As per Notification No.12/2017-Central Tax (Rate) dated 28.06.2017, services by way of generation and distribution of electricity are exempt from GST. Following are the services which are exempt as per the notification:

1) Services supplied by electricity distribution utilities by way of construction, erection, commissioning, or installation of infrastructure for extending the electricity distribution network up to the tube well of the farmer or agriculturalist for agricultural use.

2) Transmission or distribution of electricity by an electricity transmission or distribution utility.

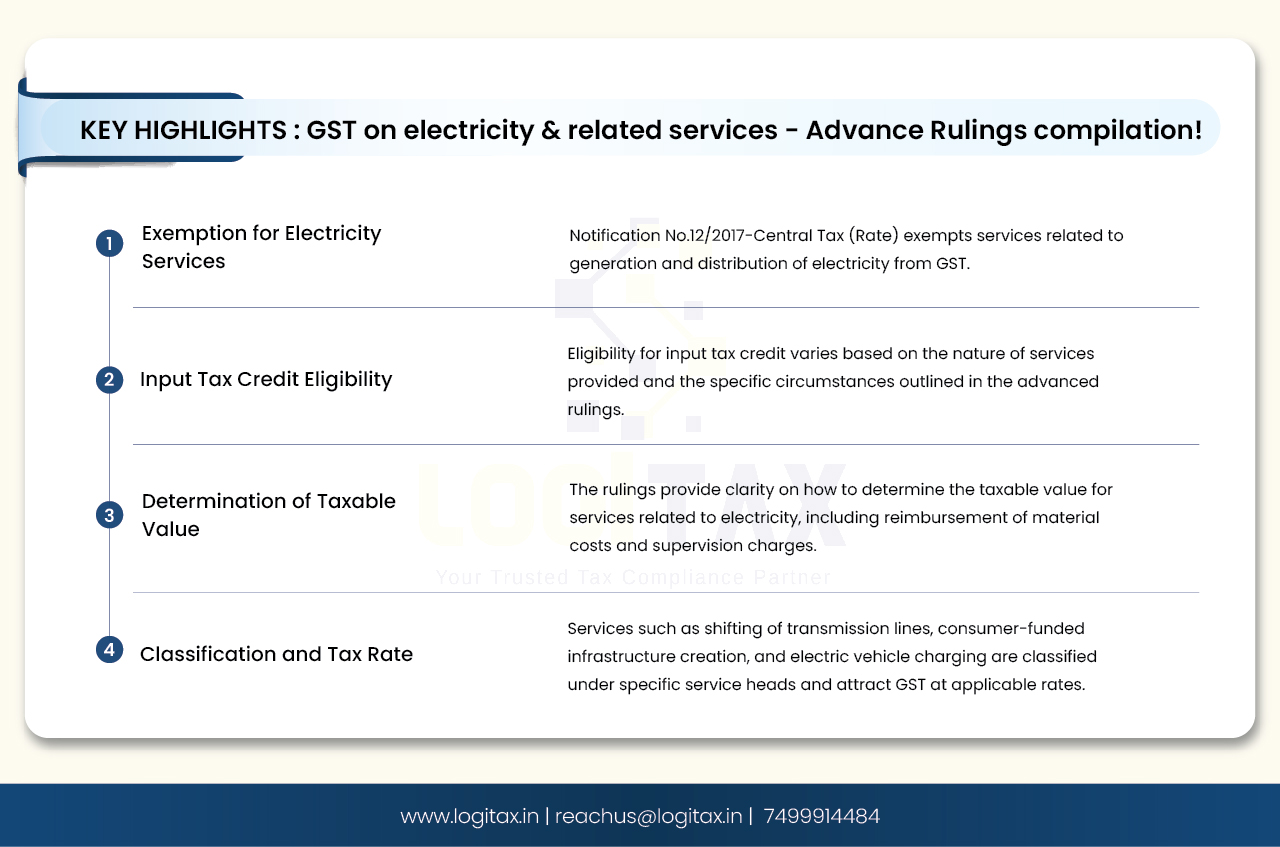

There are plenty of advance rulings on the applicability of GST on various services related to electricity. We have compiled it for you!

| Sr No. | Name of the applicant | Order Date | State | Ruling |

|---|---|---|---|---|

| 1. | TAMIL NADU GENERATION AND DISTRIBUTION CORPORATION LIMITED | 19/12/2023 | Tamil Nadu |

GST on various charges collected in relation to the Generation and Distribution of Electricity:

Supply of electricity is a service, which falls under SAC 9969. Undoubtedly, Applicant-TANGEDCO is an ‘Electricity transmission or distribution utility’ and the transmission or distribution of electricity services provided by an applicant is exempt from GST as per the Notification No. 12/2017-CT(Rate) dated 28.06.2017. But not all services rendered by the applicant for which they charge, are naturally bundled with the main service i.e. transmission or distribution of electricity. Various charges collected by the applicant are for the services rendered by the Applicant are only ancillary services, which can be considered as value-added services under ‘electricity consumption’. Apart from Belated payment surcharge (BPSC), Dishonoured cheque service charge and Network/wheeling charges all the other charges listed in the applicant are liable for GST at the appropriate prevailing rate of 18% GST as per Notification 11/2017-CT(Rate) dated 28.06.2017. |

| 2. | UNIQUE WELDING PRODUCTS P LTD | 15/01/2024 | West Bengal | Eligibility to Input Tax Credit on the inputs, input services, and capital goods used for the erection, commissioning, and installation of rooftop solar power plant: The Roof Solar Plant is not permanently fastened to the building. Thus, it qualifies as a plant and machinery and is not an immovable property, hence, it is not covered under blocked credit as mentioned in 17(5)(d) of the CGST Act, 2017. Therefore, the applicant is eligible to avail of ITC on rooftop solar systems with installation & commissioning. |

| 3. | HITACHI ENERGY INDIA LIMITED | 25/09/2023 | Chhattisgarh |

Works Contract for setting up terminals for establishing transmission links for the transmission of electricity:

The supply of services made by the applicant under the Fifth Contract relating to construction, erection, civil works, testing, commissioning, etc. of HVDC terminals, which includes the services of transportation, freight, and insurance, is a composite supply of works contract. The instant activity of the applicant being a composite works contract classifiable under construction services falling under SAC 9954, attracts 18% GST under residual entry mentioned at Sr. no.3 (xii) of Notification no. 11/2017 Central Tax (Rate) dated 28.06.2017, as amended. |

| 4. | VERSATILE AUTO COMPONENTS PRIVATE LIMITED | 02/09/2023 | Telangana |

Classification and the applicable rate of GST on electrically operated vehicles, including two & three-wheeled electric vehicles and electrical & mechanical spare parts of electric vehicles:

All electrically operated vehicles including three-wheeled electric vehicles are classified under HSN 8703 for the purpose of taxation under GST. Electrical & mechanical spare parts of electric vehicles are not covered by any description in Notification No. 01/2017, therefore they fall under residual entry and are liable to 18% GST. |

| 5. | PURVANCHAL VIDYUT VITRAN NIGAM LIMITED | 21/04/2023 | Uttar Pradesh |

Electricity Lines are installed under the appellant’s supervision to supply electricity at the designated location at the request of customers. Whether the value of material and cost of execution work for installation of lines is includible in the value of supply for determination of taxable value under GST where all such costs are taken as reimbursement and supervision charges are collected for the supply of supervision service?

Customers of the applicant purchase the material and arrange installation work and they advise the applicant to do only supervision work. The taxable value of supply for the applicant is only supervision work and GST is liable to be charged and payable on the transaction value i.e. supervision charge collected from customers by the applicant. GST is liable to be charged and payable for installation work done by the contractors hired by customers based on the invoice raised for the work/service and the applicant should raise an invoice and charge GST only for supervision charge (on total cost) as per applicant’s terms and conditions excluding GST on cost of all materials. |

| 6. | CHAMUNDESWARI ELECTRICITY SUPPLY CORPORATION LIMITED | 13/07/2023 | Karnataka |

The applicant intends to set up various public charging stations (PCS) for charging electric vehicles (EVs) for which the applicant would issue tax invoices and collect the “Electric Vehicle Charging Fee”, which includes ‘Energy Charges, and ‘Service Charges’. Whether charging of the electric battery is an activity of ‘supply of electrical energy’ as supply of goods and ‘service charges’ as supply of service; or the same to be treated as ‘supply of service’?

The charging stations do not require a license to charge the battery of an EV and thus the said stations are not involved in transmission, distribution, or trading of electricity. Therefore, even on this count also the impugned activity amounts to the supply of service. The activity of charging the battery of an Electrical Vehicle is treated as a ‘supply of service’ that gets covered under SAC 998714 and attracts 18% GST in terms of entry No.25(ii) of Notification No. 11/2017-Central Tax (Rate), dated 28-06-2017, as amended. The applicant is eligible can avail input tax credit to set off output tax liability. |

| 7. | PUNJAB STATE TRANSMISSION CORPORATION LIMITED | 30/05/2023 | Punjab |

Classification of applicable rate of tax on services of shifting of Transmission Lines on the request of NHAI (Contribution work) for widening of the road:

The primary business of the applicant is the transmission of electricity which is the principal supply, however, the applicant indulging in contribution work or deposit work is to be considered as ancillary services to the main work or activities of the applicant. The services provided are never made for a single price, they are always charged separately. The services of shifting Transmission Lines on the request of NHAI would be classified under Service Head 998631 and would attract 18% GST. |

| 8. | HOSUR COIR FOAMS PRIVATE LIMITED | 11/07/2023 | Tamil Nadu |

Eligibility to input tax credit for the capital goods, input, and input services for undertaking “consumer funded jobs” i.e. creating infrastructure for electricity distribution:

The inputs against which the applicant has sought to avail of Input Tax Credit are not part of the outward supply classified by the applicant under HSN 9986 as “Support Services to Electricity Transmission and Distribution”. The inputs such as cables, sub-stations, etc. are inputs for the principal supply of “Electricity Transmission and Distributions” and have no connection with the supply of services such as New Electricity Connections, Load enhancement, etc. The applicant is not eligible to claim an Input Tax Credit in respect of input/input services/ Capital Goods used for undertaking consumer-funded jobs. |

The compilation of advance rulings on GST for electricity and related services offers valuable insights into the taxation framework. From exemptions on transmission and distribution to the eligibility of input tax credits, these rulings provide clarity on various aspects of GST compliance in the electricity sector. Stay informed and ensure compliance with GST regulations to avoid any potential issues.

gst registration documents

electricity hsn code

electricity gst

electricity gst rate

gst on electricity bill

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More