16-11-2023

Notification No. 52/2023 - Central Tax dated 26.10.2023 covers various changes related to FORM GST REG-01, FORM GST REG-08, FORM GSTR-8, FORM GST PCT-01 and FORM GST DRC-22 and some rules.

Let’s understand these changes:

Form GST REG-01 is an application for GST registration. In Part B of this form, a new option has been given to select the constitution as a “One Person Company”.

Issues were raised by the persons registering as ‘One Person Company’ while they took GST registration. Upon analysis, GSTN noticed that the option of choosing One Person Company is not there in the form notified by CGST/SGST Acts and hence not available on the GSTN portal either. Therefore, on 21.03.2023, GSTN issued an advisory that in ‘Part B’ of GST Registration Form ‘REG-01’, the applicant may select Constitution of Business under the ‘Business Details’ tab using the dropdown list option “Others”, if the taxpayer wants to register for GST as “One Person Company”. After selecting the option “Others”, the applicant shall also mention “One Person Company” in the text field and follow the steps for a normal registration application to complete the process.

Now, this issue has been resolved by GSTN. A separate option for selecting the constitution as “One person company” is given.

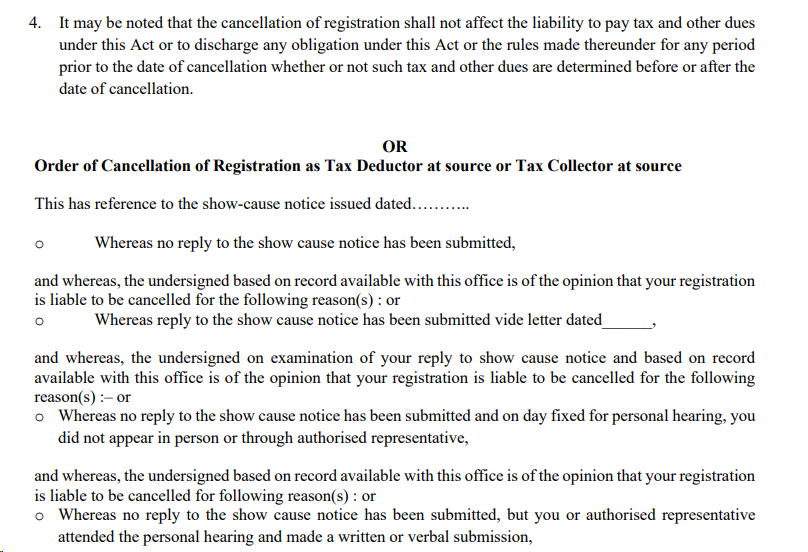

Form GST REG-08 is “Order of Cancellation of Registration as Tax Deductor at source or Tax Collector at source”. This form has been substituted for the old form. The new format is as follows:

Form GSTR 8 is a Statement for tax collection at source to be filed by E-commerce operators. GSTR 8 is to be filed by the 10th date of the next month. If it is filed late, a fee of Rs. 200 per day is levied. Form GSTR 8 did not have a separate field for late fees. Now, late fee fields are added in this form.

Following are the changes in form GSTR 8:

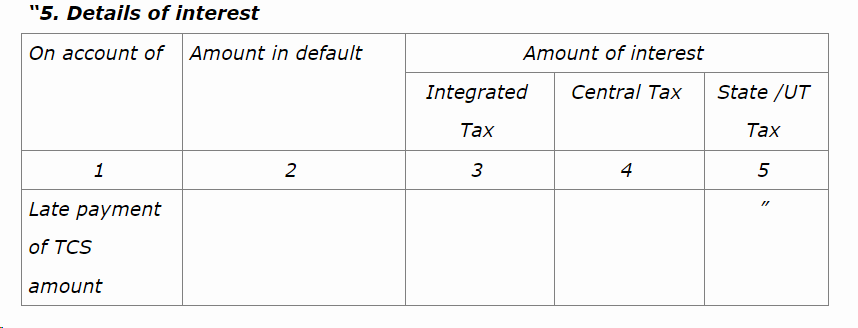

It had Table No. 5- Details of interest . The same table has been removed by way of this notification. The table was as follows:

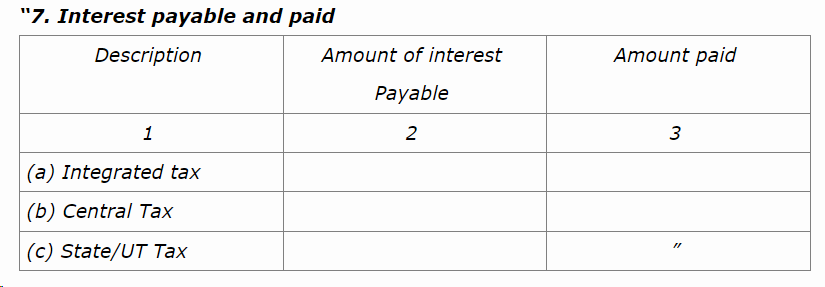

Table No. 7- “Interest payable and paid” format was as follows before this notification:

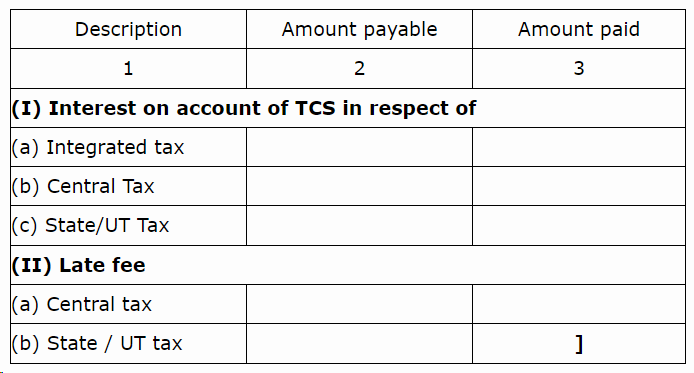

Now, below format is substituted for it:

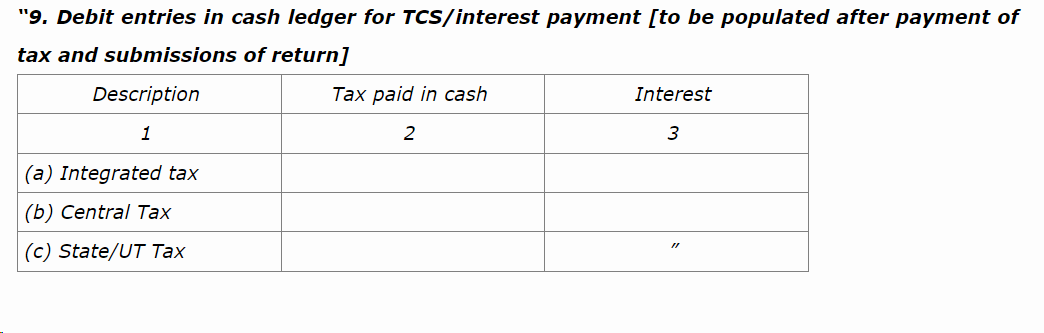

Table No. 9- “Debit entries in cash ledger for TCS/ interest payment” format was as follows before this notification:

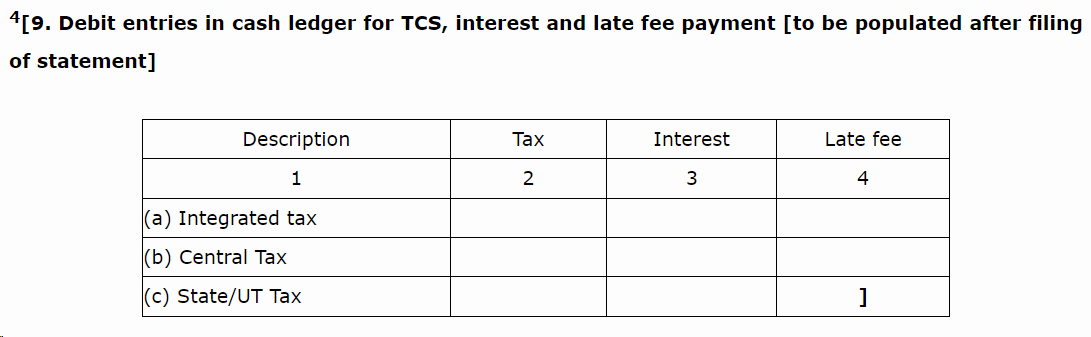

Now, a new format is introduced as shown below:

DRC-22 is the order of Provisional attachment of property under section 83. The GST Council in its 52nd meeting recommended an amendment in sub-rule (2) of Rule 159 of the CGST Rules, 2017 to provide the order for provisional attachment in FORM GST DRC-22 shall not be valid after the expiry of one year from the date of the said order. This will facilitate the release of provisionally attached properties after the expiry of a period of one year, without the need for a separate specific written order from the Commissioner.

Therefore, a new paragraph has been added at the end in this form as follows: “This order shall cease to have effect, on the date of issuance of order in FORM GST DRC-23 by the Commissioner, or on the expiry of a period of one year from the date of issuance of this order, whichever is earlier.”.

With the recent amendments introduced through Notification No. 52/2023 - Central Tax dated 26.10.2023, crucial changes have been made in GST REG-01, GST REG-08, GSTR 8, and DRC 22. Notably, the inclusion of a dedicated option for “One Person Company” in GST REG-01, the revamped format of GST REG-08, and the added late fee fields in GSTR 8 aim to enhance the clarity and efficiency of the GST registration and filing processes. Moreover, the time-bound provision in GST DRC-22 ensures a more streamlined approach to provisional property attachment, emphasizing the need for a swift resolution within one year. Stay informed and updated to navigate these changes seamlessly.

Gst registration form,

Gst reg forms

Form gst reg 06

Gst reg 01

Gst form 6

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More