Many companies provide food services, like a canteen, for their workers and employees. This is a common practice in manufacturing industries. The meals can be either free or have a small cost for employees. Usually, companies hire external caterers on a contract basis to manage this service. Know more about GST- Input Tax Credit on Canteen facility.

Confusion arises about the following 2 issues:

There are plenty of advance rulings on these issues in various states. We have compiled it for you!

| Sr No | Name of the applicant | Order Date | State | Ruling |

|---|---|---|---|---|

| 1. | FAIVELEY TRANSPORT RAIL TECHNOLOGIES INDIA PRIVATE LIMITED | 20/12/2023 | Tamil Nadu |

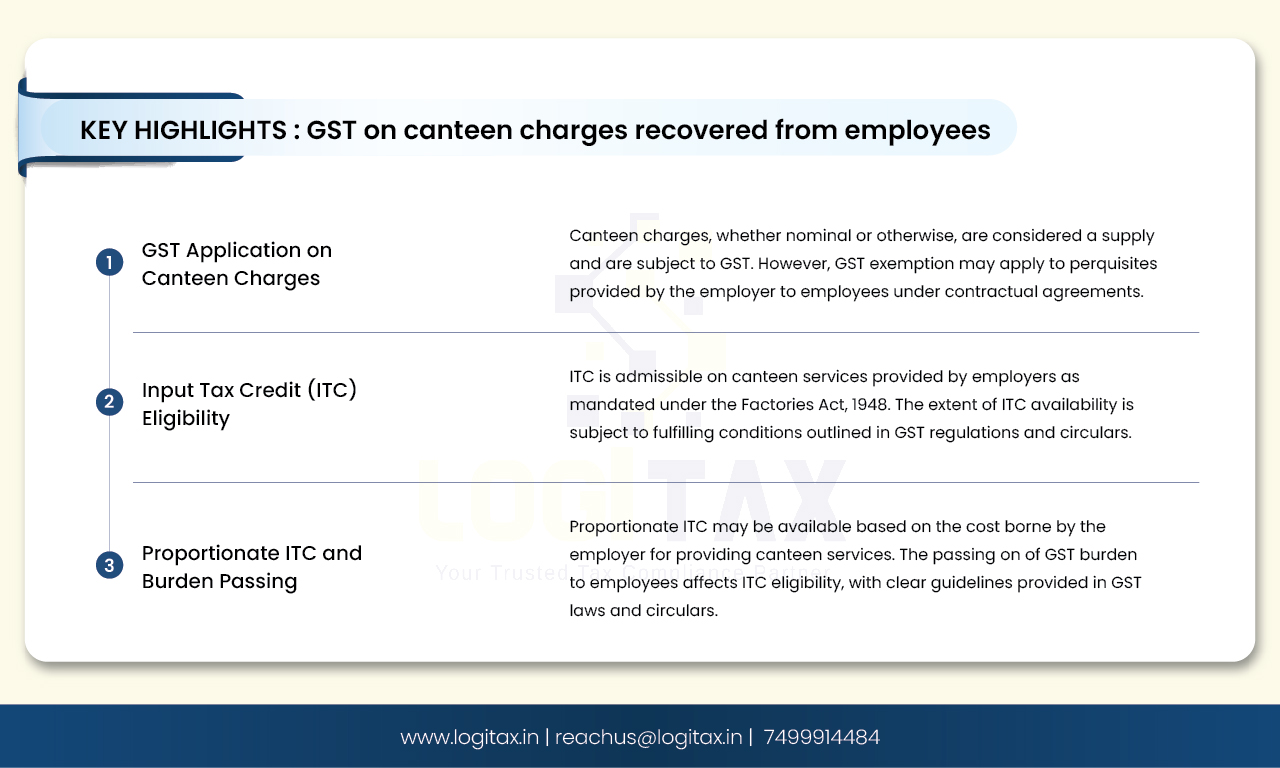

a. The amount charged to the employees by the applicant, whether nominal or otherwise, is to be treated as the consideration for such supply of canteen service on its account to its employees on which GST is liable to be discharged by the applicant-employer.

b. ITC is admissible on the supply of all the goods or services referred to in section 17(5)(b) of the CGST Act, where an employer must provide the same to its employees under any law for the time being in force. |

| 2. | SUZUKI MOTOR GUJARAT PVT LTD | 03/02/2024 | Gujarat |

a. In terms of circular No. 172/04/2022-GST, perquisites provided by the ‘employer’ to the ‘employee’ in terms of the contractual agreement entered into between the employer and the employee, will not be subjected to GST when the same is provided in terms of the contract between the employer and employee. In the instant case, the canteen facility is provided by the applicant as mandated in Section 46 of the Factories Act, 1948 and the applicant has provided a copy of the Meal Policy. Given the foregoing, the deduction made by the applicant from the employees who are availing food in the factory would not be considered as a ‘supply’ under the provisions of section 7 of the CGST Act, 2017.

b. The aforementioned finding is only in respect of permanent employees and it would not apply to canteen facilities provided to employees of SMC on deputation, employees of the applicant on business travel and temporary workers as the temporary/contract workers, employees on deputation and employees on business travel, does not pass the test of the employer-employee relationship. c. Input Tax Credit will be available to the applicant in respect of the canteen facility which is obligatory under the Factories Act, 1948. read with Gujarat Factories Rules, 1963. |

| 3. | TUBE INVESTMENT OF INDIA LIMITED | 22/12/2023 | Uttarakhand |

a. In the instant case, the employee doesn't need to consume the food from the canteen and secondly, the Canteen facility is provided by the applicant in their factory by the mandate under the Factories Act, 1948; but in place of such facility, collects an amount though nominal, fixed as employee cost.

b. Establishing a canteen is in the furtherance of business of the applicant and the supply of food to the employees when the same is not contractually agreed is not an allowance as a part of the employment. Thus, the provision of food in the canteen for a nominal cost is a ‘supply’ for GST. c. ITC on GST charged by the canteen service provider will only be available to the extent of cost borne by the applicant only upon fulfillment of the terms and conditions of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017. |

| 4. | KOHLER INDIA CORPORATION PVT LTD | 05/01/2024 | Gujarat |

a. In terms of Circular No. 172/04/2022-GST, it is clarified that perquisites provided by the ‘employer’ to the ‘employee’ in terms of contractual agreement entered into between the employer and the employee, will not be subjected to GST when the same are provided in terms of the contract between the employer and employee.

b. Therefore, the deduction made by the applicant from the employees who are availing food in the factory would not be considered as a ‘supply’ under the provisions of section 7 of the CGST Act, 2017. c. Input Tax Credit will be available to the appellant in respect of food and beverages as the canteen facility is obligatory to be provided under the Factories Act, 1948, read with Gujarat Factories Rules, 1963 as far as the provision of canteen service for employees is concerned. It is further held that the ITC on GST charged by the CSP will be restricted to the extent of cost borne by the appellant only. |

| 5. | SUNDARAM CLAYTON LIMITED | 05/09/2023 | Tamil Nadu |

a. Supply made by a taxable person in the course or furtherance of business is an ‘Outward supply’ and establishing a canteen is in the furtherance of the business of the Applicant. Thus, the provision of food in the canteen for a nominal cost is a ‘Supply’ for the purposes of GST.

b. The benefit of the non-levy of GST could be extended only to the extent of the consideration being borne by the Applicant out of the total cost for supply of the food/beverages, but not to the extent of the consideration being collected at the subsidized rates, by the Applicant from their employees. Thus, GST is to be levied on the amount recovered by the Applicant from the employees towards canteen provision. |

| 6. | KIRBY BUILDING SYSTEMS & STRUCTURES INDIA PRIVATE LIMITED | 15/11/2023 | Telangana |

a. Canteen services being such a prerequisite under Section 46 of the Factories Act, 1948 and also a contractual obligation in terms of employment contract, the supply of canteen services by the factory to its employees is exempt from GST.

b. If the applicant has recovered only nominal amounts and the applicant has recorded these costs borne by them in their books of accounts for providing the canteen services then they are eligible for input tax credit as enumerated in the proviso to Section 17(5)(b) of the CGST Act, 2017 |

| 7. | M/S EIMCO ELECON INDIA LIMITED | 24/08/2023 | Gujarat |

a. In terms of Circular No. 172/04/2022-GST, perquisites provided by the ‘employer’ to the ‘employee’, in terms of contractual agreement entered into between the employer and the employee, will not be subjected to GST when the same are provided in terms of the contract between the employer and employee. Accordingly, the subsidized deduction made by the applicant from the employees who are availing food in the factory would not be considered as a ‘supply’ under the provisions of the GST Act.

b. Applicant is not liable to pay GST on the amount representing the employees' portion of canteen charges, which is collected by the applicant and paid to the third-party canteen service provider. c. The supply of food by the applicant is a ‘supply of service’ by the applicant to their contractual worker and the cost recovered from the salary of the contractual worker, as deferred payment is a ‘consideration’ for the supply. d. As far as the provision of canteen service for full-time/direct employees working on a permanent basis at the factory is concerned, the applicant is eligible to claim ITC in respect of food and beverages as the canteen facility is obligatory to be provided under the Factories Act and Rules. It is further held that the ITC on GST charged by the canteen service provider will be restricted to the extent of cost borne by the appellant only. e. The applicant is not eligible for an Input Tax Credit on the food supplied by the third-party canteen service provider to contractual workers as per Section 17(5) of the CGST Act, 2017. |

| 8. | KSH AUTOMOTIVE PVT LTD | 29/05/2023 | Andhra Pradesh | a. As per the Factories Act and AP Factories Rules, the Canteen facility is to be compulsorily made available to the workers of the applicant. Due to the mandatory nature of maintenance of the canteen, an applicant is eligible for proportionate ITC on a permanent employee on food supplied under canteen service to employees only and not contractual workers. |

| 9. | TATA AUTOCOMP SYSTEMS LTD | 19/06/2023 | Gujarat |

a. The deduction of the amount by the applicant from the salary of the employees who are availing canteen facility provided in the factory premises would not be considered as a 'supply' under the provisions of Section 7 of the CGST Act, 2017.

b. Input Tax Credit, to the extent of the cost borne by the applicant for providing canteen services to its employees, will be available to the applicant on GST charged by the service provider in respect of canteen facility provided to its employees other than contract employees working in their factory, in view of the provisions of Section 17(5)(b) as amended effective from 1.2.2019 and clarification issued by CBIC vide circular No. 172/04/2022-GST dated 6.7.2022, however, proportionate credit to the extent embedded in the cost of goods recovered from such employees is disallowed to the applicant. |

| 10. | SHRIRAM PISTONS AND RINGS LIMITED | 05/12/2022 | Uttar Pradesh |

a. Applicant is not liable to pay GST on the amount deducted/ recovered from the employees.

b. ITC on GST paid on canteen facility is admissible under Section 17(5)(b) of CGST Act on the food supplied to employees of the company subject to the condition that burden of GST have not been passed on to the employees of the company. |

The rulings on GST applicability and Input Tax Credit (ITC) for canteen charges collected from employees vary across states and circumstances. While some cases mandate GST on canteen charges and allow ITC, others exempt the charges from GST. Companies need to assess their specific situations and adhere to relevant GST regulations to ensure compliance and minimize financial implications.

gst

canteen charges

gst on food

gst on restaurant service

ITC on canteen facility

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More