A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate holder. In the context of GST in India, a DSC is essential for authenticating a taxpayer's identity in all GST-related forms. It is mandatory for GST registration and filing.

Let's troubleshoot errors while using DSC on the GST portal!

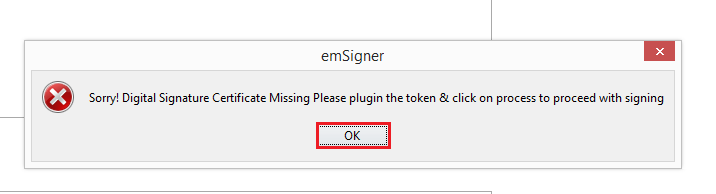

If you are facing the below error, ensure that the DSC is installed or the token is plugged into your system.

Click the OK button and install the DSC or plug the token into your system. Or if the DSC is still plugged in and you are facing the above issue, please follow the below-mentioned steps:

Uninstall the emSigner before installing any new emSigner. Always follow the below instructions to check your DSC certificate.

Step 1- Go to Internet Explorer (press ALT-X)

Step 2- Go to Internet options > Content tab

Step 3- Click the Certificates button. Select your DSC certificate. Click the View button.

Step 4- Click the Details tab of your certificate. Scroll down and go to Key Usage.

It should be “Digital Signature, Non-Repudiation”.

If it is “Key Encipherment” please remove this Certificate from the Windows store.

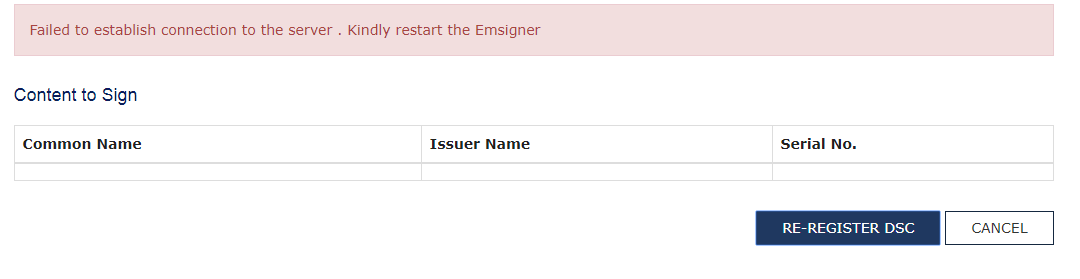

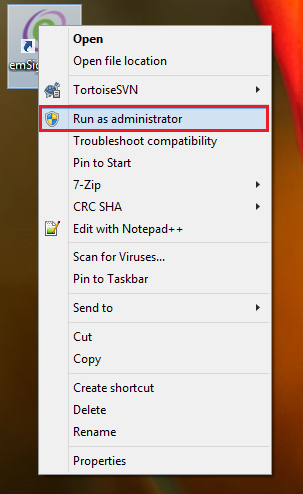

If you are facing issues while registering or signing DSC on the GST Portal, check if the emSigner is started or not.

Resolution:

emSigner server is started – Stop the server and start the emSigner server as ‘Run as Administrator’.000000

emSigner server is not started – Start the emSigner server as ‘Run as Administrator’.

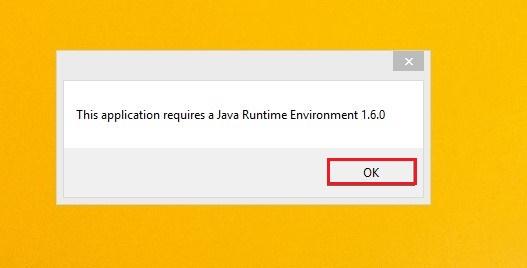

If you are facing the below error while starting the emSigner server, you need to install java (JRE) in your system.

Click the OK button and you will be redirected to the below screen where you can download and install the correct Java version.

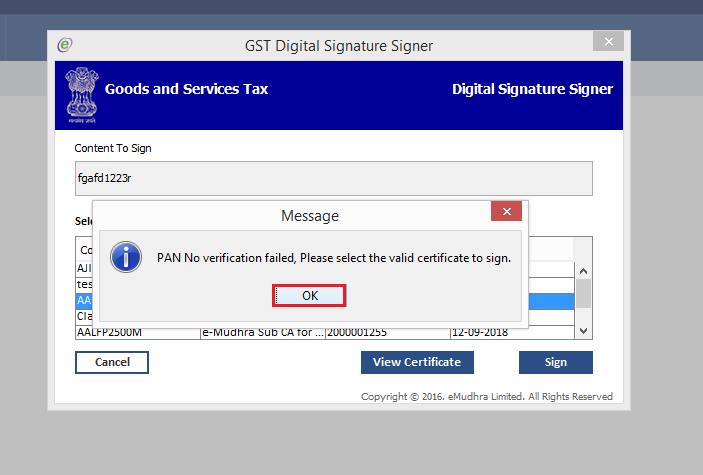

If you are facing the below error, you need to check the PAN details in the DSC.

Click the OK button and enter the correct PAN details or verify the details with the vendor providing the DSC.

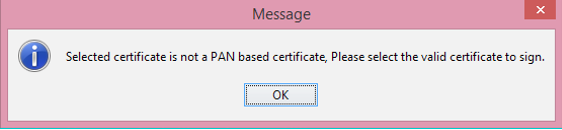

If you are facing the below error, you need to check the DSC. The DSC that you are trying to register is not PAN-based.

Click the OK button. You need to procure a PAN-based Class 2 or Class 3 DSC and then register the DSC at the GST Portal.

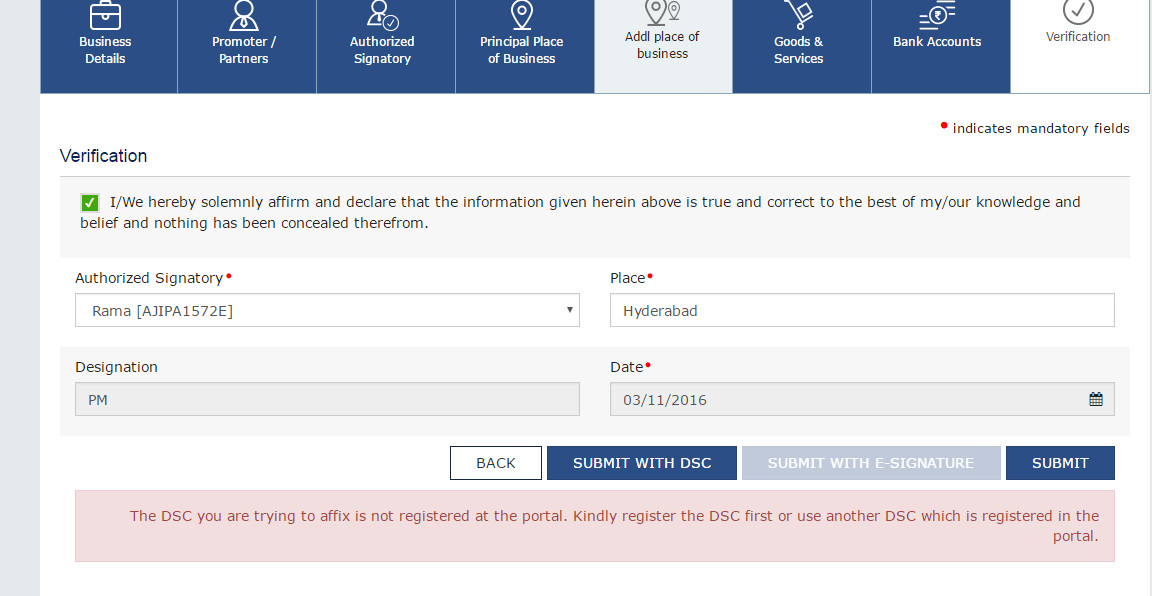

If you are facing the below error, ensure that the DSC is registered at the GST Portal.

Navigate to Dashboard > Register/Update DSC tab and register the DSC at the GST Portal.

Note: Normally Firefox browser needs manual intervention to add a root certificate.

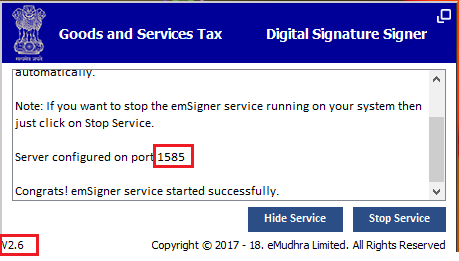

1. Add the URL - https://127.0.0.1:portNo (port on which server is started Eg: https://127.0.0.1:1585). in the browser address bar and press the Enter key.

2. You will be prompted to add the certificate to the exception site list. Click the Add Exception button.

Check the Port on which the server is started. Ensure that the port number is matching with the emSigner port description.

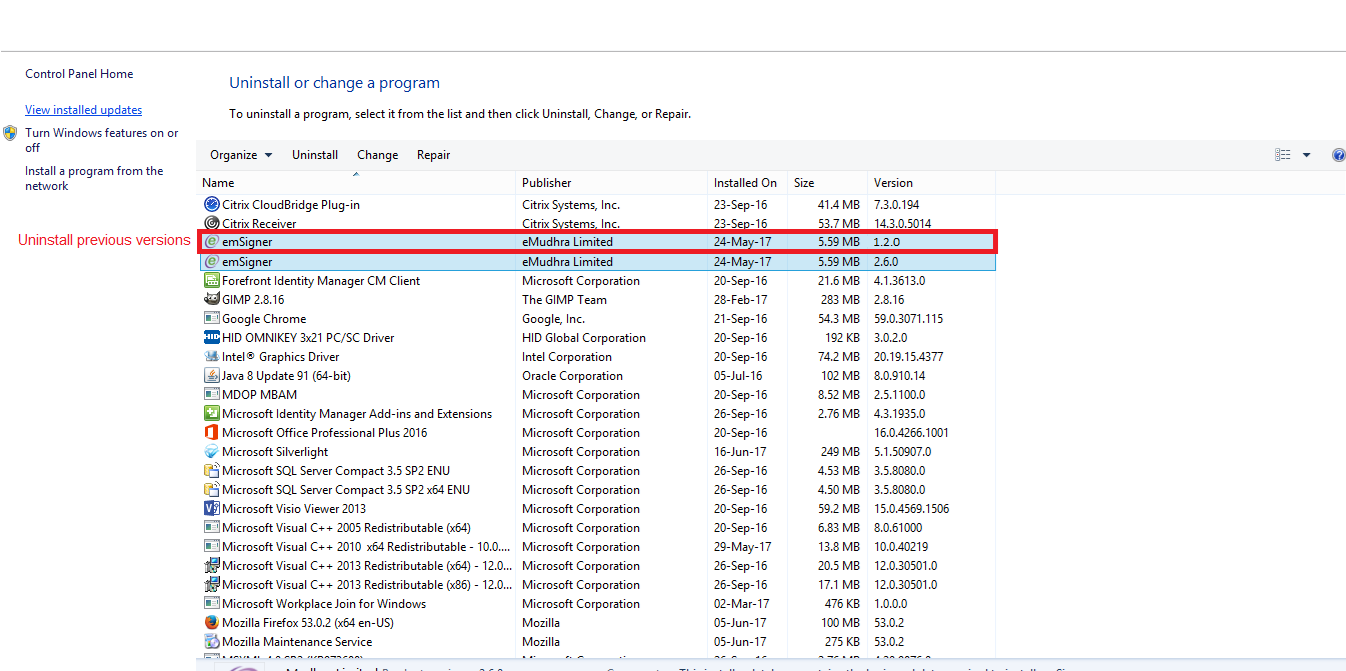

Note: Go to Control Panel > Program and Features to check the version of emSigner. In case the emSigner version is 1.2, you need to uninstall this version and install the emSigner v2.6.

Note: Go to Control Panel > Program and Features to check the version of emSigner. In case the emSigner version is 1.2, you need to uninstall this version and install the emSigner v2.6.

3. Type the URL https://127.0.0.1:1585 in the Mozilla Firefox browser.

4. Click the Advanced button.

5. Click the Add Exception button.

6. Click the Confirm Security Exception button.

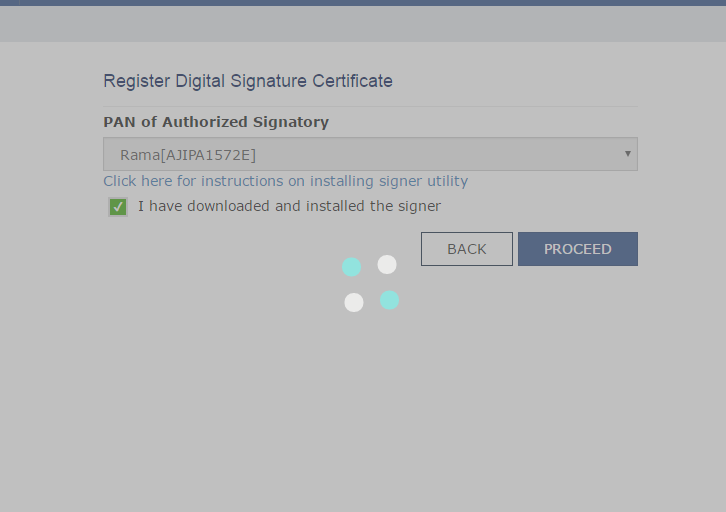

If you are facing the below error after clicking the PROCEED button or if the web socket is not visible, you need to start the emSigner.

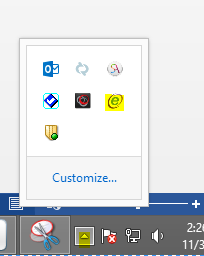

Click the emSigner icon in the taskbar. If web socket is already opened, it will be visible. Otherwise, you need to restart the emSigner server.

1. Download the Web Socket installer for Macintosh OS

2. Unzip the downloaded folder.

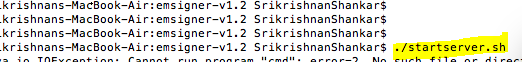

3. Open Shellscript and navigate to the downloaded folder

4. Execute ./startserver.sh command

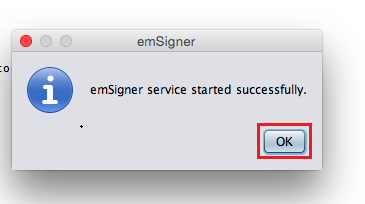

5. If emSigner is started successfully, the below message is displayed. Click the OK button

5. If emSigner is started successfully, the below message is displayed. Click the OK button

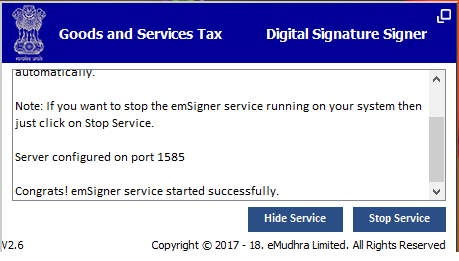

6. In the taskbar, the emSigner icon will be created and you can see the status of the emSigner server.

Note:

Uninstall the emSigner before installing any new emSigner. Always follow the below instructions to check your DSC certificate.

Step 1- Go to Internet Explorer (press ALT-X)

Step 2- Go to Internet options > Content tab

Step 3- Click the Certificates button. Select your DSC certificate. Click the View button.

Step 4- Click the Details tab of your certificate. Scroll down and go to Key Usage.

It should be “Digital Signature, Non-Repudiation”.

If it is “Key Encipherment” please remove this Certificate from the Windows store.

If you are not able to verify the signature in the Registration Certificate (RC), follow the below steps:

1. Open the RC with any PDF app.

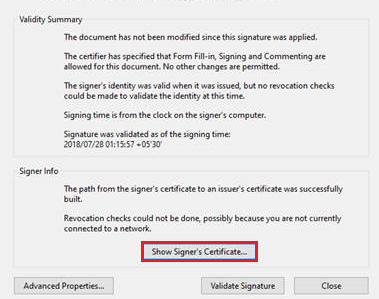

2. Right-click on the Question Mark showing the Signature not Verified/Validity Unknown.

3. Click on Show Signature Properties.

4. Click on Show Signer's Certificate.

4. Click on Show Signer's Certificate.

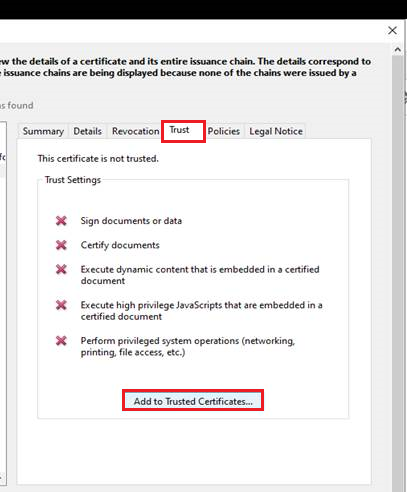

5. Select the Trust tab and click on Add to Trusted Identities.

5. Select the Trust tab and click on Add to Trusted Identities.

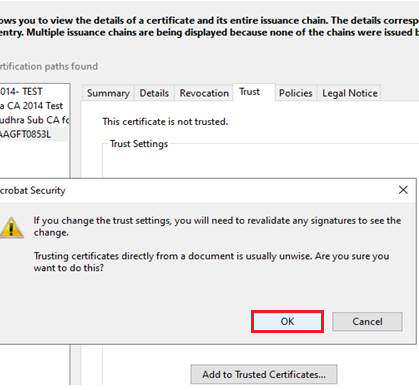

6. The second pop-up will be opened. Click OK.

6. The second pop-up will be opened. Click OK.

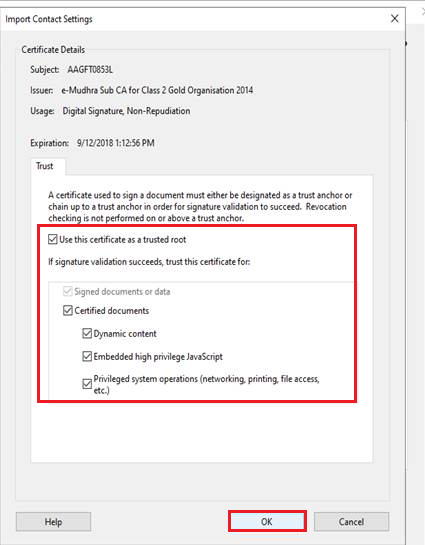

7. Select all the checkboxes and click OK.

7. Select all the checkboxes and click OK.

8. Close all the pop-ups and check the signature.

8. Close all the pop-ups and check the signature.

Navigating DSC errors on the GST portal can be challenging, but with the right troubleshooting steps, these issues can be resolved efficiently. Ensuring that your DSC is properly installed and configured, and addressing common errors like missing tokens, server connection issues, or invalid PAN details, will streamline your GST compliance process.

gst dsc

how to register dsc on gst portal

dsc in gst

how to register dsc in gst portal

gst register dsc

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More