While paying the GST, there can be inadvertent mistake by the taxpayer while selecting head. For example, IGST amount is wrongly entered in CGST. In such cases, this amount gets reflected in Electronic Cash Ledger under CGST. This balance can not be used for payment of IGST liability. Therefore, Form GST PMT-09 is available to provide the facility to correct such errors.

Form GST PMT-09 has been provided to registered taxpayers to transfer the amount;

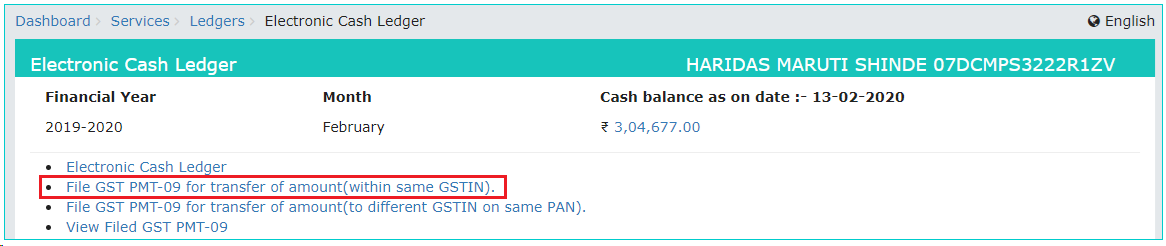

To file GST PMT-09 for transfer of amount (within same GSTIN), navigate to Services > Ledgers > Electronic Cash Ledger > File GST PMT-09 for transfer of amount (within same GSTIN).

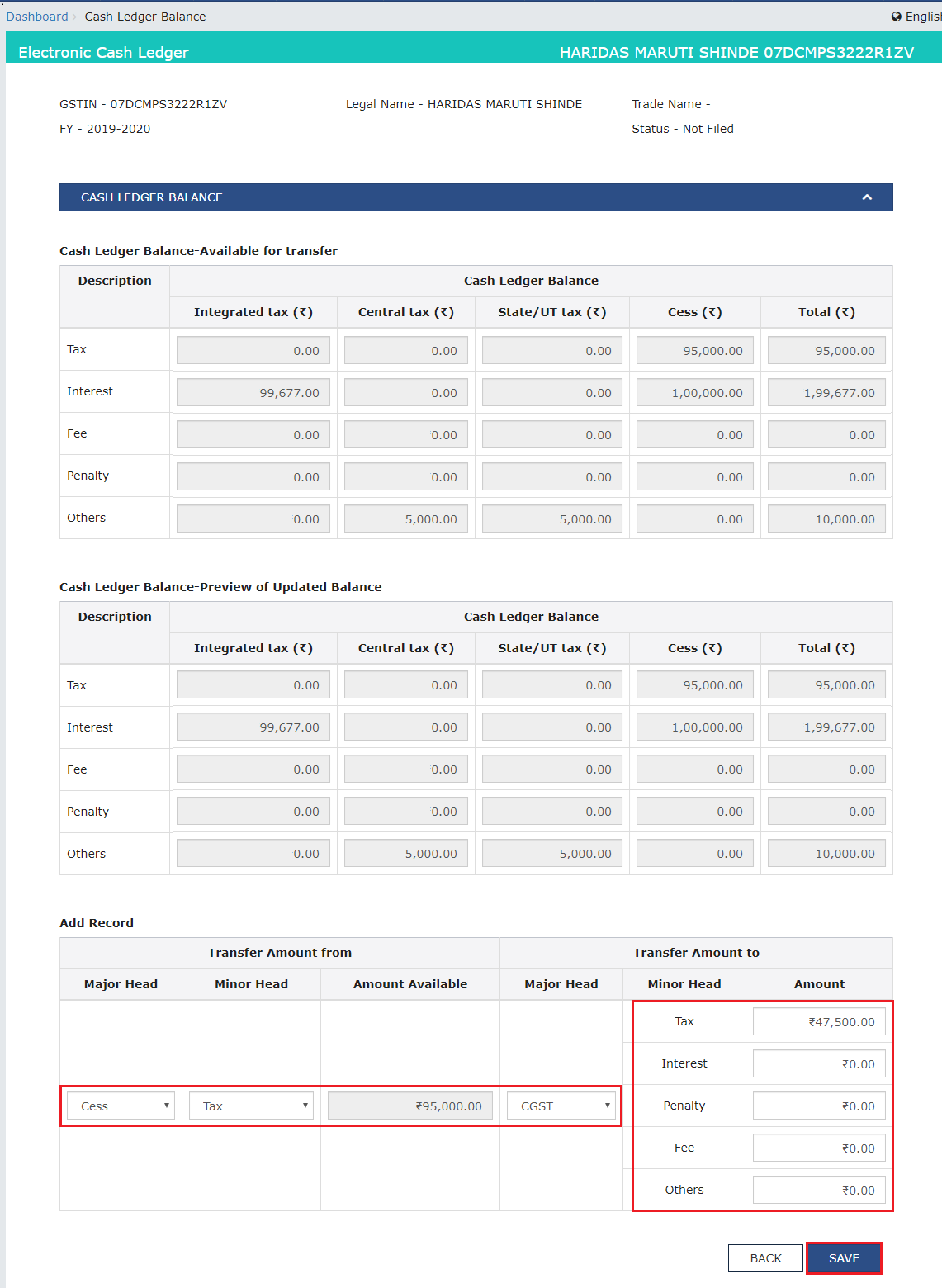

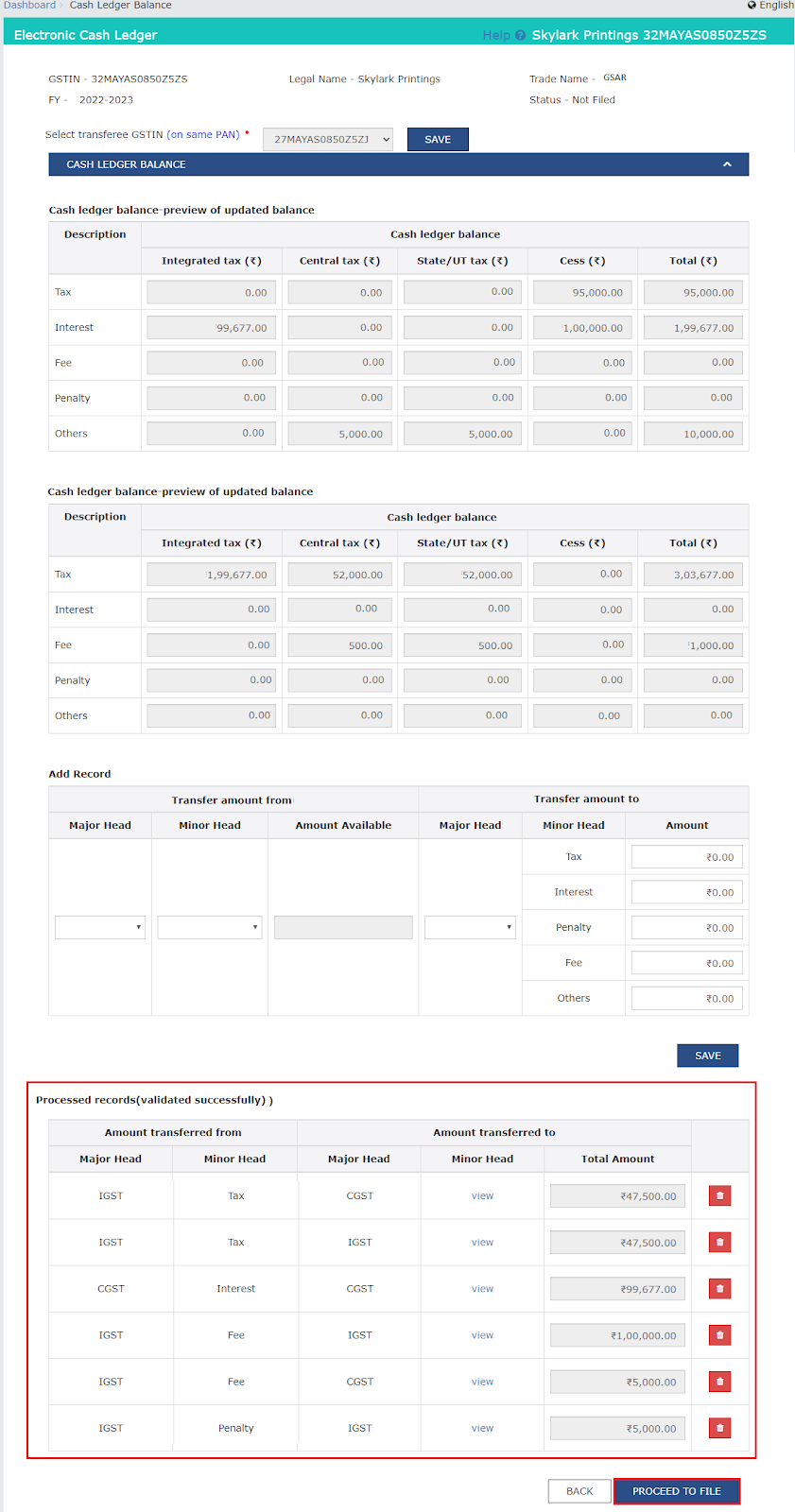

Electronic Cash Ledger page is displayed.

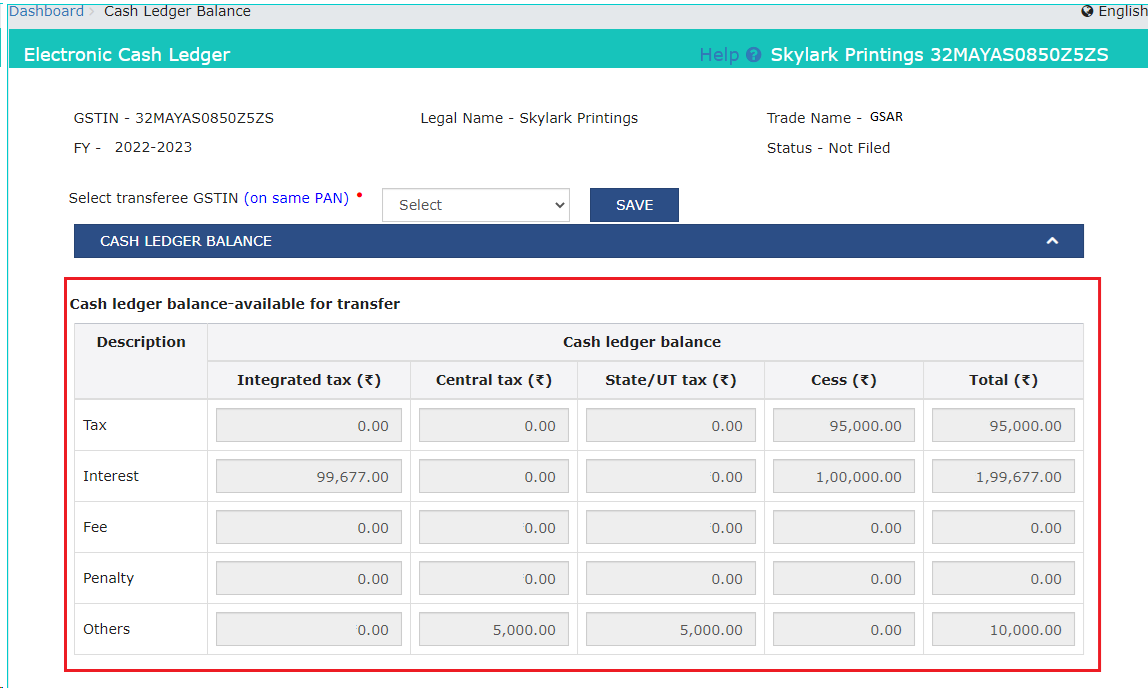

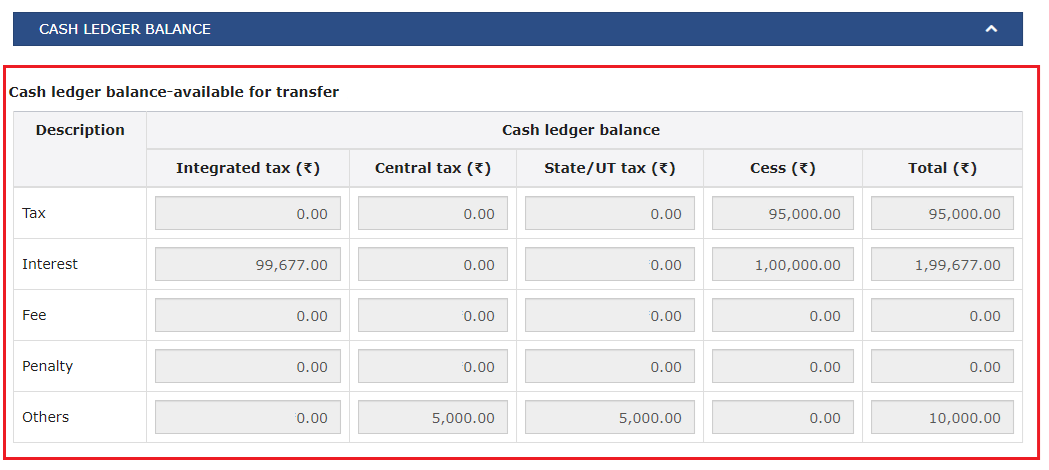

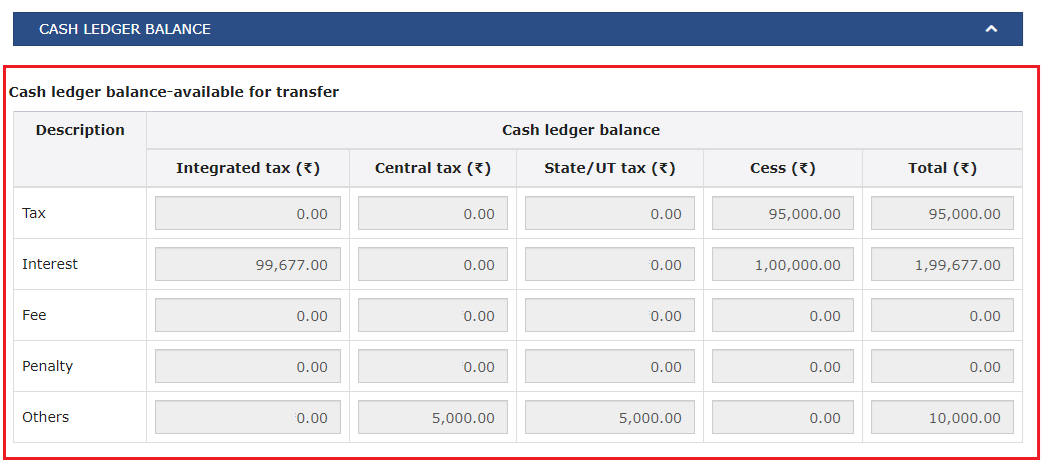

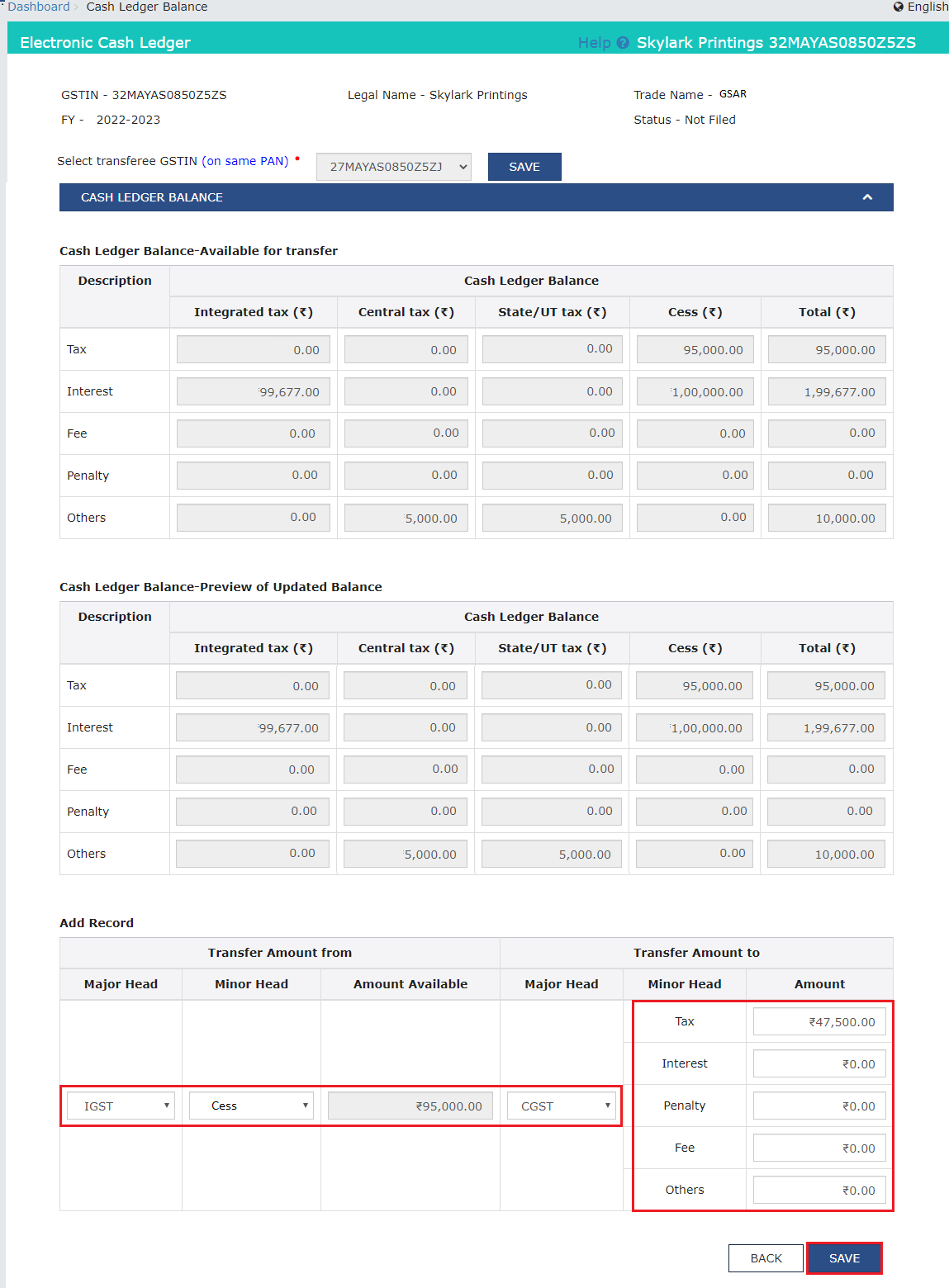

Under CASH LEDGER BALANCE, Electronic Cash Ledger balance which is available for transfer, is displayed.

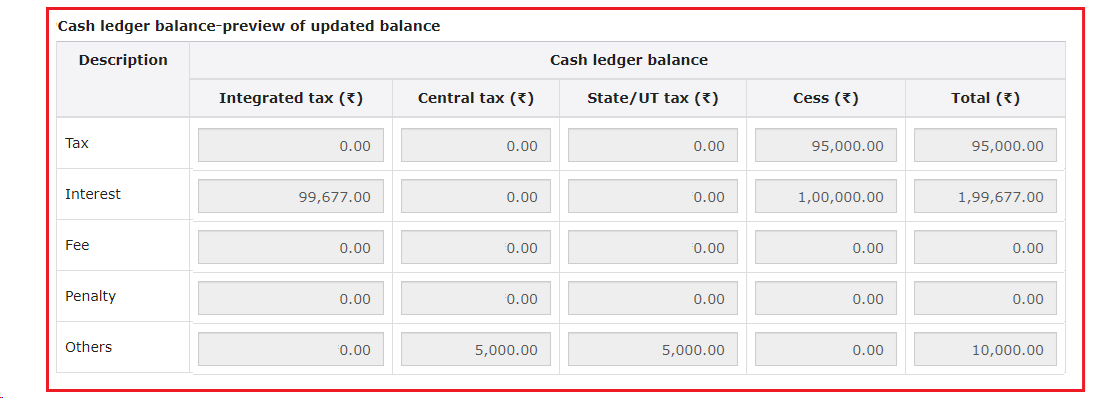

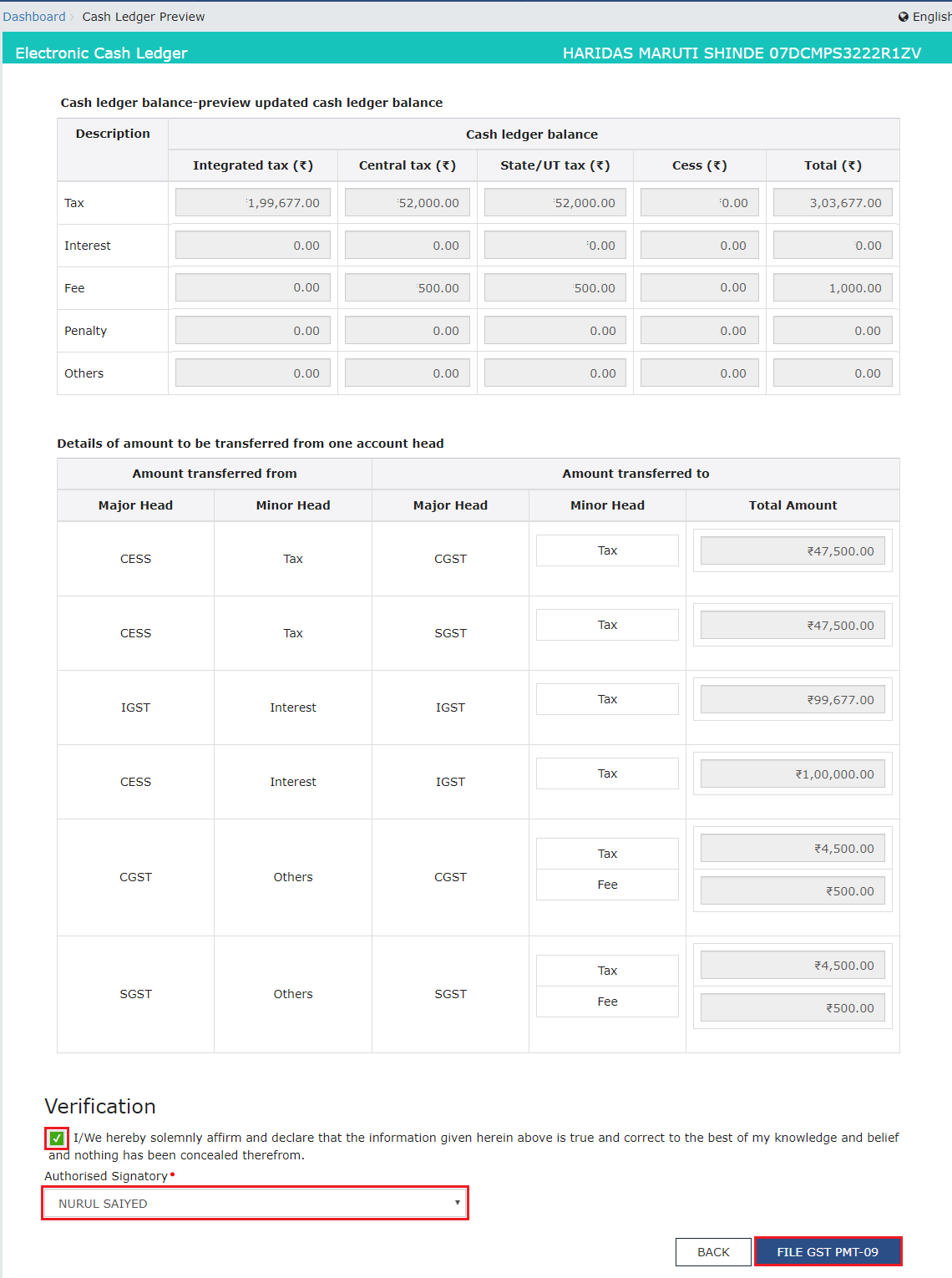

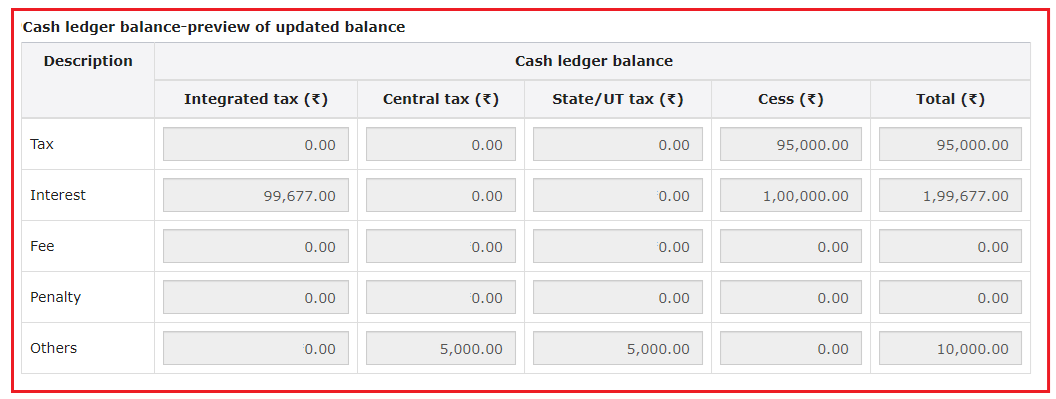

Under CASH LEDGER BALANCE, preview of updated Electronic Cash Ledger balance i.e. the resultant figures which will remain in various heads, after transfer of amount is effected by GST Portal on filing of Form GST 09, is displayed.

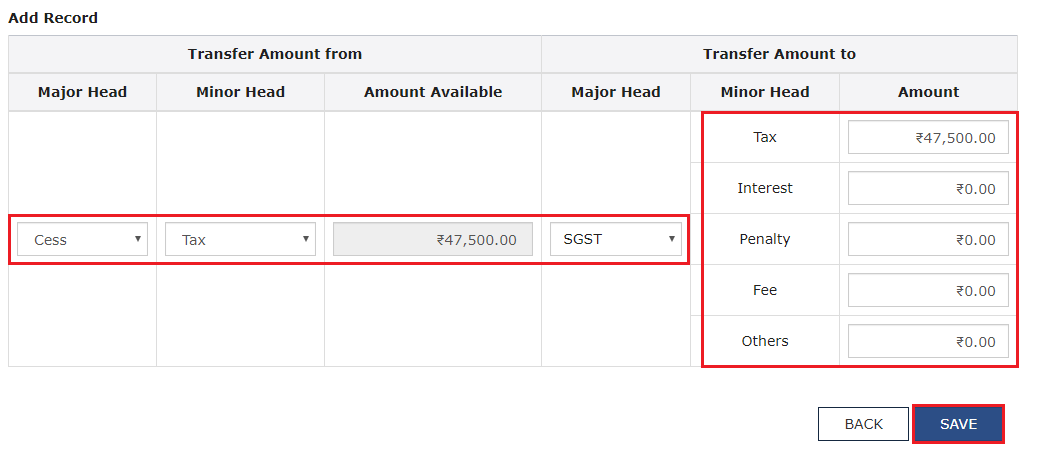

You can transfer amounts under any of the Minor Heads i.e. tax, interest, penalty, fee or others, under any Major Head i.e. IGST, CGST, SGST/UTGST and Cess to the appropriate tax, interest, penalty, fee or others Minor Head of the relevant Major Head i.e. IGST, CGST, SGST/UTGST and Cess. Enter the details in transfer amount from and transfer amount to and click SAVE to continue.

Click YES to proceed the transfer of amount.

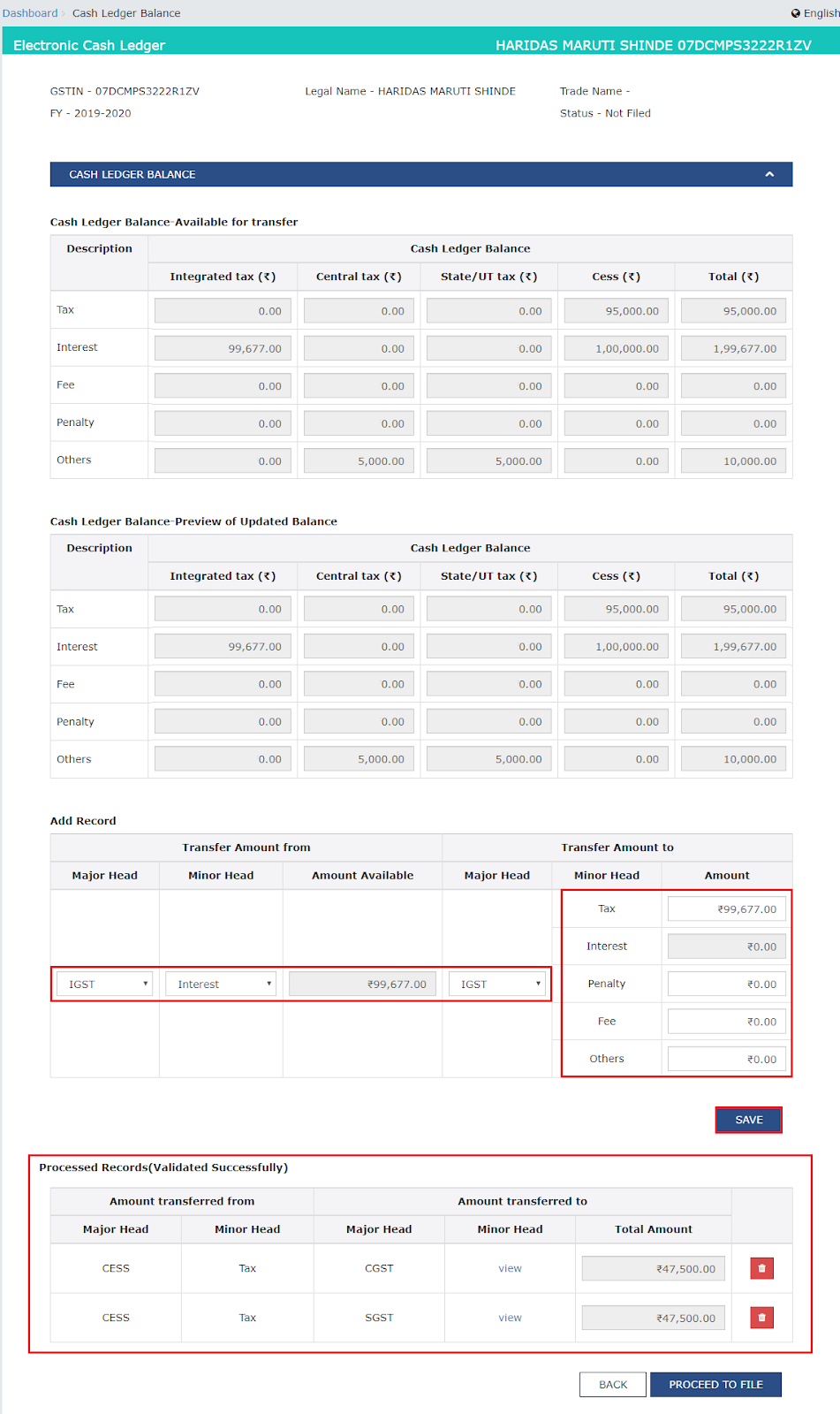

Enter additional record under Add Record option and click SAVE.

Click YES to proceed the transfer of amount.

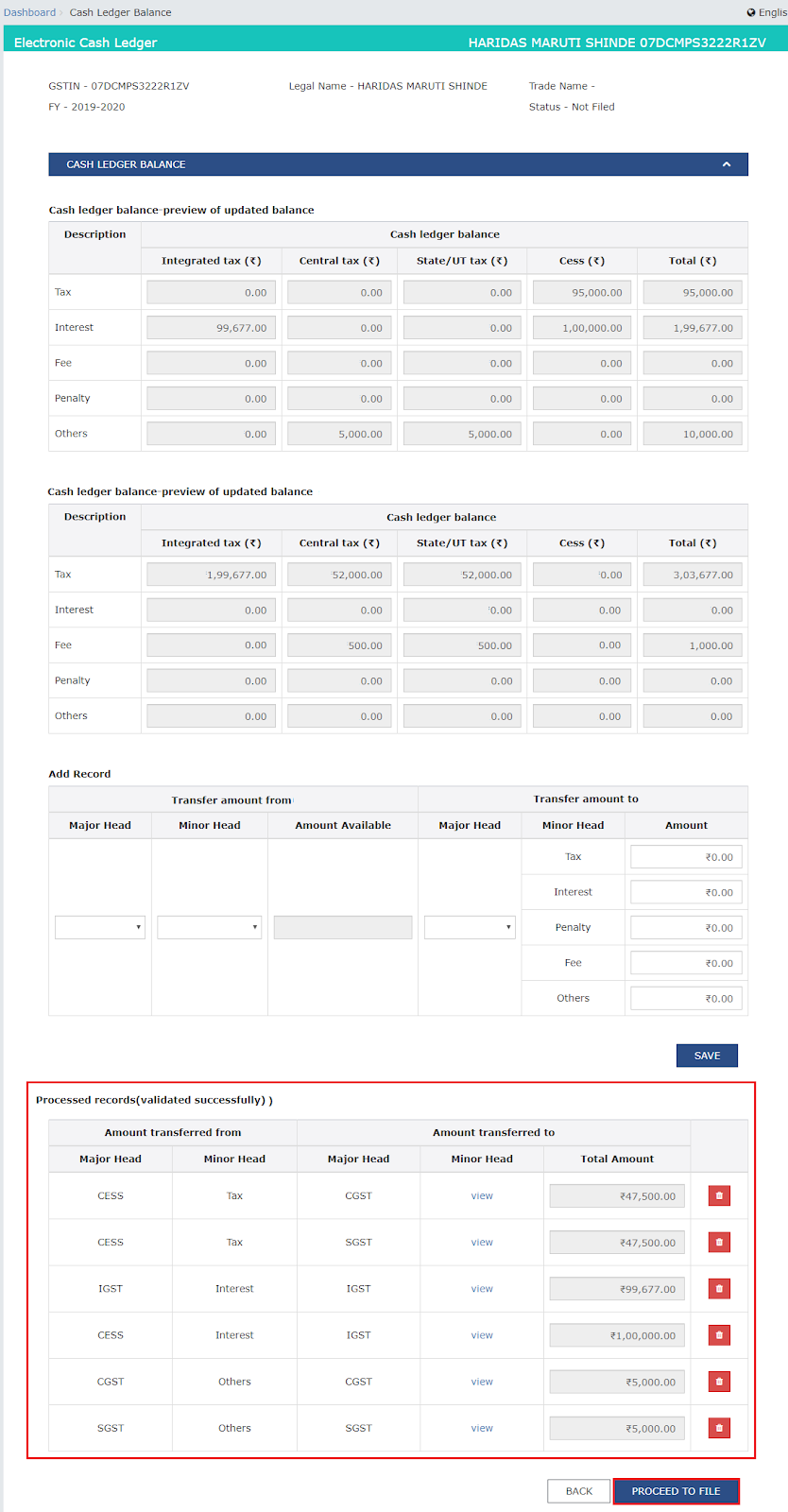

Notice that both the details are added under “Processed Records” section. The table for Cash Ledger Balance-Available for transfer and Cash Ledger Balance-Preview of Updated Balance is accordingly updated. Similarly, you can add multiple records under Add Record option before clicking PROCEED TO FILE.

Click PROCEED TO FILE.

Note :

Select the Verification checkbox and select the Authorised Signatory. Click FILE GST PMT-09.

Click YES.

Click the FILE WITH DSC or FILE WITH EVC button.

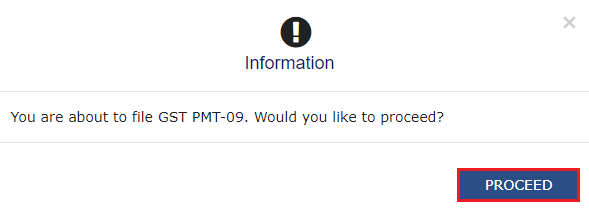

Click PROCEED.

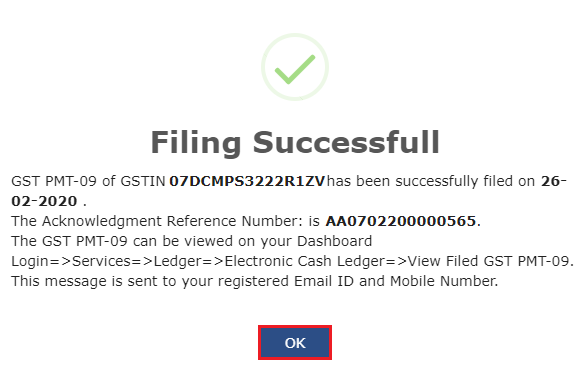

A confirmation message is displayed that the filing has been successful and ARN is displayed on the screen. Click OK.

Note: After Form GST PMT-09 is filed:

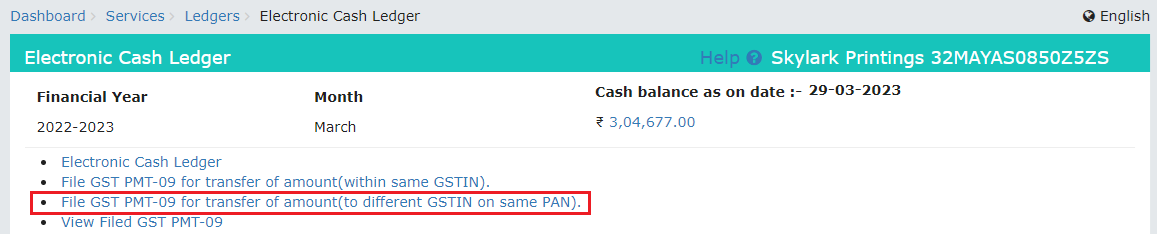

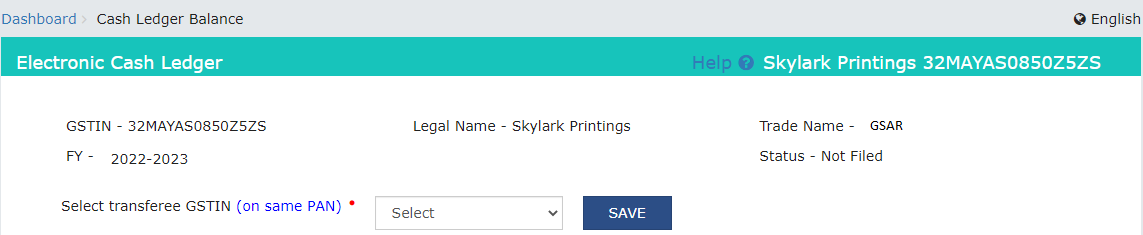

To file GST PMT-09 for Transfer of amount (to different GSTIN on same PAN), navigate to Services > Ledgers > Electronic Cash Ledger > File GST PMT-09 for transfer of amount (to different GSTIN on same PAN).

3a. Under CASH LEDGER BALANCE, preview of updated Electronic Cash Ledger balance i.e. the resultant figures which will remain in various heads, after transfer of amount is effected by GST Portal on filing of Form GST 09, is displayed.

Note: By default it is showing the balance available in the Electronic Cash Ledger. Once the details are added to make Intra-head and Inter-Head transfer of funds, table for Cash ledger balance-preview of updated balance, is updated accordingly.

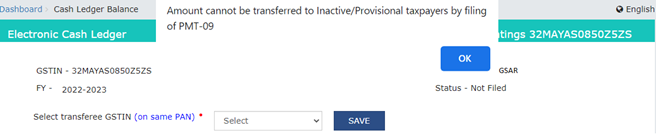

Note: If you select any inactive GSTIN (whose status is inactive on the taxpayer's profile), then the following pop-up will be displayed. Click the OK button.

Note: If you select any inactive GSTIN (whose status is inactive on the taxpayer's profile), then the following pop-up will be displayed. Click the OK button.

Note: You can transfer maximum amount available with you under the respective heads.. In case, you try to transfer amount, which is not available, you will receive an error message that enough amount is not available with you in cash ledger corresponding to the amount intended to be transferred.

Note:

Note:

After Form GST PMT-09 is filed:

Form GST PMT-09 provides a crucial solution for correcting inadvertent errors in GST payments. This user-friendly process allows taxpayers to transfer amounts within the same GSTIN or to a different GSTIN on the same PAN. Whether making intra-head or inter-head transfers, the step-by-step guide ensures a seamless correction process. Stay informed and avoid complications by utilizing Form GST PMT-09 for accurate cash ledger management.

delivery challan format

gst challan payment

gst challan generation

challan format

gst payment status

25-07-2024

GST

Mrudula Joshi

CBIC had issued Circular No. 227/21/2024-GST on 11th July, 2024. A revised procedure for Read More

24-07-2024

GST

Mrudula Joshi

In the recent budget announced on July 23, 2024, several key changes were made to the tax structure in India. Read More

23-07-2024

E-Invoice

Mrudula Joshi

The landscape of Goods and Services Tax (GST) compliance in India is continuously evolving, Read More

18-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Read More

17-07-2024

GST

Mrudula Joshi

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular to clarify Read More

17-07-2024

GST

Mrudula Joshi

Notification No. 04/2024- Central Tax dated 05th January 2024, all the registered persons engaged in manufacturing Read More

15-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

11-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

09-07-2024

GST

Mrudula Joshi

To help the taxpayers make data entries faster and to reduce errors while creating their Statement of outward supplies in Form GSTR-1, Read More

08-07-2024

GST

Mrudula Joshi

STAK (Single time authentication key) which can be generated using the “GST SECURE OTP” mobile application that a Read More

06-07-2024

GST

Mrudula Joshi

A Digital Signature Certificate (DSC) is a secure digital key issued by government-authorized certifying authorities to verify the identity of the certificate Read More

05-07-2024

GST

Mrudula Joshi

For online signing of legally binding documents, emSigner is a dependable choice. This web-based platform allows Read More

03-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs Read More

01-07-2024

GST

Mrudula Joshi

On June 22, 2024, the 53rd GST Council meeting was held in Delhi, with Union Minister for Finance and Corporate Affairs, Read More

25-06-2024

GST

Mrudula Joshi

As per section 78 of the CGST Act, 2017, recovery proceedings under GST can be initiated after three months' expiry Read More