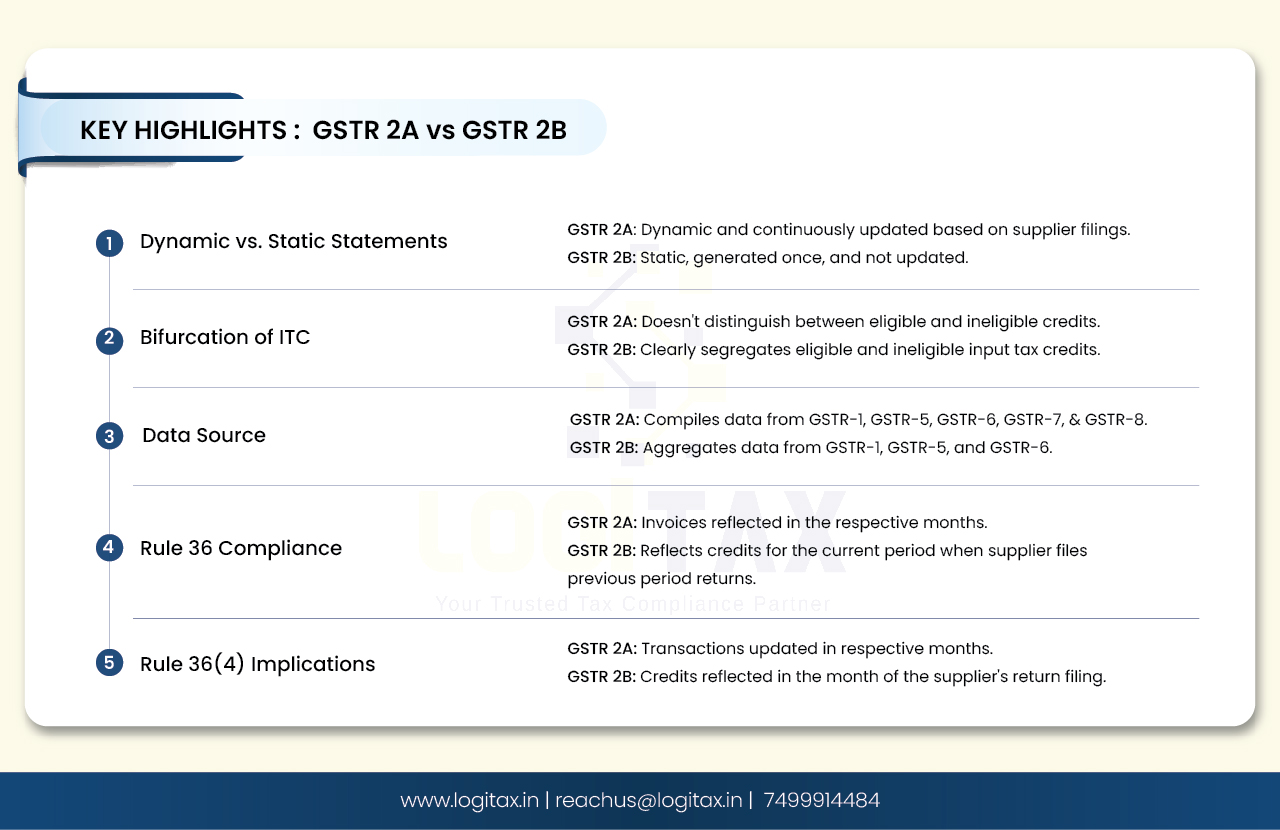

| Sr.No | Basis for comparison | GSTR 2A | GSTR 2B |

|---|---|---|---|

| 1 | Type of statement | Form GSTR-2A is a form of a dynamic statement. The details of inward supplies vis-à-vis input tax credit will be updated continuously. | Form GSTR-2B is a form of a static statement. This statement, once generated, does not get updated. |

| 2 | Bifurcation of ITC | Form GSTR-2A doesn’t provide bifurcation of eligible input tax credit and ineligible input tax credit. | Form GSTR-2B briefly bifurcates the eligible and ineligible input tax credit. |

| 3 | Source of data | Form GSTR-2A collects/ complies data on the basis of returns filed by the supplier in Form GSTR-1; Form GSTR-5; Form GSTR-6; Form GSTR-7 and Form GSTR-8. | Form GSTR-2B complies data from Form GSTR-1; Form GSTR-5 and Form GSTR-6 filed by the supplier. |

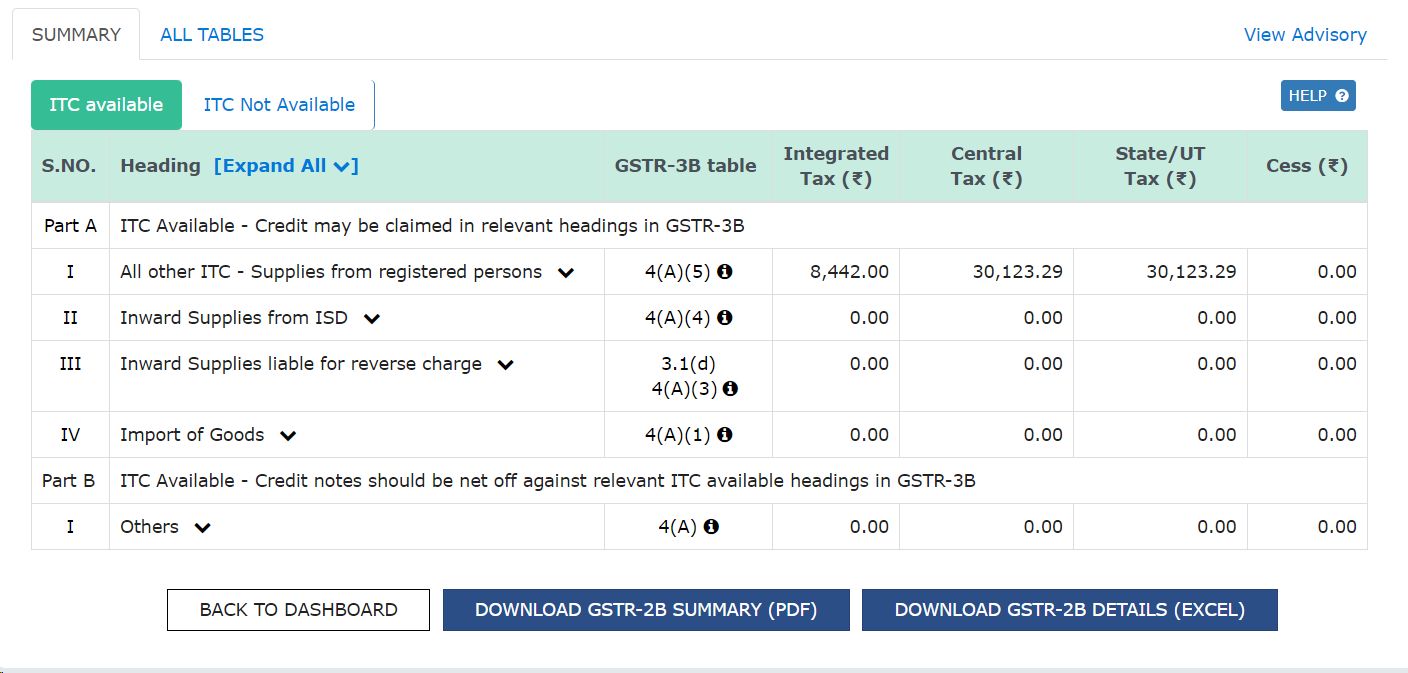

Summary view:

Detailed view :

As per rule 36(4) of the CGST Rules, 2017, no input tax credit shall be availed by a registered person in respect of invoices or debit notes the details of which are required to be furnished under sub-section (1) of section 37 unless,-

(a) the details of such invoices or debit notes have been furnished by the supplier in the statement of outward supplies in FORM GSTR-1 or using the invoice furnishing facility; and

(b) the details of input tax credit in respect of such invoices or debit notes have been communicated to the registered person in FORM GSTR-2B under sub-rule (7) of rule 60.

It is mentioned that ITC can not be availed for such purchases which are not reflected in GSTR 2B. However, it is pertinent to note that when the supplier files the return of any previous period in the current month, the ITC will be reflected in the GSTR 2B of the current period in which it is filed. For example, if the supplier files his GSTR-1 of April 2023 in July 2023, ITC will be reflected in the taxpayer’s GSTR 2B of July 2023. Therefore, no credit can lapse even if the supplier files his GSTR 1 late. In the case of GSTR 2A, transactions get updated in the respective months to which the transaction pertains. Therefore, it is difficult to trace the credit for the taxpayer.

Even though GSTR 2A and GSTR 2B, both provide similar information; GSTR 2B provides more clear picture of the eligible a href="https://medium.com/@LogiTax/input-tax-credit-under-gst-e09495311fc5" target="_blank">ITC for preparing GSTR 3B. Therefore, GSN considers it as base for GSTR 3B.

gstr 2a and 2b

difference between gstr 2a and 2b

gstr 2a vs 2b

gst compliance

gst return filing

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More