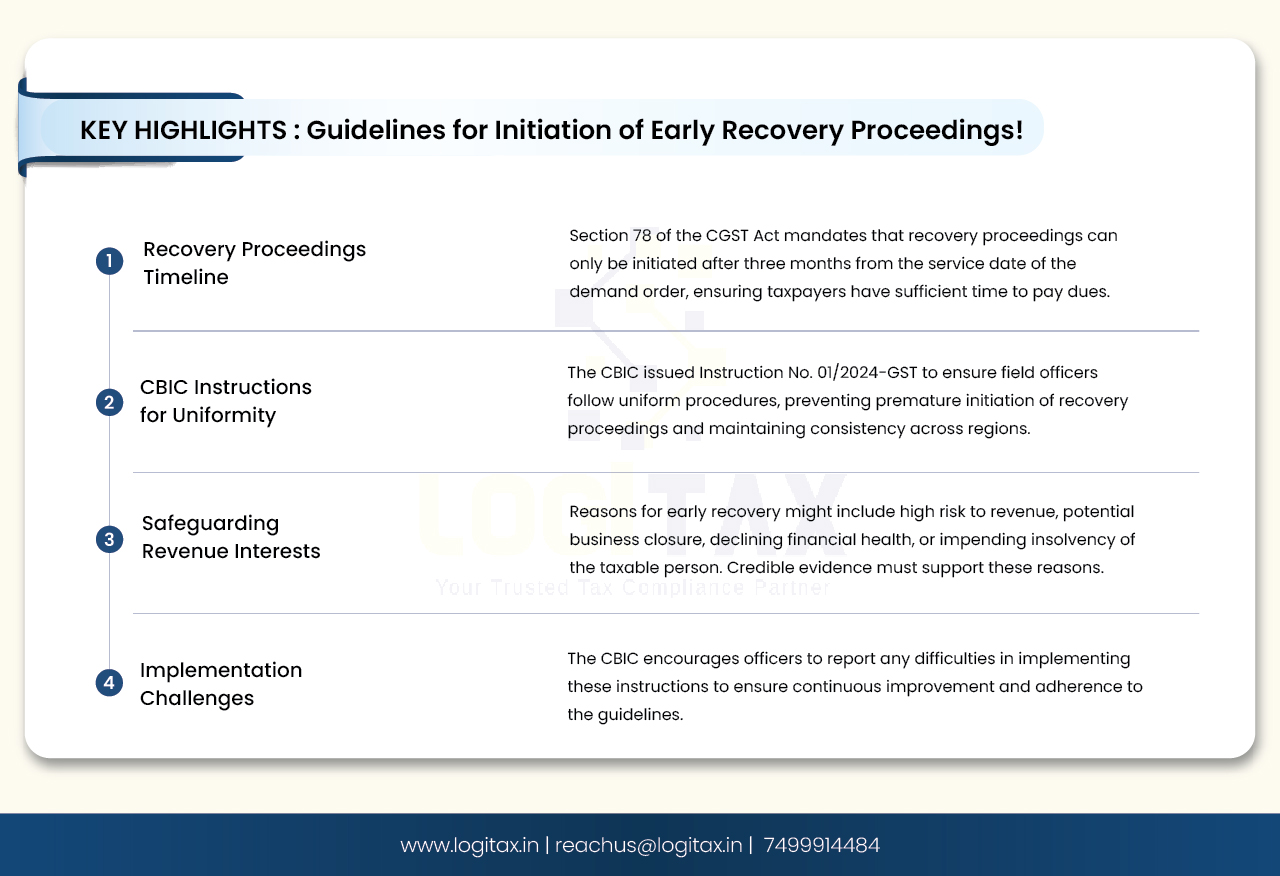

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry from the demand order's service date. Three months is given to the assessee for payment of the dues. However, CBIC has observed that some field officers initiate recovery proceedings before the expiry of three months. Therefore, to ensure uniformity in the implementation of the provisions of the law, CBIC issued Instructions on 30th May 2024.

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS

GST POLICY WING

F. No. CBIC-20016/9/2024-GST

To,

All the Principal Chief Commissioners / Chief Commissioners / Principal Commissioners /Commissioners of Central Tax

All the Principal Directors General/ Directors General of Central Tax

Subject: Guidelines for initiation of recovery proceedings before three months from the date of service of demand order- regarding

Attention is invited to sub-section (1) of section 79 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the 'CGST Act'), which provides that where any amount payable by a person to the Government under any of the provisions of CGST Act or Rules made thereunder is not paid, the proper officer shall proceed to recover the amount by one or more of the modes specified in the said sub-section. Attention is further invited to Section 78 of the CGST Act, which provides for the time for initiation of such recovery proceedings. These sections are reproduced below for ease of reference:

"Section 78: Initiation of recovery proceedings.-

Any amount payable by a taxable person in pursuance of an order passed under this Act shall be paid by such person within three months from the date of service of such order failing which recovery proceedings shall be initiated:

Provided that where the proper officer considers it expedient in the interest of revenue, he may, for reasons to be recorded in writing, require the said taxable person to make such payment within such period less than a period of three months as may be specified by him."

"Section 79: Recovery of tax.-

"1. Where any amount payable by a person to the Government under any of the provisions of this Act or the rules made thereunder is not paid, the proper officer shall proceed to recover the amount by one or more of the following modes, namely: -

...".

1.2 On reading the above sections, it becomes clear that the general rule for initiating recovery proceedings is that, where any amount payable by a taxable person in pursuance of an order passed under the CGST Act is not paid within three months from the date of service of such order, recovery proceedings shall be initiated by the proper officer only after the expiry of the said period of three months.

1.3 Only in exceptional cases, where it is necessary in the interest of revenue, the proper officer may require the said taxable person to pay the said amount within a period less than the period of three months from the date of service of the order, as may be specified by him, after recording the reasons for doing so in writing. If the said amount is not paid by the said taxable person within the period specified by the proper officer under the proviso to section 78 of the CGST Act or even after the expiry of three months from the date of the service of the order, the same can then he recovered by the proper officer as per provisions of sub-section (1) of section 79 of CGST Act.

2. It has been brought to the notice of the Board that some of the field formations are initiating recovery before the specified period of three months from the date of service of the order, even in the cases where the taxable person has not been specifically required by the proper officer, for reasons to be recorded in writing, for payment of such amount within a period less than the period of three months from the date of service of the order.

Therefore, to ensure uniformity in the implementation of the provisions of law across the field formations, the Board, in the exercise of its powers conferred by section 168 of the CGST Act, hereby issues the following instructions to be followed in cases where it is necessary, in the interest of revenue, to initiate recovery before the period of three months from the date of service of the order.

3.1 As per Circular No. 3/3/2017- GST dated the 5th July 2017, the proper officer for recovery under Section 79 of the CGST Act is the jurisdictional Deputy or Assistant Commissioner of Central Tax. It is also mentioned that the proper officer under proviso to Section 78 is the jurisdictional Principal Commissioner/ Commissioner of Central Tax.

3.2 Therefore, while recovery proceedings under sub-section (1) of section 79 of CGST Act are required to be undertaken by the jurisdictional Deputy or Assistant Commissioner of Central Tax, however, in the cases, where it is felt that recovery proceedings in respect of an amount payable by a taxable person in pursuance of an order need to be initiated in the interest of revenue before completion of three months from the date of service of the order, the matter needs to be placed by the jurisdictional Deputy or Assistant Commissioner of Central Tax before the jurisdictional Principal Commissioner/ Commissioner of Central Tax, along with the reasons/ justification for such an action.

The jurisdictional Principal Commissioner/ Commissioner of Central Tax shall examine the reasons/ justification given by the jurisdictional Deputy or Assistant Commissioner at the earliest and if he is satisfied that it is expedient in the interest of revenue to ask the said taxable person to pay the said amount before completion of three months from the date of service of the order, he must record in writing, the reasons as to why the concerned taxable person is required to make payment of such amount within such period, less than a period of three months, as may be specified by him. After recording such reasons in writing, he may issue directions to the concerned taxable person to pay the said amount within the period specified by him in the said directions. Copy of such directions must also be sent to the jurisdictional Deputy or Assistant Commissioner of Central Tax for information.

3.3 It is further mentioned that the jurisdictional Principal Commissioner/ Commissioner of Central Tax should provide the specific reason(s) for asking the taxable person for early payment of the said amount, clearly outlining the circumstances prompting such early action. Such reasons could include high risk to a revenue involved in waiting till the completion of the three months due to apprehension that the concerned taxable person may close the business operations shortly, or due to the possibility of default by the taxable person due to his declining financial conditions or impending insolvency, or likely initiation of proceedings under Insolvency and Bankruptcy Act, etc.

Reasons to believe the apprehension of risk to revenue should be based on credible evidence, which may be kept on record to the extent possible. While issuing any such directions, the proper officer must duly consider the financial health, status of business operations, infrastructure, and credibility of the taxable person, and strike a balance between the interest of the revenue and ease of doing business. It is implicit that such directions for early payment of the confirmed demand should not be issued mechanically, and must be issued only in cases where the interest of revenue is required to be safeguarded due to specific apprehension/ circumstances in the said case.

3.4 Wherever such directions are issued by the jurisdictional Principal Commissioner/ Commissioner of Central Tax as per powers conferred under proviso to section 78 of CGST Act, and where the taxable person fails to make payment of the said amount within the period specified in the said directions, the jurisdictional Deputy or Assistant Commissioner of Central Tax shall proceed to recover the said amount as per the procedure specified in sub-section (1) of section 79 of CGST Act.

4. Difficulties, if any, in the implementation of these instructions may be informed to the Board (gst-cbec@gov.in).

(Sanjay Mangal)

Principal Commissioner, GST

The CBIC aims to ensure uniformity of procedures nationwide by issuing this instruction. It clarifies the timing for officers to initiate recovery proceedings, thereby reducing unnecessary pending cases.

Recovery proceedings under GST

Section 79 of CGST Act

Section 78 of the CGST Act

CBIC

Early Recovery Proceedings

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More