CIF stands for Cost, Insurance, and Freight. A CIF Contract is a contract of sale of goods by shipment where the seller pays for the cost of transport and insurance of the goods to the destination and the legal delivery is when the goods cross the ship's rail in the port of shipment.

In case of imports under CIF contracts, ocean freight is borne by the seller located outside India. The question here is whether IGST on reverse charge basis is payable on such ocean freight by the importer.

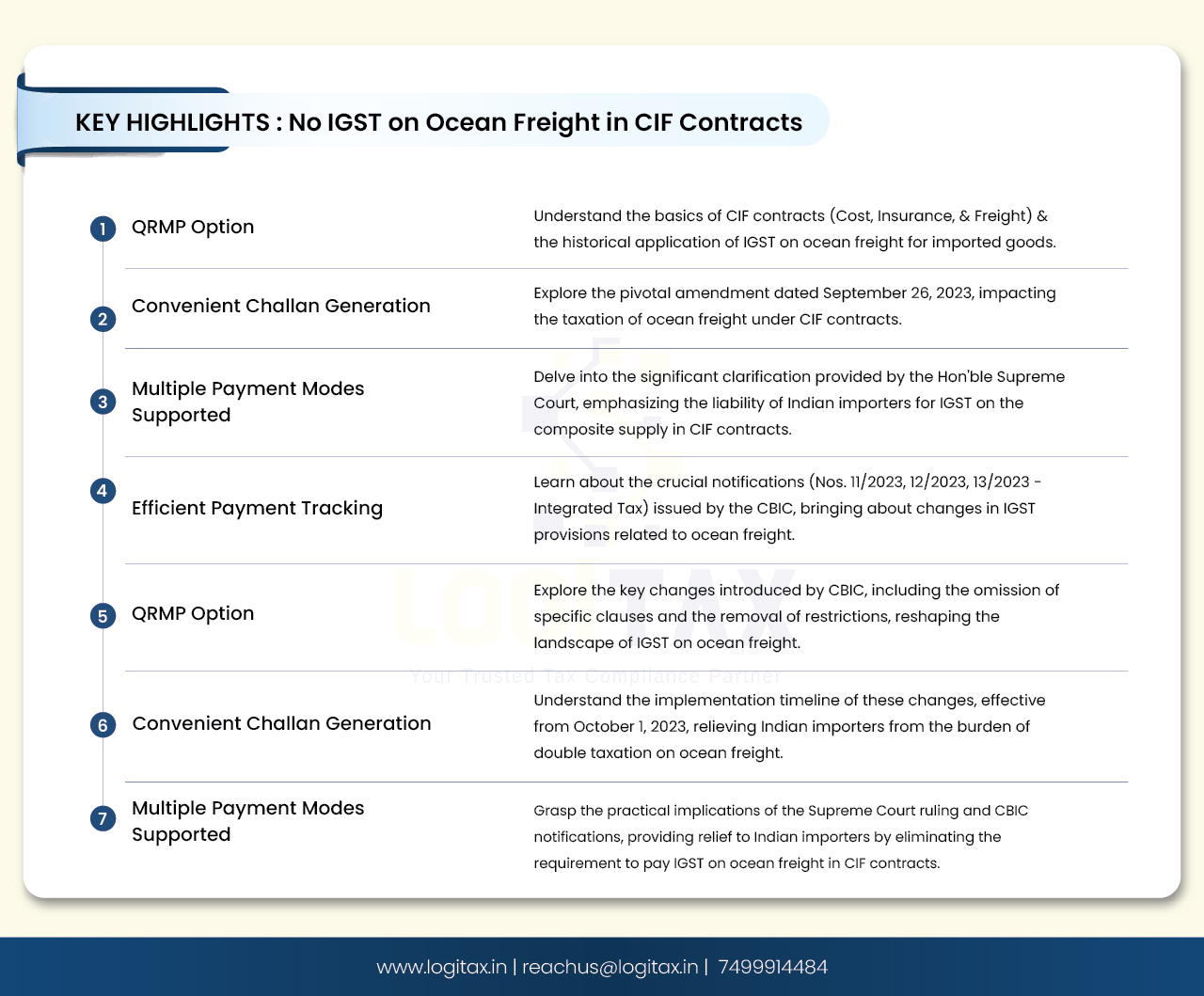

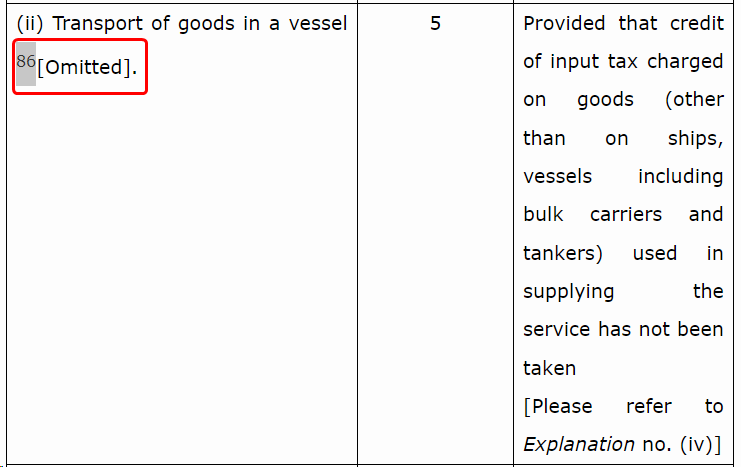

Earlier, Sl. No. 9(ii) of Notification No. 8 /2017-Integrated Tax (Rate) dated June 28, 2017 ("the IGST Service Rate Notification") provided that on the inter-state supply of services of "Transport of goods in a vessel including services provided or agreed to be provided by a person located in non-taxable territory to a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India" was leviable to Integrated Tax at rate of 5 percent.

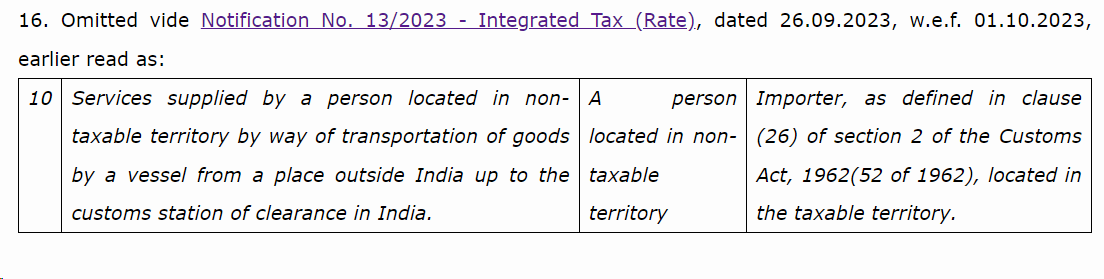

Further, SI. No. 10 of Notification No.10/2017-Integrated Tax (Rate) dated June 28, 2017 ("the Reverse Charge Service Notification") stated that services supplied by a person located in non-taxable territory to a person located in non-taxable territory of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India, is taxable under reverse charge basis.

Accordingly, the importer was liable to pay IGST on ocean freight paid on imported goods under the reverse charge mechanism.

This aspect was clarified by the Hon'ble Supreme Court, in the case of Union of India v Mohit Minerals Pvt. Ltd. on 19th May, 2022.

Following are the points held by the court:

Thereafter, the CBIC issued Notification Nos. 11/2023, 12/2023, 13/2023-Integrated Tax (Rate), dated September 26, 2023 made the following changes:

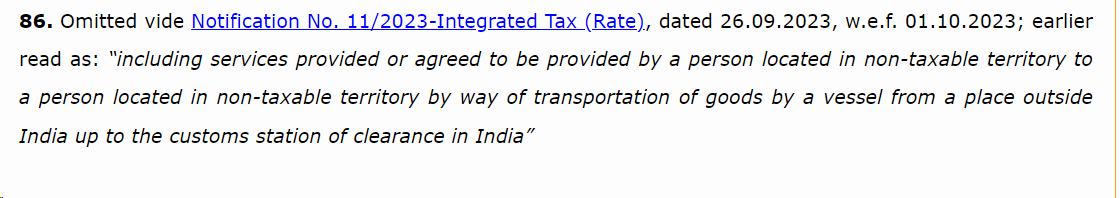

The CBIC vide Notification No. 11/2023-Integrated Tax (Rate) dated September 26, 2023 omitted the words "including services provided or agreed to be provided by a person located in non-taxable territory to a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India." from Sl no. 9(ii) of the IGST Service Rate Notification.

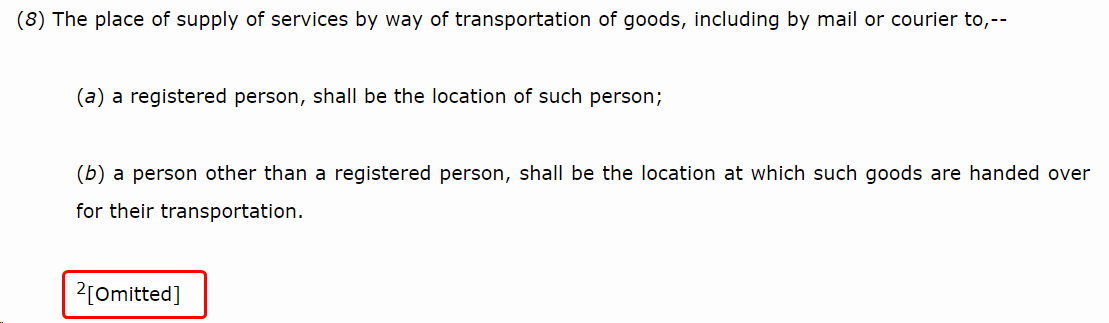

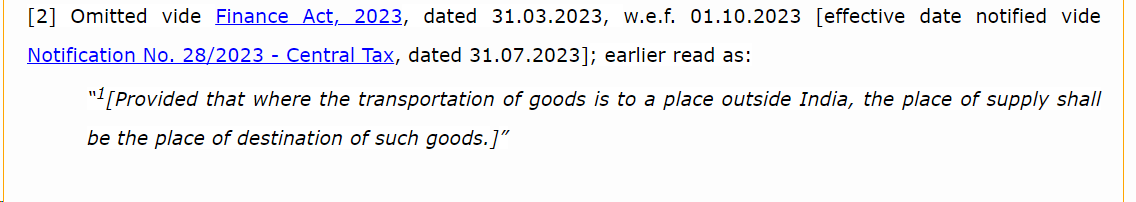

Also, Proviso to Section 12(8) of the IGST Act is omitted with effect from October 01, 2023 so as to specify the place of supply of services by way of transportation of goods to a registered person, to be the location of recipient, and in other cases the location at which goods are handed over for their transportation, irrespective of destination of the goods, in cases where the supplier of services and recipient of services are located in India.

Also, the CBIC vide the Notification 12/2023-Integrated Tax (Rate) dated September 26, 2023 removed the restriction as stated in the IGST Service Exemption Notification.

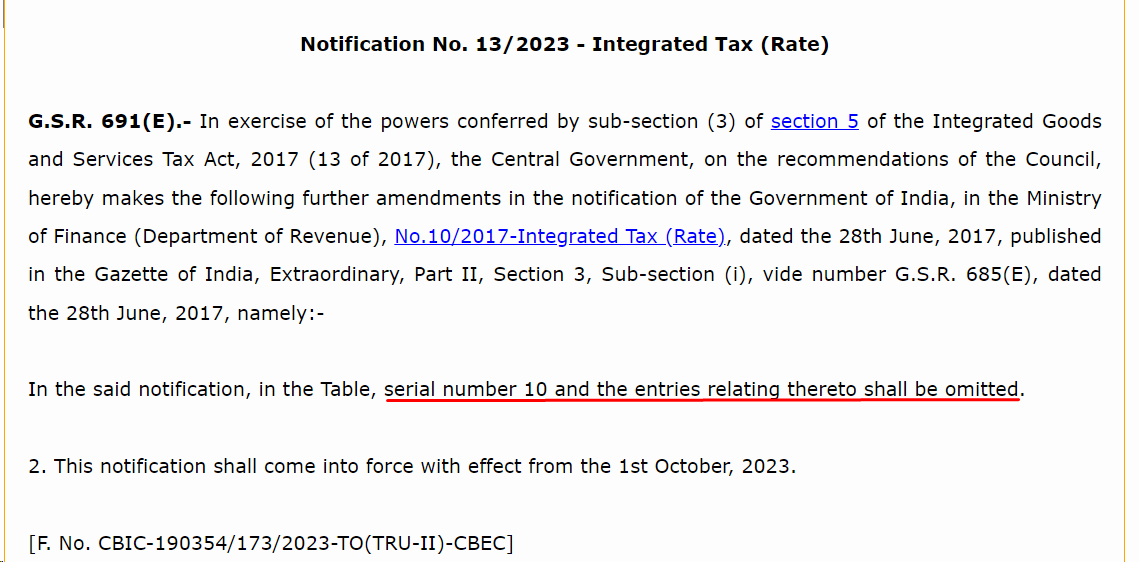

Furthermore, the CBIC vide Notification 13/2023-Integrated Tax (Rate) dated September 26, 2023, omitted Sl. No. 10 of the Reverse Charge Service Notification.

As the effect of the above mentioned notifications and decision of Hon’ble Supreme Court, no IGST is to be paid on ocean freight while importing the goods under CIF contracts. This is effective from 01st of October, 2023. As per the ruling in the Mohit Minerals case, the Hon’ble Supreme Court had held that since the Indian importer is liable to pay IGST on the ‘composite supply’, comprising of supply of goods and supply of services of transportation, insurance, etc in a CIF (Cost Insurance Freight) contract, a separate levy on the Indian importer for the ‘supply of services’ by the shipping line would be in violation of the GST Act. This is implemented by the CBIC by way of issuing notifications dated 26.09.2023. This will relax the burden of double taxation on Indian importers on the part of freight.

gst on freight charges

gst on freight

gst on ocean freight

freight gst rate

gst on air freight

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More