On 31st July, 2023, CBIC issued Notification no. 28/2023-Central Tax. The notification mentioned that the provisions of sections 137 to 162 (except sections 149 to 154) of the Finance Act, 2023 shall come into force w.e.f. 01st of October, 2023.

Also, it specified that the provisions of sections 149 to 154 of the said Act shall come into force w.e.f. 01st of August, 2023.

To understand section 137 to 139 of the Finance Act, read our blog “Effective GST Changes w.e.f. October 01, 2023- Part I”.

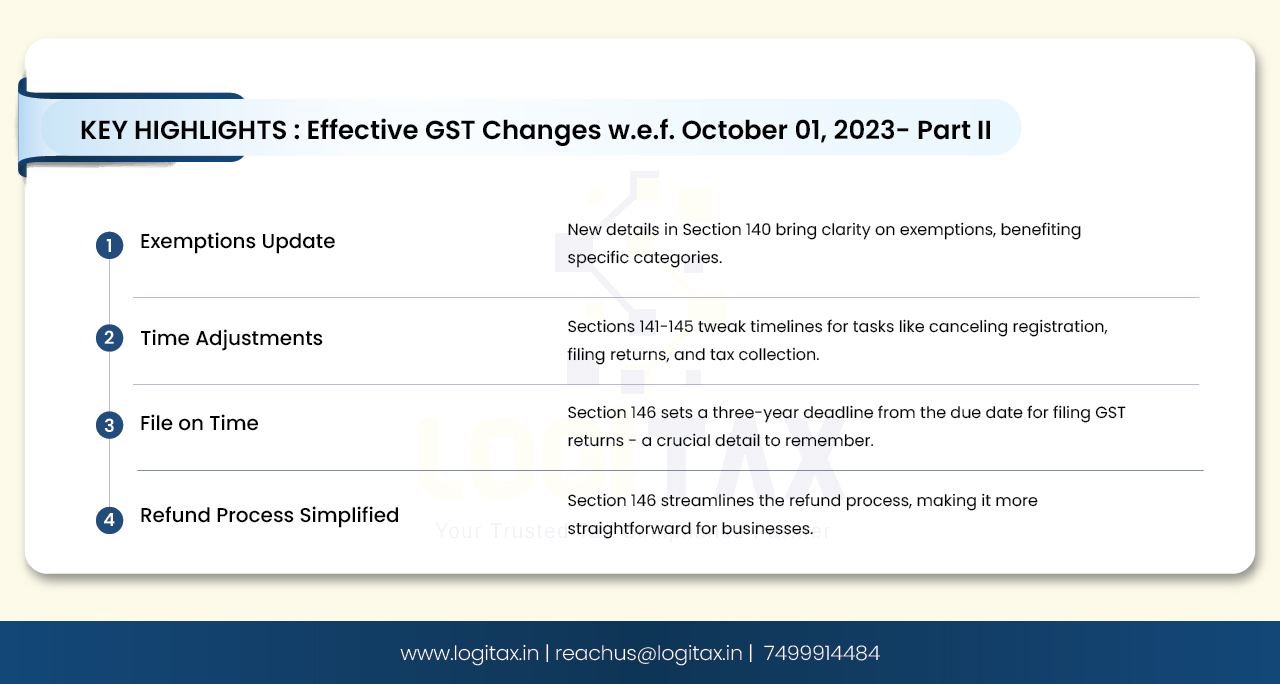

Let's discuss section 140 to 150 of the Finance Act, 2023 in this part!

Section 140 deals with amendments in section 23 of the CGST Act, 2017.

Section 23 of the CGST Act, 2017 covers provisions related to Persons not liable for registration.

Earlier, its sub-section 2 stated that the Government may, on the recommendations of the Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act.

Now, it is substituted for these wordings that “Notwithstanding anything to the contrary contained in sub-section (1) of section 22 or section 24, the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, specify the category of persons who may be exempted from obtaining registration under this Act.” This amendment is retrospectively made w.e.f. 01-07-2017.

This amendment grants an exemption to a person from taking registration in GST as per Section 22(1) of the CGST Act and compulsory registration under Section 24 of the CGST Act. It means that the following persons already exempted from compulsory registration need not obtain registration under GST:

Section 141 deals with amendments in section 30 of the CGST Act, 2017.

Section 30 of the CGST Act, 2017 covers provisions relating to the Revocation of cancellation of registration.

Sub-section 1 of the same earlier stated that Subject to such conditions as may be prescribed, any registered person, whose registration is canceled by the proper officer on his motion, may apply to such officer for revocation of cancellation of the registration in the prescribed manner within thirty days from the date of service of the cancellation order.

Now the wordings “the prescribed manner within thirty days from the date of service of the cancellation order” are substituted to “such manner, within such time and subject to such conditions and restrictions, as may be prescribed.”

Also, it had a proviso which stated that such period may, on sufficient cause being shown, and for reasons to be recorded in writing, be extended, –

This proviso is removed by way of this amendment.

This means that the time limit of Rule 23 of the CGST Rules, 2017 is to be followed. This rule was amended by way of Notification No. 38/2023 - Central Tax dated 04.08.2023. As per this rule, a person can apply for revocation of cancellation of registration within ninety days from the date of the service of the order of cancellation of registration. Now, this time limit of 90 days will apply. Also, this time limit can be increased by the officer for a further period of 180 days.

Section 142 deals with an amendment to section 37 of the CGST Act, 2017. Section 143 deals with an amendment to section 39 of the CGST Act, 2017. Section 144 deals with an amendment to section 44 of the CGST Act, 2017. Section 145 deals with an amendment to section 52 of the CGST Act, 2017.

Following are the provisions these sections cover:

| Section 37 | Furnishing details of outward supplies- GSTR 1 |

| Section 39 | Furnishing of returns- GSTR 3B |

| Section 44 | Annual return- GSTR 9 and 9C |

| Section 52 | Collection of tax at source- GSTR 8 |

A new provision has been inserted in all of the above-mentioned sections as follows:

“A registered person shall not be allowed to furnish a return for a tax period after the expiry of three years from the due date of furnishing the said return.

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish the return for a tax period, even after the expiry of the said period of three years from the due date of furnishing the said return.”

It means that the Registered person will not be allowed to furnish belated returns in Form GSTR-1, GSTR-3B, GSTR-8, GSTR-9, and GSTR-9C after the expiry of three years from the due date of furnishing the relevant returns.

Section 146 deals with amendments to section 54 of the CGST Act, 2017. Section 54 of the CGST Act, 2017 covers provisions relating to Refund of Tax. Its sub-section 6 was earlier read as follows:

“Notwithstanding anything contained in sub-section (5), the proper officer may, in the case of any claim for refund on account of zero-rated supply of goods or services or both made by registered persons, other than such category of registered persons as may be notified by the Government on the recommendations of the Council, refund on a provisional basis, ninety percent. of the total amount so claimed, excluding the amount of input tax credit provisionally accepted, in such manner and subject to such conditions, limitations, and safeguards as may be prescribed and thereafter make an order under subsection (5) for final settlement of the refund claim after due verification of documents furnished by the applicant.”

By way of this amendment, the words “excluding the amount of input tax credit provisionally accepted,” are removed.

This amendment removes the reference to the provisionally accepted ITC to align the same with the scheme of availing of self-assessed ITC as per Section 41(1) of the CGST Act.

The recent GST changes effective from October 1, 2023, bring noteworthy amendments to various sections of the CGST Act. Sections 140 to 150 address crucial aspects, from exemptions for specific categories under Section 140 to modifications in registration cancellation timelines under Section 141. Additionally, Sections 142 to 145 introduce a time limit of three years for furnishing returns, emphasizing timely compliance. The removal of the proviso in Section 141 streamlines the process of revoking the cancellation of registration. Lastly, Section 146's amendment in Section 54 simplifies the provisional refund process.

gst latest news

gst notifications

gst

gst amendment

gst portal

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More