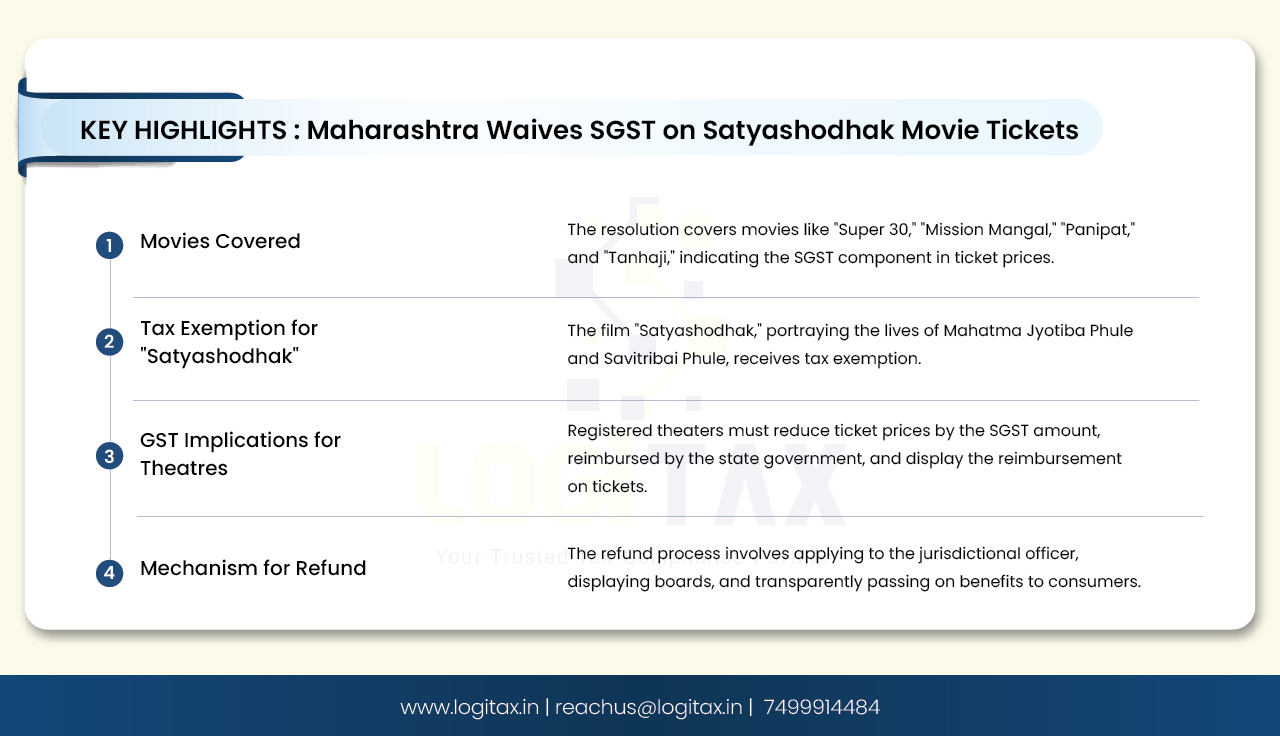

On 11th January, 2024, Government of Maharashtra issued a Government Resolution (GR) to reimburse the SGST component to the registered theatre with respect to Satyashodhak movie.

Government of Maharashtra has issued Government Resolutions (GR) regarding reimbursement, to the registered theatres, of the component of State Goods and Services Tax (SGST) prominently indicated in the ticket which was issued for the supply of service by way of admission to the exhibition of movies “Super 30”, “Mission Mangal”, “Panipat” and “Tanhaji: The Unsung Warrior” for the specified periods.

The demand put forth by State Food, Civil Supplies, and Consumer Protection Minister Chhagan Bhujbal has been successful. The film 'Satyashodhak,' based on the lives of Mahatma Jyotiba Phule and Savitribai Phule, who pioneered women's education in the country and paved the way for Bahujans' educational access, has been granted tax exemption.

“Satyashodhak” is a biographical journey through the life of Mahatma Jyotirao Phule. It enumerates the multiple reforms that the man brought forth and the situation that he had to face as a result of his morals.

Registered theatre after indicating CGST and SGST in the price of ticket shall reduce the ticket price by amount equal to SGST in order to pass on the benefit to the consumer. “Registered theatre” means theatre registered under the Maharashtra GST Act. Registered theatre shall prominently indicate the component of SGST, CGST and amount of discount on account of reimbursement to be claimed from Government of Maharashtra in the ticket price of movie.

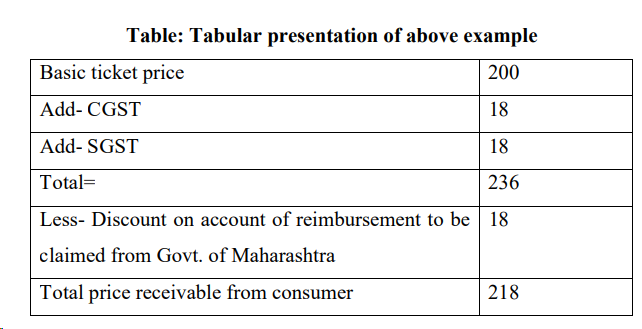

Example: Suppose basic ticket price is Rs 200/-. SGST applicable is Rs 18/- and CGST applicable is Rs 18/-. Total price comes to Rs 236/-. Here, Government is going to reimburse the amount equal to SGST payable which is at Rs 18/-. The theatre shall reduce this amount of SGST to be reimbursed by the State Government at Rs 18/- from Rs 236/- and collect balance amount of Rs 218/- from consumer. The theatre shall prominently indicate this reimbursement amount of Rs 18/- which is equal to SGST in the ticket.

The registered theatre shall pay the tax, SGST as well as CGST, in a regular manner. If the registered theatre has recovered full amount from consumer without reducing the amount equal to SGST, then no refund of such amount will be granted to the theatre. In order to claim a refund of SGST paid, the registered theatre is required to pass on the benefit of this scheme to the consumer.

Registered theatres which are going to take benefit of this scheme shall prominently display in their theatre premises a board to the effect that Government of Maharashtra is going to reimburse the component of SGST to the registered theatre and cost of ticket is reduced accordingly. Jurisdictional officer may visit the theatre to verify whether theatre is passing on this benefit to consumer or not.

After filing the return under section 39 of MGST Act, registered theatre shall make an application to State jurisdictional officer for reimbursement of SGST component which he has paid in the return period in Annexure-I within thirty days from the filing of return and payment of tax for the said period. If registered theatre is under jurisdiction of Central authority, then he will apply to concerned divisional Joint Commissioner of State Tax or to the locational administrative head of the office.

Registered theatre shall produce the books of accounts for the verification before jurisdictional officer for ascertaining refund claim as and when required. Apart from verification of books of accounts, jurisdictional officer will also verify whether registered theatre has fulfilled all the conditions prescribed in the Government Resolution. After due verification, refund will be disbursed to the registered theatre. The refund shall be disbursed within 30 days from the date of the application.

The trade circular functions as an elucidative manual, elucidating the reimbursement protocol for State Goods and Services Tax (SGST) on movie tickets in Maharashtra. The delineated procedure is designed to guarantee a transparent delivery of benefits to consumers, incorporating mechanisms for thorough verification and prompt disbursement of refunds.

Goods And Services Tax GST

gst online payment

MGST

SGST

Chhagan Bhujbal

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More