GSTN periodically makes changes in the return filing process to facilitate smoother compliance. A recent example of such a modification pertains to GSTR-1, effective from January 2024.

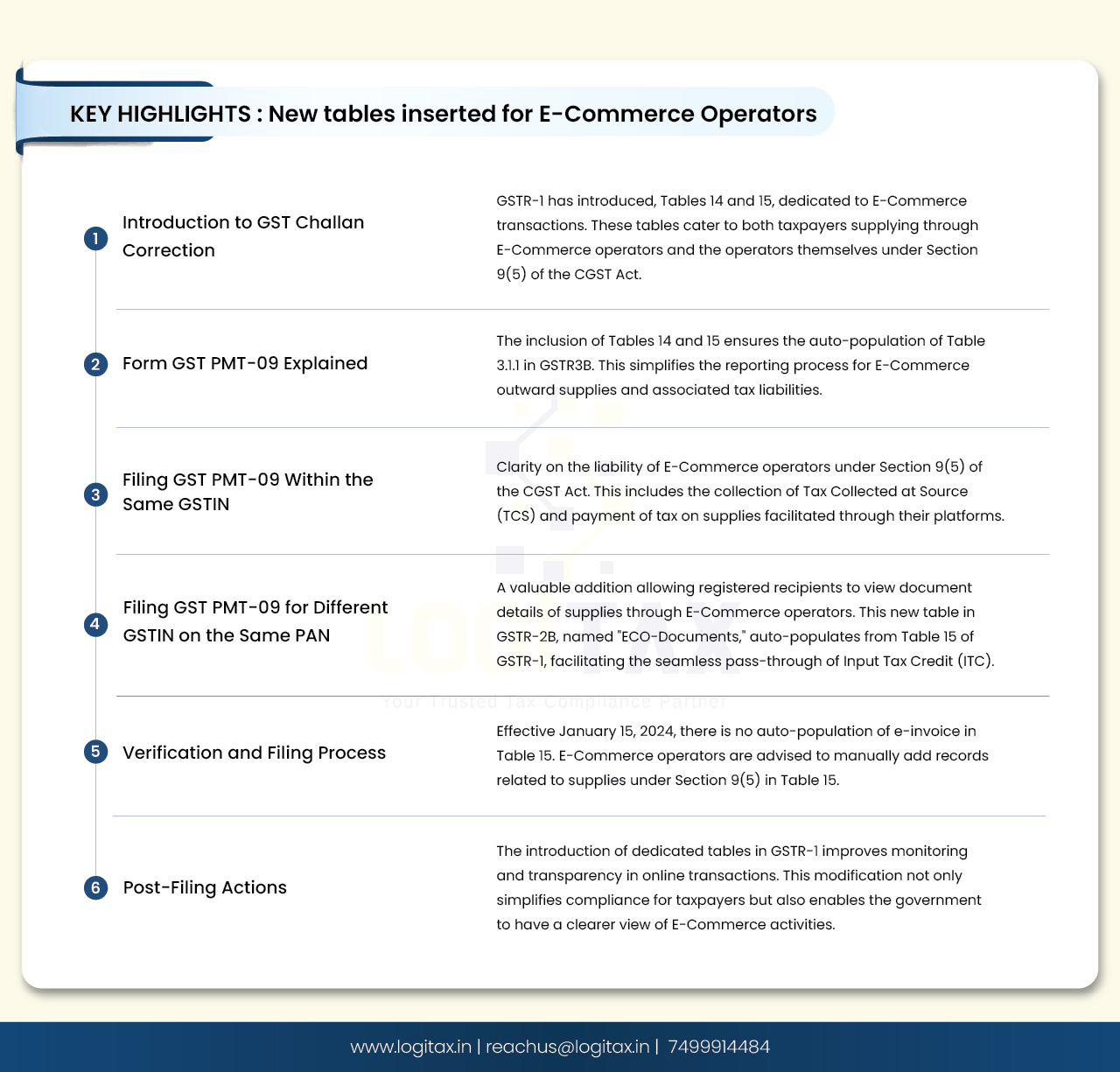

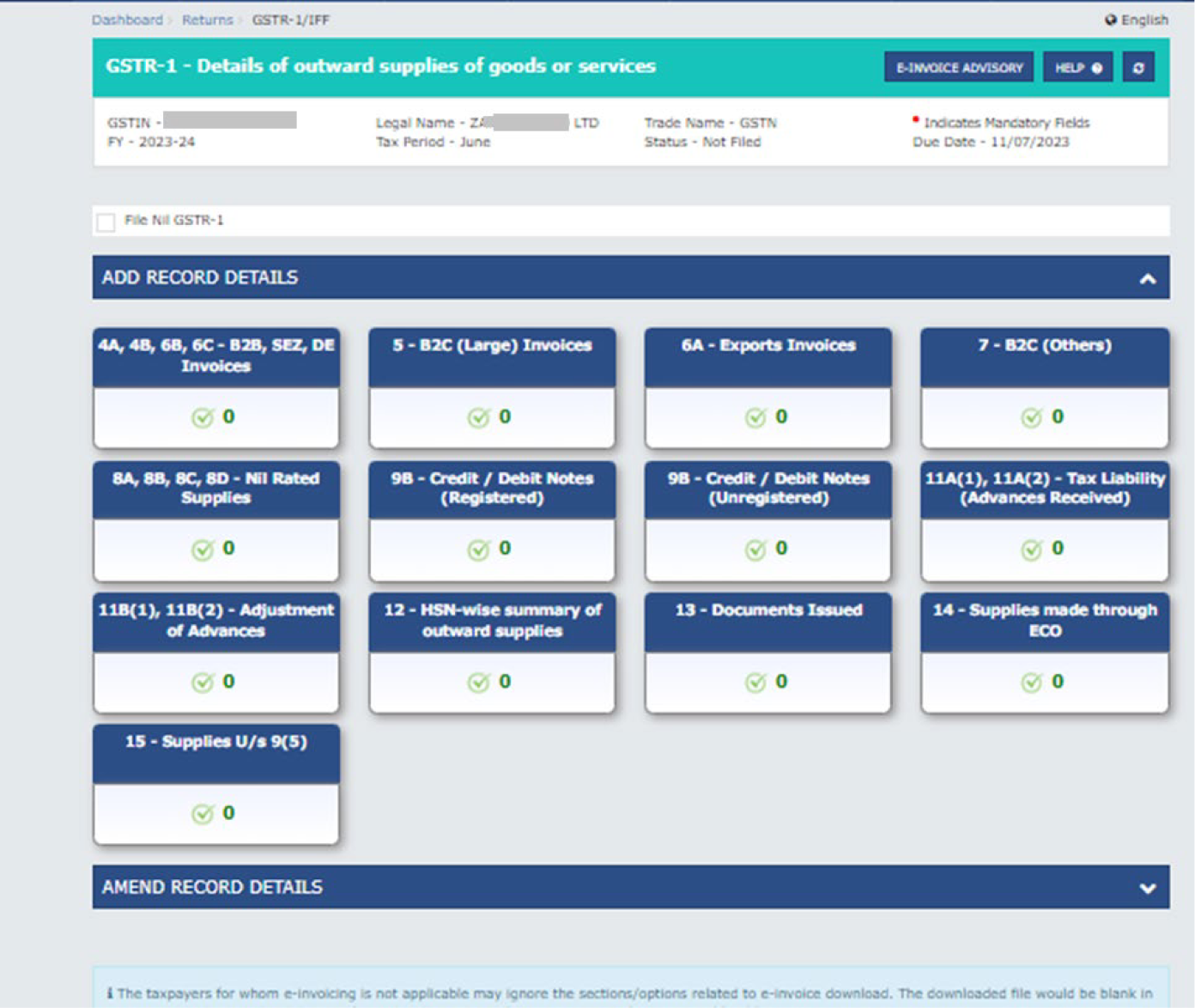

Two new tables have been added in GSTR-1, namely Table 14 and Table 15. These tables are relevant for those taxpayers who supply through E-Commerce operators and to the E-Commerce operators liable to pay tax under Section 9(5) of the CGST Act.

A new table 3.1.1 was added in GSTR-3B from 1st August 2022, where E-Commerce operators and E-commerce sellers can report supplies made under Section 9(5) of CGST Act. There was no means to get this table auto-populated on the basis of filed GSTR-1.

The insertion of new tables 14 and 15 in GSTR-1 will ensure auto-population of Table 3.1.1 in GSTR3B. This will further streamline the process of reporting E-commerce outward supplies and tax payable on the same.

An E-Commerce operator refers to any person or entity that owns, operates, or manages a digital platform that facilitates the supply of goods or services between suppliers and customers.

The liability of an E-Commerce operator to pay GST arises under the following circumstances:

This table is used to report the outward supplies that are made by taxpayers through an E-Commerce operator.

Table 14 is divided into two parts.

The taxpayer has to report the details like GSTIN of E-Commerce operator, Trade name/Legal name, net value of supplies, IGST, CGST, SGST and Cess in Table 14.

Table 15 is used by E-Commerce operators to report the outward supplies on which the E-Commerce operator is liable to pay tax on reverse charge basis under Section 9(5) of CGST Act. These supplies shall not be reported anywhere else in GSTR-1/IFF.

The taxable value along with tax liabilities filled in this table shall be auto-populated in Table 3.1.1(i) of GSTR 3B.

Table 15 is divided into four parts based on the type of supplier and recipient.

This section requires reporting of supplies at invoice level where both supplier and receiver are registered. In this case, debit note/credit note is to be reported in Table 9B of GSTR-1. This section is also available in IFF.

This section is to be reported by the E-Commerce operator at supplier level along with POS and GST rate and the recipient in this case will be unregistered. This is to be reported net of credit/debit notes.

This section will not be available in IFF.

This section is to be reported at document level along with GSTIN of the recipient. In this case, debit note/credit note is to be reported in Table 9B of GSTR-1. This section is also available in IFF.

This section is to be reported by E-Commerce operators, based on POS and GST rate, and also net of credit/debit notes. It will not be available in IFF.

As per the Advisory issued by GSTN on 15th January, 2024, there will be no auto-population of e-invoice in Table -15. E-invoices reported for supplies u/s 9(5) will be populated in GSTR-1 as per the existing functionality.

E-Commerce operators are advised to examine and add the records which are related to supplies u/s 9(5) in Table 15.

The advisory further states that tax payers are being provided a facility to pass ITC to registered recipients receiving supplies through E-Commerce operator u /s 9(5).

A new table will be added in GSTR-2B under All Other ITC section named ECO-Documents. In this table, the registered recipient can view the document details of the supplies received through E-Commerce operators on which E-Commerce operator is liable to pay tax under section 9(5) of the Act.

The values will be auto populated from B2B and URP2B section of table 15 of GSTR-1 to this new ECO- Documents table of GSTR-2B.

As the E-commerce sector continues to expand, there is an increasing demand to simplify and standardize the regulatory requirements for both E-commerce operators and sellers.

The introduction of dedicated tables in GSTR-1 for E-commerce transactions signifies a crucial advancement in improving the efficiency of the return filing process. It will help auto-populate some tables in GSTR-3B and ITC from such supplies will be reflected in GSTR-2B in a separate table.

This modification will not just simplify compliance for taxpayers but also enable the government to monitor online transactions and foster transparency.

e commerce operator

electronic commerce operator

e commerce operator under gst

electronic commerce operator under gst

e commerce gst

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More