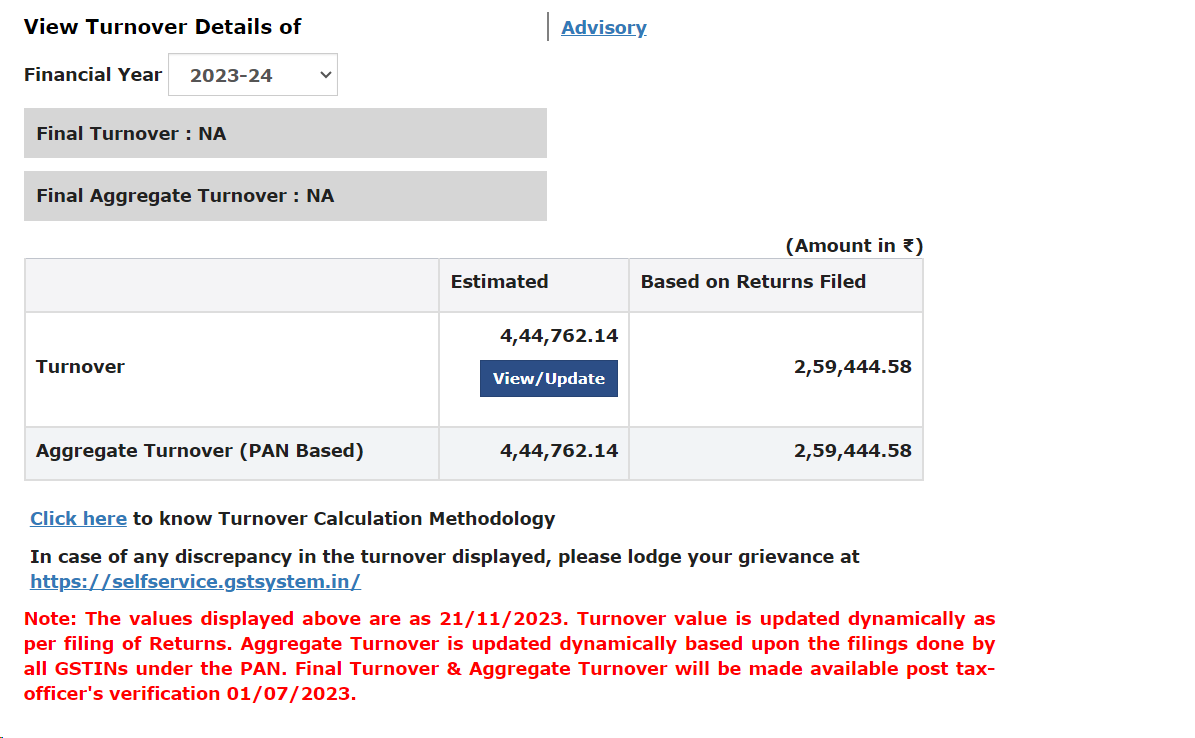

The GSTN implemented a new feature called Annual Aggregate Turnover (AATO) from FY 2021-22. This functionality has been integrated into taxpayers' dashboards, providing them with enhanced capabilities. Taxpayers can now conveniently access and review their AATO directly from their dashboard upon logging in

As per section 2(6) of the CGST Act, 2017, "aggregate turnover" means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

Turnover reported in GSTR-3B Column 2 of Table 3.1 { (a),(b),(c) & (e)} during the Financial Year 2020-21 have been taken into consideration (in case all the returns have been filed for the same).

The following formula is used for extrapolation of turnover:

(Sum of taxable value) X (*No.of GSTR-3B liable to be filed)/(No. of GSTR-3B filed)

*Categorisation of taxpayers to derive the number of GSTR-3B liable to be filed

For Composition Taxpayers opted-in throughout the FY: Since the Annual Aggregate Turnover limit for opting-in as a Composition Taxpayer is up to Rs. 1.5 crore, and will use the following extrapolation formula:

(Sum of taxable value) X (*No. of CMP-08 liable to be filed)/ (No. of CMP-08 filed)

Advisory on AATO functionality suggests to read the following advisory carefully before proceeding ahead:

Note: Taxpayers are expected to use this functionality only if they observe a discrepancy in the system-calculated turnover as per the calculation logic mentioned above.

The Annual Aggregate Turnover (AATO) update functionality proves exceedingly beneficial as it meticulously showcases the Pan-based turnover data of a duly registered person.

aato in gst

aato full form

how to check turnover in gst portal

gst portal

gst gov in

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More